Bitcoin (BTC) has experienced a 7% decline over the past week. While this drawdown is partly due to the broader cryptocurrency market weakness, it is primarily driven by a reduction in buying activity from large investors, commonly referred to as “whales.”

As these key coin holders continue to watch from the sidelines, BTC risks plummeting further. Here is why.

Bitcoin Whales Refrain From Buying

According to IntoTheBlock, Bitcoin’s large holders’ netflow has dropped by 116% in the past seven days. Large holders are addresses that hold more than 0.1% of an asset’s circulating supply.

Their netflow measures the difference between the amount of cryptocurrency flowing into addresses belonging to these large holders (inflows) and the amount flowing out of their addresses (outflows). As with Bitcoin, when this metric declines, whale outflows exceed inflows as these large investors are selling their coin holdings for profit.

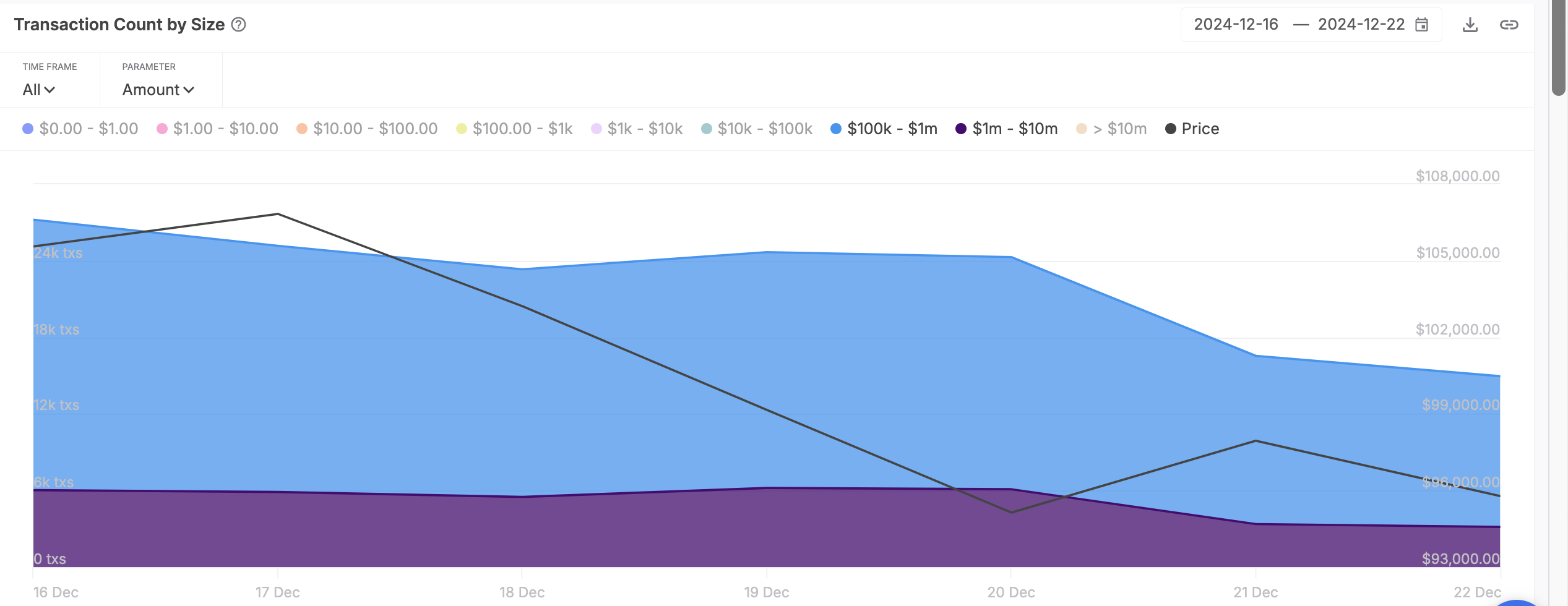

Moreover, the decline in the coin’s daily large transaction count confirms the reduction in whale activity. According to IntoTheBlock, the daily count of BTC transactions worth between $100,000 and $1 million over the past week has decreased by 48%.

Likewise, during the same period, the number of larger BTC transactions valued between $1 million and $10 million has dipped by 50%.

This decline in BTC’s whale activity is notable because reduced buying pressure from large investors can weaken price support and increase the likelihood of further price declines.

BTC Price Prediction: Break Below $95,690 Could Spell $85,000 Crash

On the daily chart, BTC hovers slightly above support at $95,690. With waning whale activity, this key level may fail to hold. In this scenario, BTC’s price will plummet below $90,000 to exchange hands at $85,721.

Conversely, if market sentiment shifts and Bitcoin whales resume coin accumulation, it may trigger a rally toward the coin’s all-time high of $108,388.

The post Bitcoin Tumbles Further from $100,000 as Whales Cut Exposure appeared first on BeInCrypto.