Jupiter (JUP) price is down 10% in the last 24 hours, cooling off after a strong rally fueled by major developments. In recent weeks, JUP made headlines with key acquisitions, including Moonshot and SonarWatch, and surpassed Raydium in Total Value Locked (TVL).

Despite the ongoing correction, its EMA lines remain in a bullish setup, while smart money continues accumulating JUP at near-record levels. Whether JUP finds support or extends its decline below $1 will depend on how the market reacts to its latest price movements.

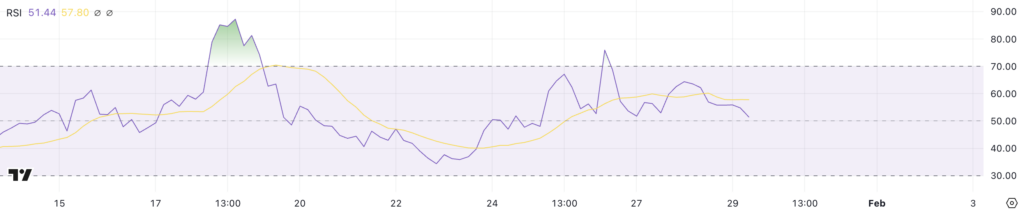

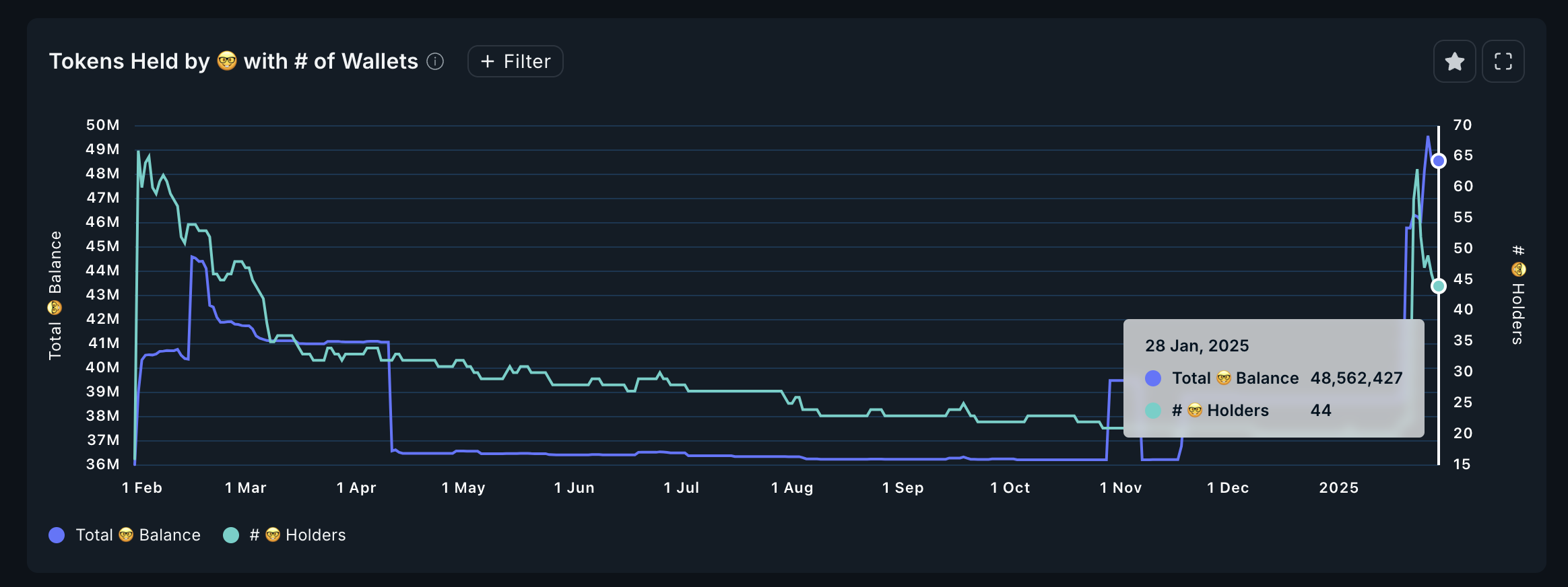

Jupiter (JUP) RSI Turns Neutral After Hitting Overbought Zone

Jupiter RSI hit 75.9 four days ago after its price surged following the announcement of its acquisitions of meme coins launchpad Moonshot and SonarWatch.

