Trump’s tariff policies shook the crypto market last week. Though countries like Mexico and Canada achieved a one-month postponement, tariffs on China have already been enacted.

BeInCrypto spoke with Kristian Haralampiev, Structured Products Lead at Nexo, to understand why Trump’s tariffs caused markets to panic, what the crypto markets should expect 30 days from now, and the areas where the industry could find opportunities.

Trump Tariff Announcements Shake Crypto Market

In the first week of February, US President Trump announced that he would impose a 25% tariff on imports from Canada and Mexico and a 10% tariff on Chinese goods. Additionally, he applied a 10% levy on Canadian energy resources.

These announcements triggered widespread reactions across traditional and crypto markets. Though these tariffs were said to be effective this Tuesday, global financial markets began selling off the prior weekend in preparation.

Though cryptocurrency markets are not inherently tied to trade deficits in the same way equities might be, they still took a significant hit. Following Trump’s tariffs announcements, the total crypto market capitalization contracted by approximately 8% in just one day– falling to about $3.2 trillion.

Bitcoin dropped to a minimum of $91,281, while Ethereum fell as low as $2,143. These fluctuations resulted in billions being wiped from the market. According to Coinglass, total liquidations exceeded $2.23 billion in a 24-hour period. No digital asset went unharmed.

A day before the executive orders were to take effect, Trump agreed to suspend the tariffs against Mexico and Canada for one month. However, China and the US did not reach a negotiation, and the US’s 10% levy on Chinese imports went into effect.

The crypto markets responded favorably to these postponements. XRP, which had dropped by over 25% in response to Trump’s tariff announcements, quickly jumped up 6% after news of the 30-day pause. Meanwhile, Bitcoin surged to $102,599, fueled by renewed investor optimism.

However, several questions remain about what will happen to the crypto market one month from now, when the threat of tariffs is again on the table.

Tariffs’ Impact on Economy Dynamics

Tariffs are taxes on imports or exports that governments use to achieve strategic goals such as trade deals or to reduce trade deficits.

Regarding Trump’s tariffs, the US imports more goods from Canada, Mexico, and China than it exports, meaning it faces a trade deficit with all three countries.

The connection between trade deficits and tariffs is important because of the potential consequences for equities and cryptocurrencies. Tariffs can increase the prices of imported goods, potentially leading to inflation as these costs are passed on to consumers.

In turn, higher costs may decrease consumer demand for those goods, resulting in reduced imports and lower profits for foreign companies, potentially leading them to withdraw from the US market.

Consequently, tariffs could raise foreign goods prices, decrease import volumes, and diminish corporate profits, incentivizing investors to reduce their equity holdings, seek less risky investments, and lower their exposure to cryptocurrency.

The cryptocurrency market’s decline following Trump’s announcements illustrates this phenomenon.

While cryptocurrency and equity markets sometimes exhibit independent behavior, significant events can create broader market disruptions, impacting seemingly unrelated assets due to prevailing market sentiment.

A Possible Opportunity for Crypto

Amidst considerable market volatility, a JPMorgan Chase survey of institutional trading clients found that 51% predict inflation and tariffs will be the dominant forces shaping global markets in 2025. The survey also highlighted market volatility as a major concern, cited by 41% of respondents, a significant increase from 28% in 2024.

However, some industry experts have pointed to a silver lining.

According to Haralampiev, Trump tariff policies, while likely to create volatility in cryptocurrency markets, may also present opportunities for Bitcoin’s long-term rise.

“The introduction of steep tariffs, particularly on Chinese imports, would likely disrupt global tradeflows, increase production costs, and contribute to inflationary pressures. Historically, such economic shifts have driven investors toward alternative assets that serve as hedges against currency devaluation and macroeconomic uncertainty. Cryptocurrencies, particularly Bitcoin, have increasingly been viewed as having this potential, hinting at bullish signals for the asset class,” Haralampiev told BeInCrypto.

In other words, as economic tensions escalate, Bitcoin’s ascent will accelerate.

“All of this could become a tailwind for Bitcoin and leading cryptocurrencies, as their decentralized nature could be viewed as an attractive proposition for investors. If inflation remains high, demand for assets that serve as a hedge —such as Bitcoin— could increase, especially if the US government keeps signaling a willingness to incorporate digital assets into its broader economic strategy,” Haralampiev added.

