First Neiro on Ethereum (NEIRO) is one of the few meme coins that registered a price increase in the last 24 hours. Within that timeframe, many meme coins saw their values plummet, but NEIRO’s crypto price gained 11%.

This development has sparked curiosity about NEIRO’s resilience. Through this on-chain analysis, BeInCrypto breaks down the factors contributing to the meme coin’s recent performance and explores potential price trajectories moving forward.

First Neiro on Ethereum Volume Rises, Whales Follow

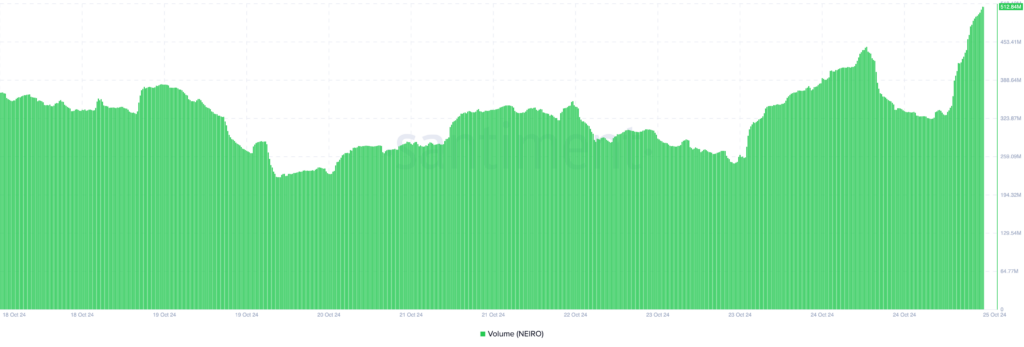

According to Santiment, NEIRO’s price increased due to the surge in volume. In simple terms, a cryptocurrency’s volume represents the total of all buy and sell transactions within a specific period.

An increase in volume indicates active buying and selling, while a decrease suggests lower investor engagement with the token. On Thursday, October 24, the meme coin’s volume almost dropped below $300 million.

However, at press time, the value had increased to $512.84 million, indicating rising interest in the token. Should the volume continue to rise, then NEIRO’s crypto price might also follow in a similar direction.

Read more: What Are Meme Coins?

Another factor contributing to the meme coin’s price increase is the activity of large-scale investors. Earlier in the week, the balance of addresses holding over 1 billion NEIRO tokens was below 318 billion.

Today, that figure has risen to 322.72 billion, indicating that whales have been accumulating the token in significant amounts.

Typically, when whales purchase substantial amounts of tokens, it tends to have a positive impact on the price. As a result, it was inevitable for the token’s value to rise.

NEIRO Price Analysis: Bullish

At press time, NEIRO’s price is $0.0016. According to the daily chart, the Chaikin Money Flow (CMF) has turned upwards.

The CMF oscillates between +1 and -1, with a centerline at 0, providing insights into market sentiment and potential price movements. With these values, the CMF can gauge accumulation (buying pressure) and distribution (selling pressure).

It also aids in interpreting key market signals, such as entry points and exit levels. When the CMF reading rises, it indicates increasing buying pressure, suggesting that more investors are accumulating the asset.

Conversely, a decline in the CMF reading signifies distribution, indicating that selling pressure is present and investors are offloading their holdings. Therefore, in NEIRO’s crypto case, the rising reading indicates that buying pressure is present and the price might increase.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

In this instance, the meme coin’s value could surge to $0.0020. However, if distribution overtakes accumulation, the price might drop to $0.0011.

The post NEIRO Up 11% as Whale Accumulation Boosts Price Against Meme Coin Slump appeared first on BeInCrypto.