Altcoin season might be closer than we think. The Altcoin Season Index has dropped to its lowest level since early September, signaling a potential shift.

If momentum picks up and key resistance levels are broken, altcoins could be primed for a powerful rally. Investors are watching closely, anticipating a rebound that could ignite significant gains across the altcoin market.

Altcoin Season Index Is Ready for a Rebound

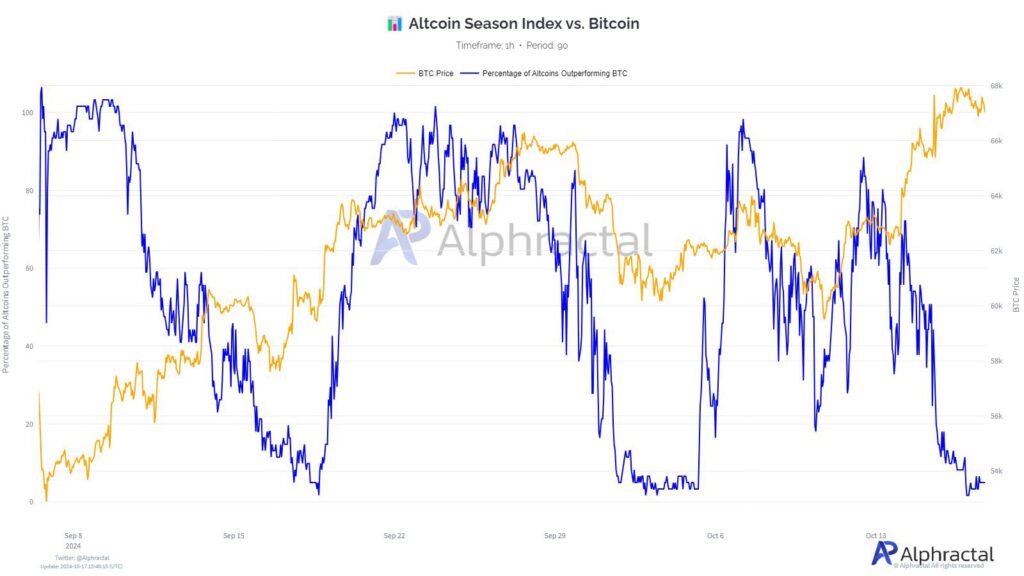

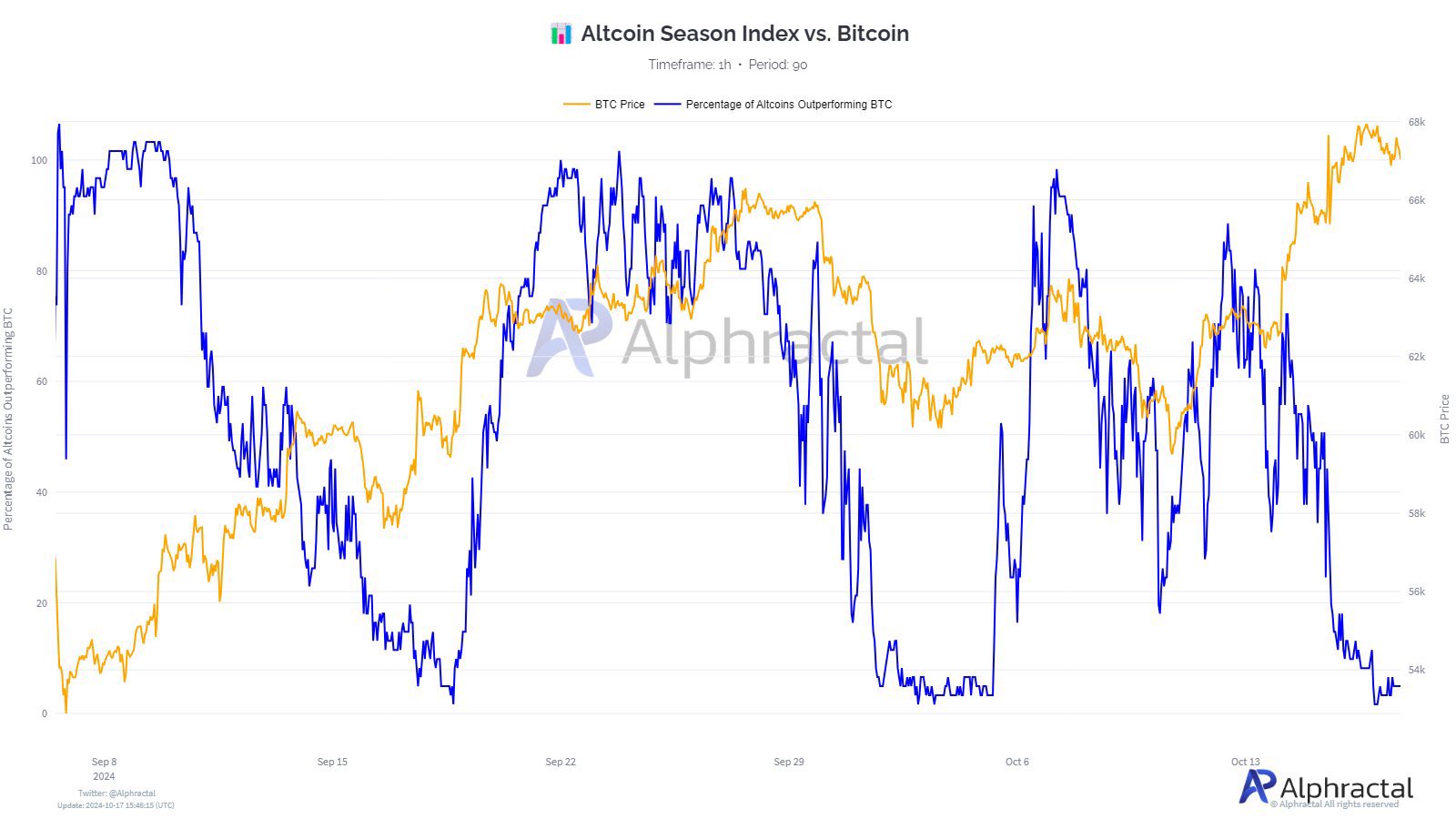

A chart by Alphractal indicates that the Altcoin Season could be approaching soon. According to the Altcoin Season Index vs Bitcoin price, the Altcoin index has reached its lowest value since early September.

The Altcoin Season Index measures the percentage of altcoins outperforming BTC, and it’s currently signaling an interesting shift.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

During September, a clear pattern emerged: whenever Bitcoin’s price rallied, the Altcoin Season Index also rose. However, in recent days, BTC’s price has surged from roughly $60,000 to $68,000, while the Altcoin Season Index has fallen below 10%. This suggests that, despite Bitcoin’s strong rally, altcoins are lagging behind, creating the potential for a significant rebound.

In mid-September, a similar scenario led to the Altcoin Season Index jumping from below 5% to over 90% in just a few days. This could be an opportunity for altcoins to make a strong comeback.