Even though Bitcoin could hedge against the inflation created by tariffs, these policies would also generate significant supply chain disruptions.

Impacts on Cryptocurrency Mining

Trump’s 10% levies on China, which are already in effect, create significant uncertainty given the role of Chinese imports in activities like cryptocurrency mining.

Following Trump’s tariff announcements, the share prices of Bitcoin mining companies MARA, Riot Platforms, and Hut 8 declined, with losses exceeding 8% in some cases. These losses made sense, given that Chinese companies dominate the industrial Bitcoin mining equipment market.

American Bitcoin mining companies rely heavily on Chinese-manufactured Integrated Circuits for Specific Applications (ASIC) equipment, which is used to optimize the mining process. Bitmain and MicroBT are among the main suppliers.

“The US mining industry relies heavily on specialized mining hardware from China, meaning higher tariffs could significantly increase equipment costs. This would temporarily squeeze profit margins for miners and potentially slow mining expansion in the short term. Should tariffs drive up costs in the short term, US-based miners could look to further optimize operations, embrace emerging technologies like immersion cooling, or seek partnerships with domestic hardware manufacturers to maintain competitiveness,” Haralampiev explained.

Haralampiev also suggested that this disruption to a key part of the cryptocurrency mining supply chain should be a wake-up call to the industry.

The Need for Domestic Manufacturers

The crypto industry has long recognized the need for increased domestic Bitcoin mining in the United States to lessen dependence on foreign suppliers. This reliance on overseas products has been criticized for hindering decentralization and weakening supply chain resilience.

Some industry players have already taken initiatives to enhance efficiency in the Bitcoin mining field. Last June, Auradine, a Silicon Valley-based Bitcoin miner manufacturer, strategically partnered with virtual power plant providers CPower and Voltus.

Auradine is an American company that develops ASIC units engineered in the United States. These units help miners optimize electricity consumption, offering a competitive advantage. Auradine aims to provide performance and integration through this partnership without relying on third-party components.

Yet, several projects like Auradine are needed to compete with established Chinese suppliers and fulfill the demand for manufacturing equipment required for Bitcoin mining.

“By making foreign mining equipment more expensive, tariffs could encourage investment in domestic mining technology and energy-efficient solutions. The US already has a competitive advantage in renewable energy sources, particularly in states like Texas, which have abundant wind and solar power,” Haralampiev said.

The United States will need to implement a similar strategy for artificial intelligence (AI) development.

US Reliance on Outsourced Semiconductors

The United States and China are in a tight-knit race to dominate AI technologies. Semiconductors play an important in this race. These small but crucial components play a significant role in determining global technological leadership.

Semiconductors are fundamental to modern technology, forming the basis of virtually all electronic devices. They enable the development of increasingly powerful and energy-efficient systems that drive innovation across industries.

These components are critical for expeditiously and accurately processing massive datasets, particularly in AI and data analytics. They power applications from predictive analytics to natural language processing, enabling data-driven insights and decision-making.

