Ethereum (ETH) surged to its highest price in nearly three years on Thursday, December 6, reaching $4,089.

The increase follows significant institutional interest, with US Ethereum ETFs seeing their largest single-day net inflow of $428.4 million on December 5.

A Revival of Institutional Investments in Ethereum ETFs

Leading the inflows was BlackRock’s ETHA fund, followed by Fidelity’s FETH. These contributions also pushed Ethereum ETFs to record their largest weekly net inflow since launching in July.

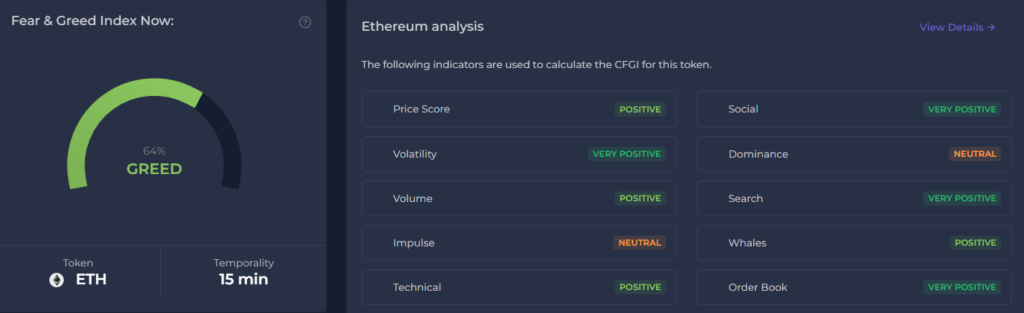

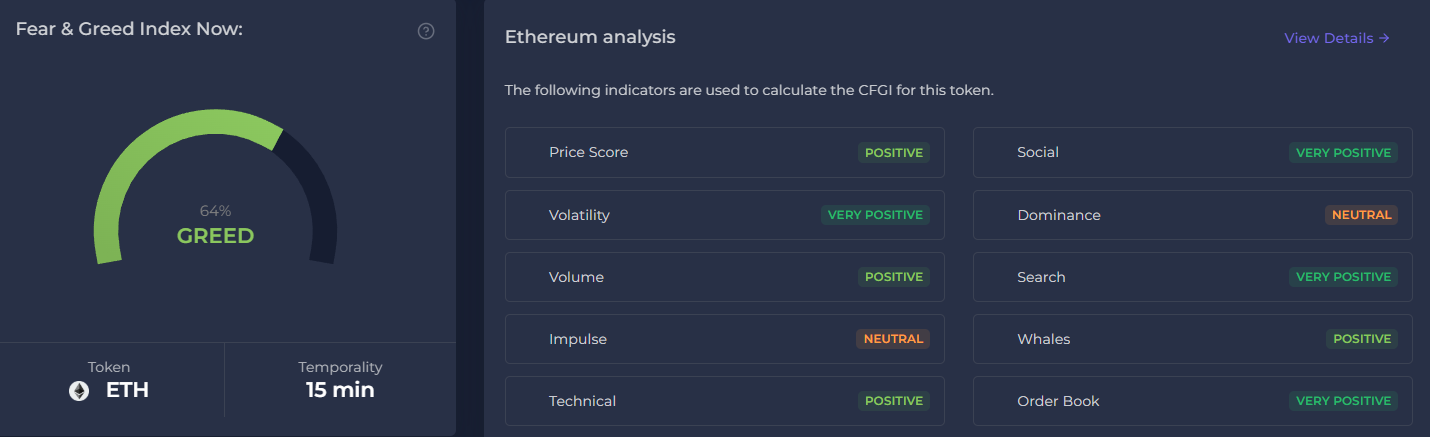

The total weekly inflow stands at $752.9 million in the first week of December. This is already a record weekly gain for the funds, even without the final figures for Friday. This wave of institutional investment spurred Ethereum’s price growth and shifted the fear and greed index to “greed,” currently at 65.

Ethereum ETFs have had a slower start in the US compared to Bitcoin ETFs. The first month of launch saw only one week of positive inflow. Currently, the total assets across nine ETFs stand at $12.5 billion. This accounts for roughly 2.7% of Ethereum’s total supply.

However, November marked a turning point, with monthly inflows exceeding $1 billion, signaling growing institutional interest despite earlier outflows.

A notable development came from the State of Michigan Retirement System (SMRS), which became the first US state pension fund to invest in an Ethereum ETF. SMRS now holds 460,000 Grayscale Ethereum shares and 110,000 ARK Bitcoin ETF shares as part of its diversified crypto portfolio.

Meanwhile, other altcoins are also entering the ETF race. Firms like VanEck, 21Shares, and Grayscale have filed for Solana ETFs. Also, WisdomTree and Bitwise are among four firms seeking approval for XRP ETFs.

As US regulations appear to adopt a more crypto-friendly stance, the ETF market for digital assets is likely to expand.

The post Ethereum Hits 3-Year High as ETFs See Record $752 Million Weekly Inflows appeared first on BeInCrypto.