Solana (SOL) price is down 6% in the last 24 hours, catching the attention of investors. Technical indicators like the Relative Strength Index (RSI) suggest the cryptocurrency may be approaching oversold territory, indicating a possible reversal.

Increased activity on Solana’s major application, PumpFun, hints at renewed user engagement that could positively influence SOL’s performance. These developments set the stage for potential changes in SOL’s price trajectory in the near future.

SOL Is Approaching The Oversold Stage

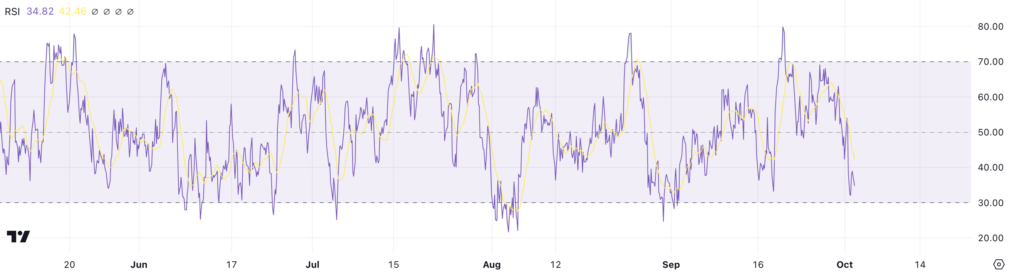

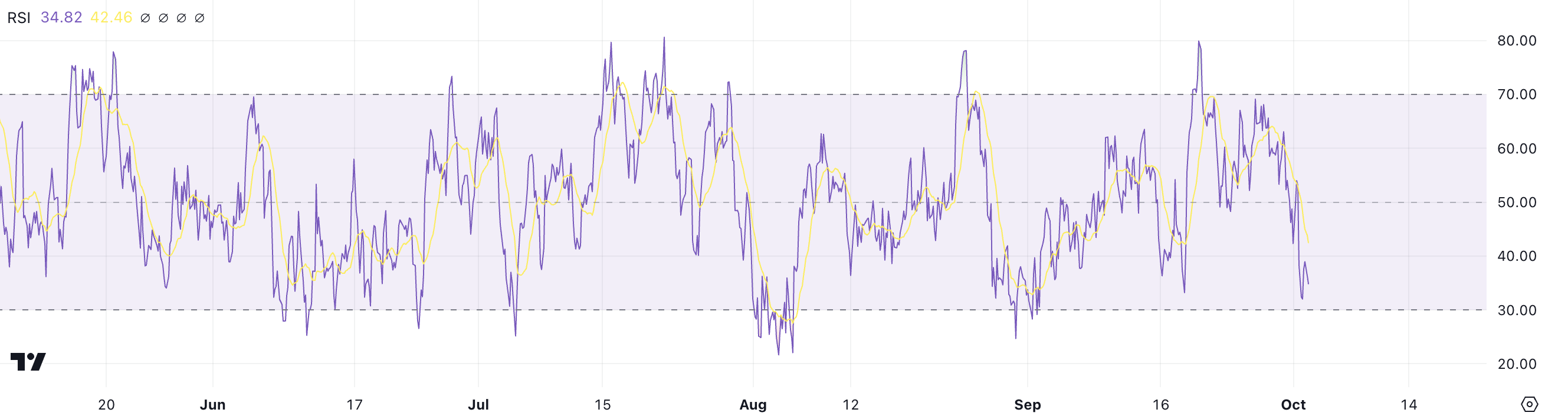

SOL currently exhibits a RSI of approximately 34.82, a notable decrease from around 70 just fifteen days prior. This substantial drop indicates a significant shift in market sentiment, moving from a bullish phase — where buying pressure was dominant — to a more bearish outlook characterized by increased selling activity. The RSI is a technical indicator used to gauge the momentum and speed of price movements.

Oscillating between values of 0 and 100, the RSI helps identify overbought and oversold conditions in the market. Traditionally, an RSI reading above 70 suggests that an asset is overbought and may be due for a price correction, while a reading below 30 indicates it is oversold and could be primed for a rebound.

Read more: Solana vs. Ethereum: An Ultimate Comparison

With SOL’s RSI nearing the oversold threshold of 30, it signals that the coin might be reaching a point where the selling pressure is waning, and buyers could start stepping in.

Such a scenario often precedes a trend reversal, where the asset’s price may begin to climb as market participants perceive it as undervalued. Therefore, according to its RSI metric, Solana price could be gearing up for a rebound, and an emerging uptrend might be on the horizon as investors look to capitalize on the lower price point.

Can New Coins Pump Solana Price?

