Binance Research’s recent report, “The ETH Value Debate,” analyzes Ethereum’s shifting role in the crypto ecosystem.

While it highlights Ethereum’s foundational role in blockchain innovation, the report notes its position is now under scrutiny due to emerging competitors and evolving market dynamics.

Binance Research Analyzes Ethereum

Binance Research’s report highlights several bullish developments for Ethereum in 2024. Key advancements include the release of the Dencun update, aimed at significantly reducing fees, and the approval of Ethereum ETFs in the US, unlocking new investment opportunities.

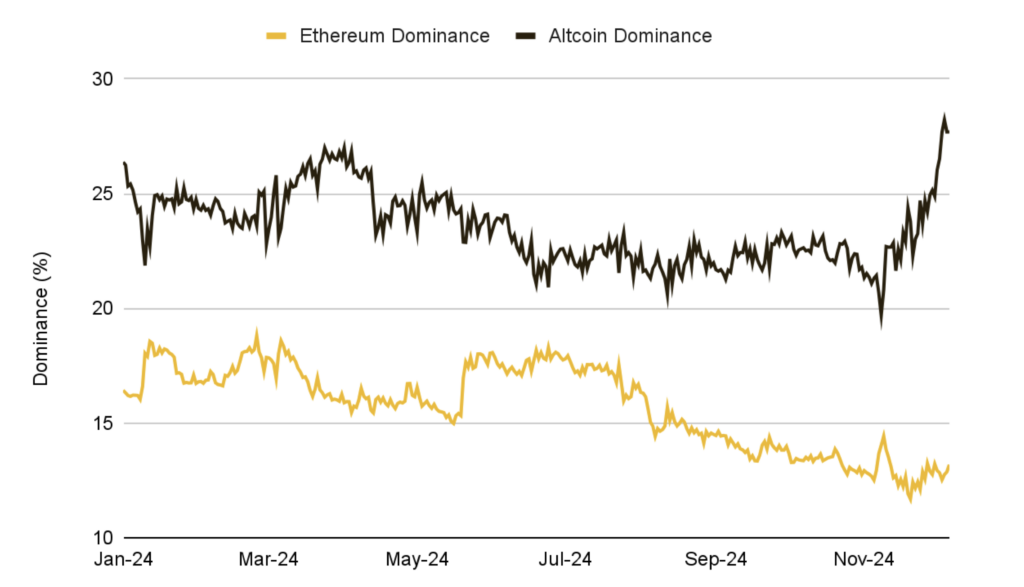

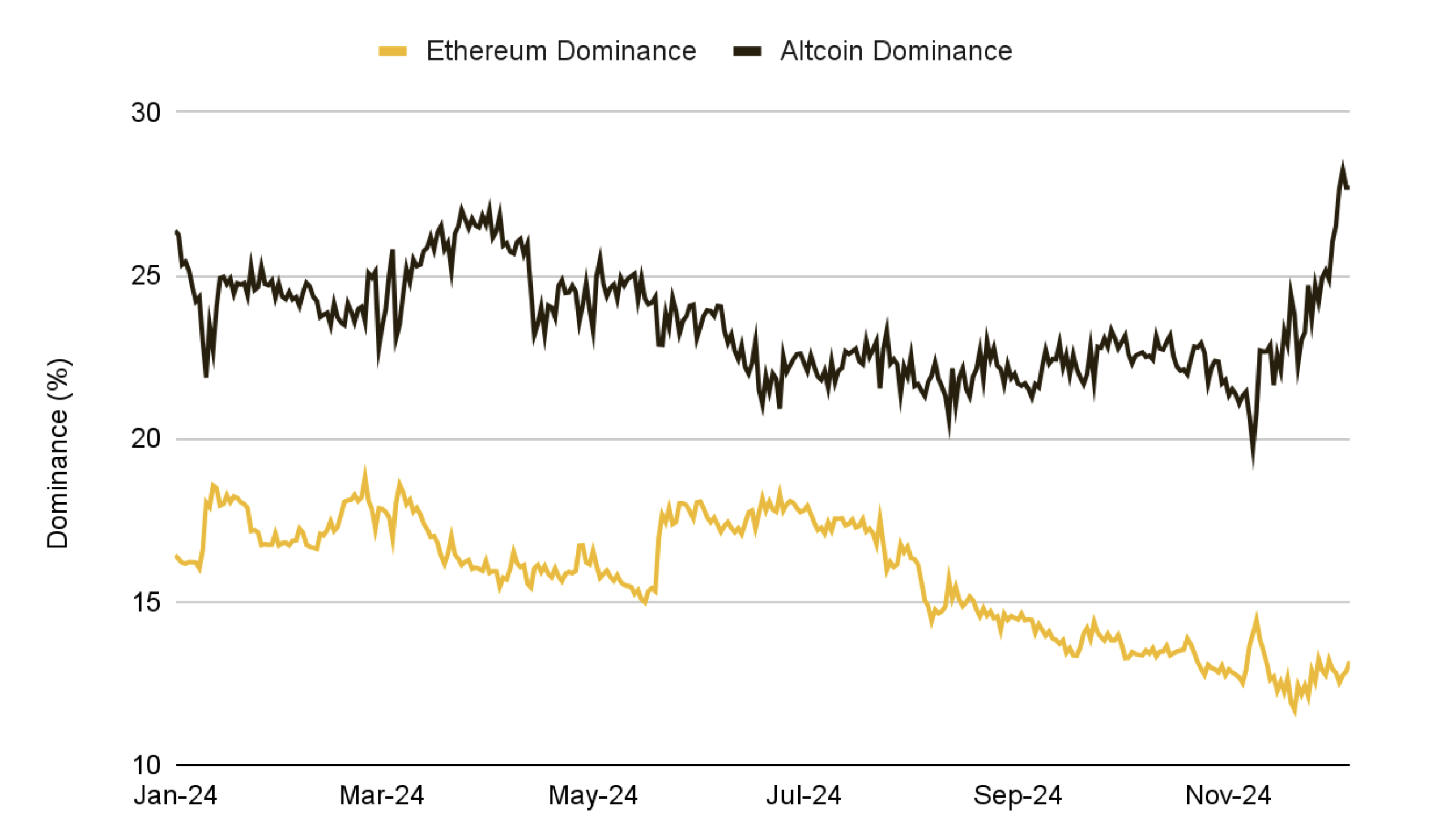

Despite these achievements, Ethereum’s market dominance has continued to decline, hitting a multi-year low of 13.1%. This drop reflects growing competition and evolving dynamics within the cryptocurrency ecosystem.

“Ethereum’s dominance, measured as its market cap relative to the total crypto market cap, has been on a downward trajectory throughout the year, reaching multi-year lows of 13.1%. This decline is particularly striking against a bullish macro backdrop, where risk-on sentiment has surged,” the report claimed.

Following the Dencun upgrade, Ethereum’s revenue dropped 99%, driven by the rising popularity of Layer-2 solutions. In addition, the protocol has shown noticeably reduced network activity. Binance Research characterized these developments in stark terms, stressing the challenges Ethereum faces in maintaining its position.

The launch of Spot ETH ETFs in July 2024 initially garnered limited interest but gained momentum after the US election, surpassing $1.7 billion in net flows. Despite this, Ethereum’s trading volumes and search interest have stayed flat, lagging behind the growing activity of alternative Layer-1s such as Solana.

This ongoing debate reflects Ethereum’s growing need for prioritization. Some believe it should scale through Layer-2 solutions, enhancing value capture and solidifying ETH’s role as non-sovereign money.

Others argue for maximizing Layer-1 capabilities by driving fee-based demand and supporting a strong decentralized application economy. A clear path forward will be crucial for its future success.

“Ambiguity in Ethereum’s objectives — between a rollup-centric roadmap and broader goals — creates market uncertainty. Aligning on a cohesive mission statement would strengthen Ethereum’s narrative and product strategy,” Binance Research stated.

The post Binance Research: Ethereum Market Share Tumbles to 2021 Low Despite Bullish Momentum appeared first on BeInCrypto.