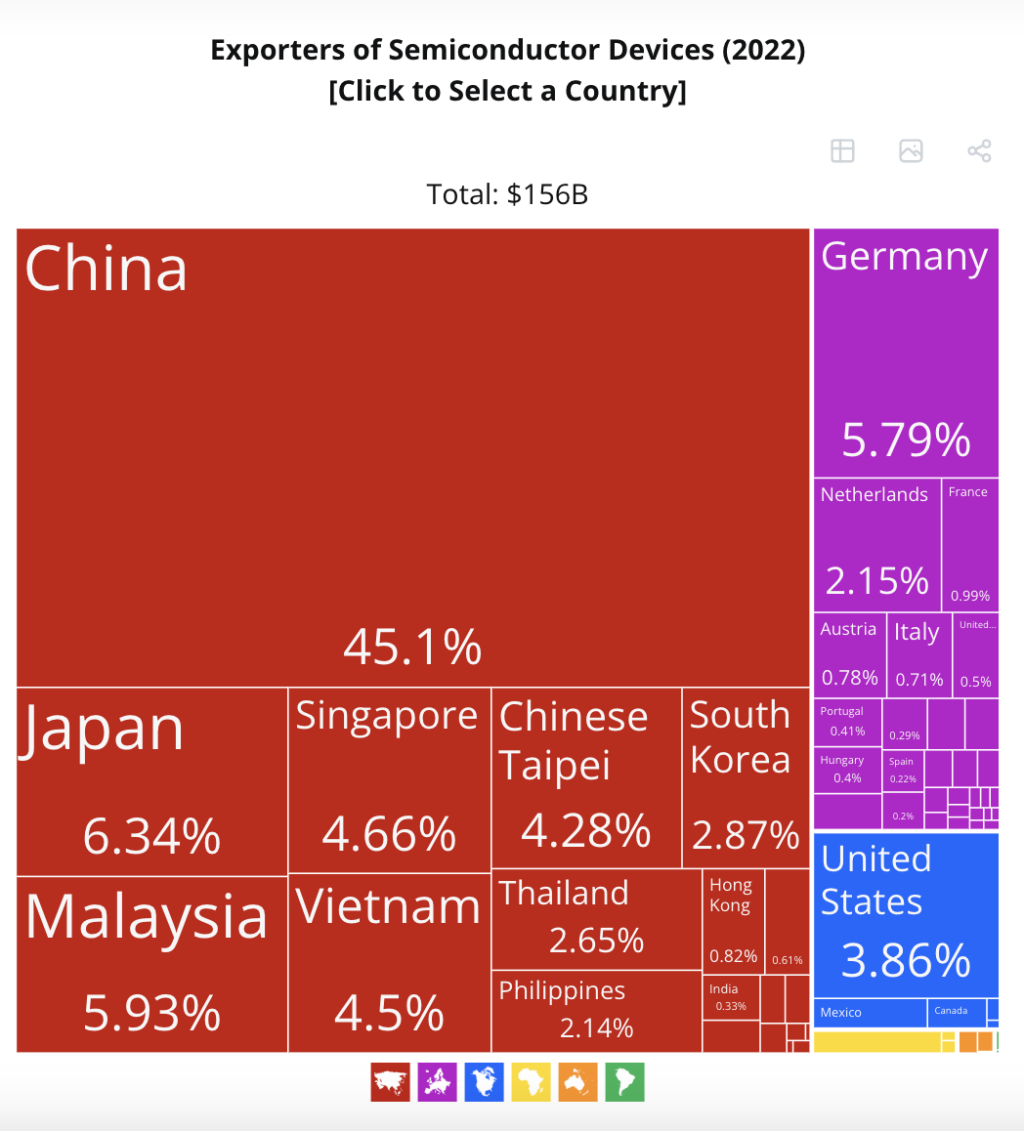

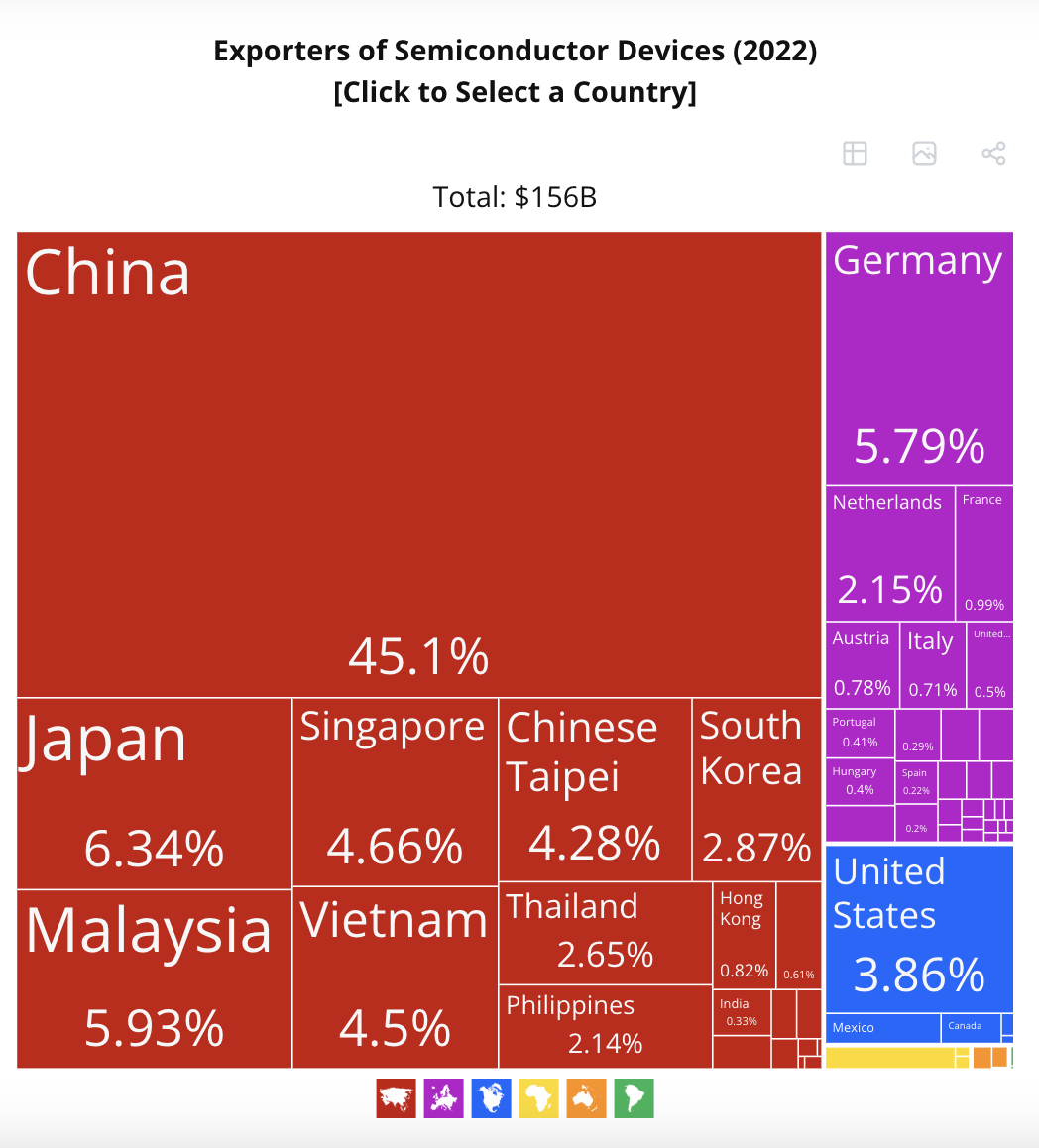

According to data from the Observatory of Economic Complexity, in 2022, the United States ranked as the world’s third-largest importer of semiconductor devices, with imports totaling $16.6 billion. The leading suppliers of these imports were Vietnam ($4.57 billion), Malaysia ($2.13 billion), Thailand ($1.66 billion), South Korea ($1.54 billion), and China ($962 million).

US semiconductor imports increased by 13% in value during early 2023 despite ongoing efforts to boost domestic production, according to Trade Finance Global. This increase demonstrates the nation’s continued dependence on foreign chip suppliers.

With Trump enacting tariffs on China, investors are also worried about their impact on semiconductor imports.

A Call for US-based Innovation

Similar to his argument regarding Bitcoin mining, Haralampiev contends that the United States must significantly increase efforts to onshore semiconductor manufacturing.

“By strategically investing in local semiconductor manufacturing and mining hardware production, the U.S. could reduce its reliance on Chinese imports and make its crypto-mining industry more self-sufficient,” he said.

By doing so, tariffs would have less of an impact.

“The US is also looking at advancements in AI, which means its semiconductor industry will eventually catch up in terms of cost-production, where it could currently lack, solidifying the country’s dominance in both mining infrastructure and chip production,” Haralampiev added.

Though Trump has not made any announcements about semiconductor production, he has announced other AI-related initiatives.

Last month, Trump announced Stargate, a $500 billion joint venture between Oracle, SoftBank, and OpenAI, to build massive data centers and infrastructure that support AI development.

However, it is presently unclear how much the federal government will contribute to this massive sum and how much will come from Stargate’s constituent companies.

Weathering the Storm

While Trump’s tariff policies have generated concern, Haralampiev views them as part of a recurring pattern of similar past events in US history.

“This transition aligns with a broader historical cycle of globalization vs. isolationism, where economies shift between prioritizing global integration and domestic self-reliance,” he told BeInCrypto.

He also noted that crypto-related industries have weathered comparable challenges and ultimately prevailed.

“Bitcoin mining has historically proven to be highly adaptable in the face of policy shifts, such as China’s mining ban in 2021, which saw a rapid relocation of mining infrastructure to North America and Central Asia,” Haralampiev added.

Future economic scenarios are uncertain, but their potential impact on cryptocurrency markets is clear. Whether that impact is positive or negative will depend on how these scenarios develop.

The post How Trump’s Tariffs Could Impact Crypto and Bitcoin’s Potential in 2025 appeared first on BeInCrypto.