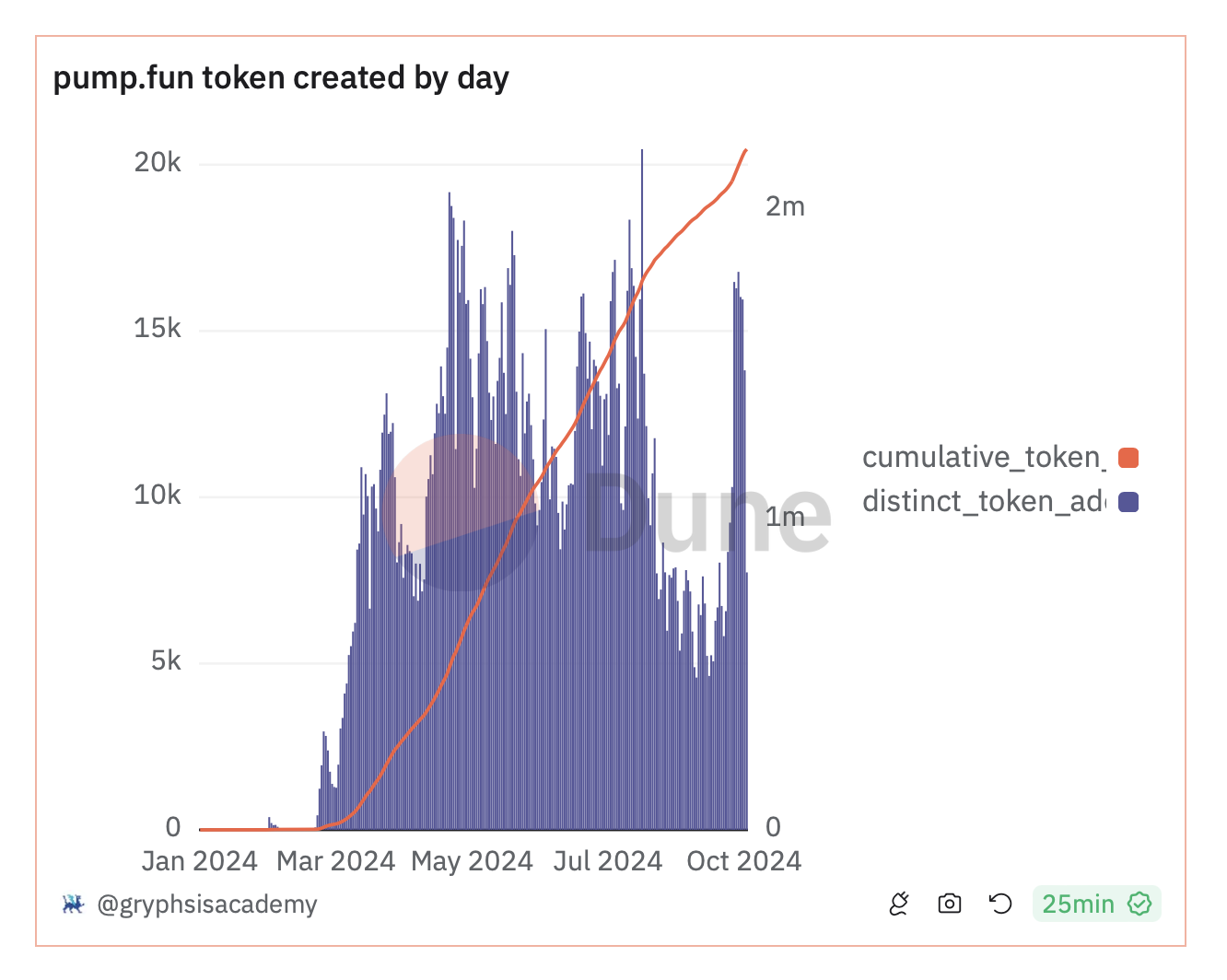

Solana’s biggest application in the last few months, PumpFun, could serve as a strong proxy for the overall health and activity on the Solana blockchain. Recent trends on PumpFun indicate that the memecoin mania within the SOL ecosystem might be making a comeback, which could positively influence SOL’s price.

On August 13, the number of unique tokens launched on PumpFun reached an all-time high of 20,465 but then experienced a dramatic decline, dropping to just 4,629 by September 14.

Historically, significant surges in the number of tokens launched on PumpFun have been followed by substantial gains in SOL price. Notably, the daily number of new PumpFun tokens began climbing again at the end of September, reaching at least 13,000 per day between September 26 and October 1.

This resurgence could indicate that the Solana chain is attracting users once more, potentially positively impacting SOL’s price, as increased activity often correlates with heightened investor interest and demand.

SOL Price Prediction: Back to $162 Soon?

Solana is exhibiting signs of a potential trend shift. Its short-term Exponential Moving Average (EMA) lines are nearing a crossover below the long-term EMAs. That formation is known as a “death cross.”

This pattern in technical analysis suggests possible bearish momentum and potential price declines in the near future. EMAs are indicators that assign more weight to recent prices, helping traders identify market trends.

If this downtrend materializes, SOL’s price could test support levels at $133 or even $110. However, if the Relative Strength Index (RSI) reaches the oversold stage (below 30) and PumpFun continues to attract new coins, this negative trend could reverse.

Read more: 13 Best Solana (SOL) Wallets To Consider in October 2024

Notably, the number of new PumpFun tokens launched daily has been climbing again since late September. This resurgence indicates renewed user interest, which could positively impact SOL’s price. In this scenario, SOL could retest the resistance level at $162, as it did at the end of August. That would mark a potential 13% gain from current prices.

The post Solana (SOL) Price Nears Support: PumpFun Activity Hints at a Potential Surge appeared first on BeInCrypto.