However, since then, RSI has declined to 51.44 as the price dropped sharply, now down roughly 10% in the last 24 hours. This suggests that the recent rally has lost strength, and selling pressure is increasing as traders take profits.

RSI (Relative Strength Index) measures momentum, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. JUP’s RSI is now at 51.44, which means it is no longer overbought but hasn’t reached oversold territory.

If RSI continues to drop, further downside could follow. However, if buyers step in and RSI stabilizes, JUP could find support and attempt a recovery.

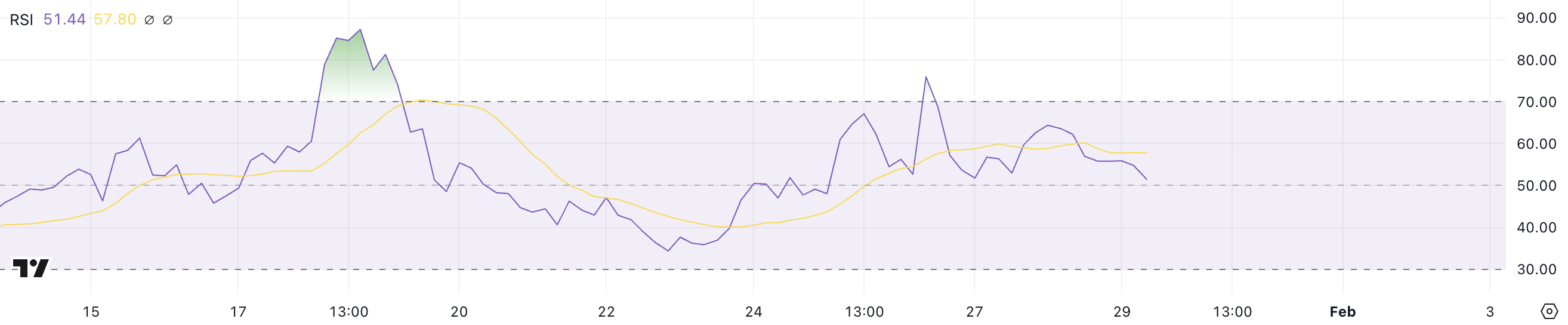

Smart Money Currently Holds 48.5 Million JUP

The number of smart wallets holding JUP saw a sharp increase, rising from 22 on January 18 to 63 on January 23, before dropping to 44.

Meanwhile, the supply held by these wallets has continued to grow, moving from 38.7 million JUP to 46.2 million and now reaching 48.5 million, after touching 49.5 million four days ago. This suggests that while some large holders may have exited, the overall accumulation trend remains strong.

Tracking smart money is crucial because these large holders can significantly impact price movements. Although the total number of smart wallets has dropped from its peak on January 23, the JUP supply in these wallets is still high, currently very close to its all-time high.

This indicates that fewer but larger entities are accumulating JUP, which could signal strong conviction among key players. If this trend continues, it may provide price stability and even fuel a potential rebound. However, if accumulation slows or reverses, it could lead to increased selling pressure and heightened volatility.

JUP Price Prediction: Will JUP Fall Below $1 Soon?

Jupiter EMA lines remains bullish, with short-term moving averages still positioned above long-term ones. However, if the current correction continues, JUP could test the key support level at $0.98.

Losing this support could trigger further downside, with potential declines toward $0.83 or even $0.76.

Despite the ongoing correction, a trend reversal could see JUP attempting to break past resistance levels it failed to surpass in recent days.

The first key targets would be $1.22 and $1.27, which previously acted as strong resistance. If these are broken, JUP could test levels around $1.4 again, solidifying its position as one of the leading applications on Solana.

The post Jupiter (JUP) Drops 10%, But Smart Money Keeps Buying appeared first on BeInCrypto.