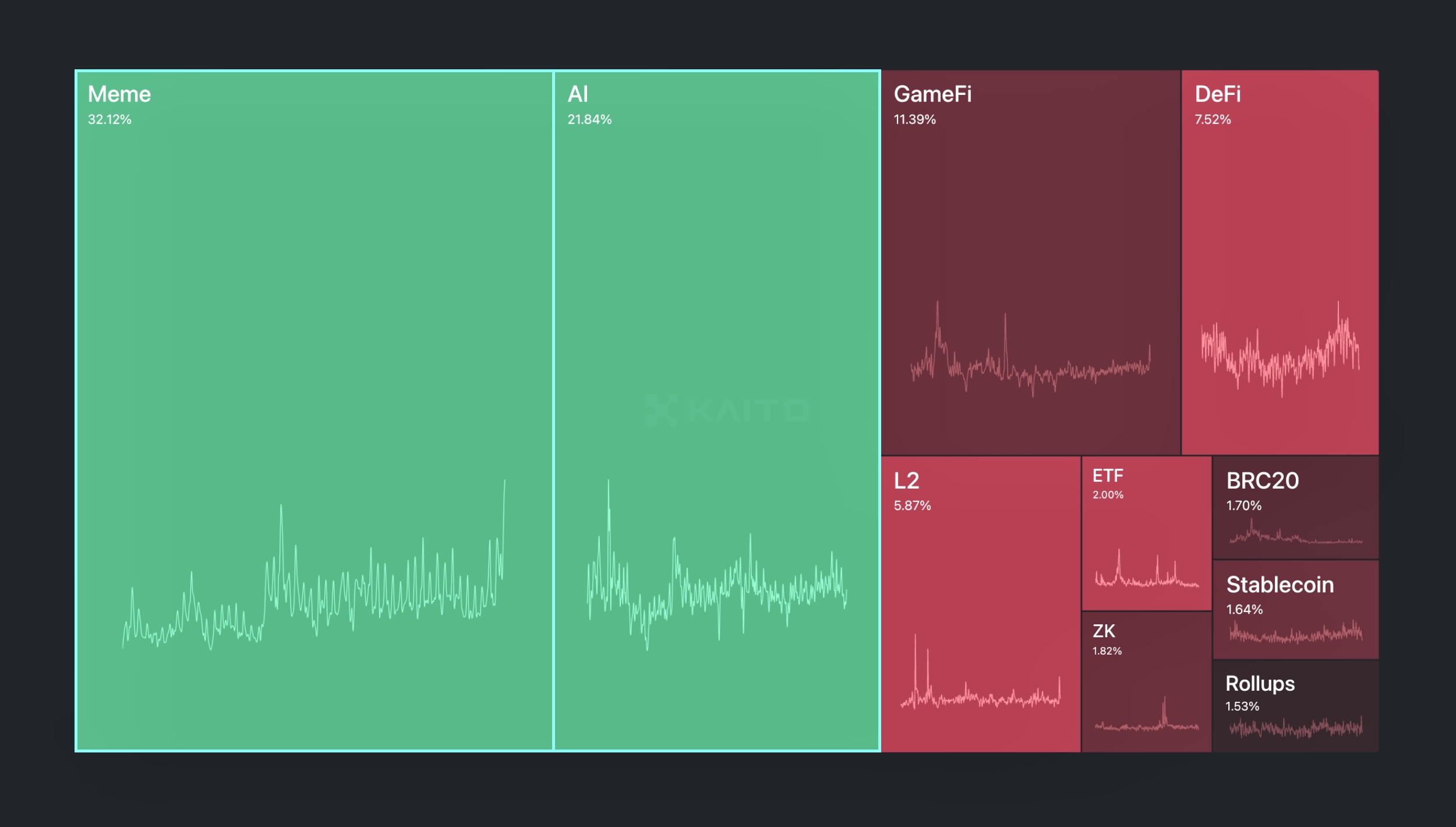

Memes and AI are the Leading Narratives

Two of the most important narratives for altcoins are currently the leading narratives in the market in terms of mindshare: AI and memes. Memes lead with 32%, while AI is at 21.84%. Other significant narratives for the Altcoin season include GameFi and DeFi, with 11.39% and 7.52%, respectively.

The interest in AI and memes indicates that traders are looking for culturally resonant coins that can generate community enthusiasm and viral growth. GameFi and DeFi, though not as dominant, still represent a vital part of the altcoin ecosystem.

If these categories are gaining more mindshare than ETFs, for example, it indicates that investors are more inclined towards altcoins rather than other crypto assets like BTC and ETH. Investors appear to be seeking out opportunities beyond the traditional giants of BTC and ETH, favoring the unique characteristics and potential of specialized altcoin projects.

The rising popularity of these narratives could signal that the market is in a phase of exploration and experimentation. The promise of high returns and groundbreaking applications is driving investor enthusiasm towards altcoins.

Altcoin Season Depends On This Metric

The crypto total market cap, excluding BTC and ETH, is currently at $620 billion, down from $777 billion in April, which was its year-high level. This decline indicates a contraction in the altcoin market but also opens up possibilities for a reversal. The total market cap is likely to test the resistance at $644 billion, a level it failed to surpass between September 28 and September 30.

Breaking through this resistance could be the spark needed to trigger a new altcoin rally. That would potentially mark the beginning of the altcoin season. Such a scenario would likely bring renewed interest and momentum to altcoins.

Read more: 10 Best Altcoin Exchanges In 2024

If this resistance is broken, the crypto market, excluding BTC and ETH, could see a significant rally, testing market caps around $660 billion, $709 billion, and even $740 billion. This represents a potential 20% increase from current levels, highlighting the volatility and opportunity in the altcoin sector.

The market’s ability to break through these resistance levels would signal a broader shift in sentiment. This would draw more investors into altcoins and set the stage for a powerful rally. This kind of momentum could fuel a more sustained altcoin season, with various projects seeing substantial gains as investors seek opportunities beyond BTC and ETH.

The post 3 Reasons Why the Altcoin Season Is Ready to Start appeared first on BeInCrypto.