Monero (XMR) price has dropped nearly 7% following Kraken’s announcement to delist the coin in the European Economic Area due to regulatory changes. As the largest privacy coin by market cap, XMR faces increased challenges in a sector already struggling with low valuations and negative returns for most of its competitors.

Despite its dominance in market capitalization, technical indicators like the Directional Movement Index (DMI) and Exponential Moving Averages (EMA) suggest a strong downtrend. If the current bearish momentum persists, Monero may soon test critical support levels, deepening the ongoing correction.

XRM Is By Far The Biggest Player In The Privacy Coins Market

Monero (XMR) has experienced a nearly 7% price drop after Kraken announced it will delist the coin for users in the European Economic Area (EEA) due to regulatory changes. Kraken, one of the world’s oldest crypto exchanges, informed its EEA clients that trading and deposits for all Monero markets will cease on October 31, with any open orders automatically closed.

Users have until December 31 to withdraw their Monero holdings, after which any remaining balances will be converted to Bitcoin. The exchange stated it had no choice but to delist Monero from the EEA due to regulatory pressures.

Read more: Monero: A Comprehensive Guide to What It Is and How It Works

2024 appears to be a challenging year for privacy coins, with only three out of the top ten showing positive returns. Privacy coins continue to be a more complicated area within the crypto space and often have lower valuations than other sectors. Among the top ten privacy coins, only Monero (XMR) boasts a market capitalization of over $1 billion, specifically $2.6 billion.

The combined market cap of the other nine leading privacy coins is $3.1 billion, which is less than that of PEPE at $4.1 billion, clearly highlighting the sector’s difficulties.

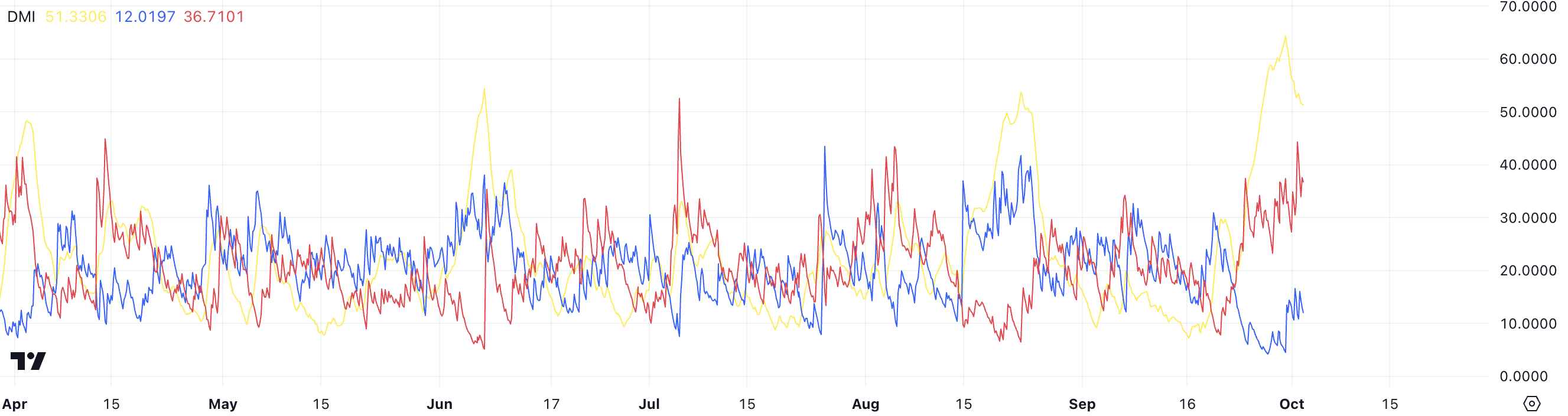

Monero DMI Shows The Current Trend Is Strong

According to its Directional Movement Index (DMI), Monero has seen its ADX climb to 51.3, signaling a strong and well-established trend in the market.

The ADX is a key metric used to gauge the strength of a trend — whether upward or downward — and tells if it’s strong or not. The DMI itself is composed of three lines: the ADX, the +DI, which reflects buying or upward pressure, and the -DI, which measures selling or downward pressure.

Currently, Monero’s +DI sits at a relatively low 12, while the -DI has surged to 36.7, indicating that sellers are firmly in control and that bearish momentum is dominating the market. This significant disparity between the two suggests that the current correction could still be in its early stages, as the downtrend appears to be gaining strength.

With such a high ADX, this bearish movement seems to have solid momentum behind it, implying that further downside could be likely as the selling pressure remains strong and could continue to drive prices lower. This combination of a high ADX and dominant -DI shows that the market is in a powerful downtrend, and a reversal does not seem imminent at this point.

XRM Price Prediction: Is The Correction Over?

On September 24, Monero (XMR) experienced a bearish signal when its EMA lines formed a death cross, after which its price dropped by 22%.

EMA lines, or Exponential Moving Averages, are used to track price trends by giving more weight to recent data. A death cross occurs when the short-term EMA crosses below the long-term EMA, often signaling the start of a downtrend.

This bearish indicator, combined with the current strong ADX reading, suggests that the market is experiencing a strong downtrend that may continue.

Read more: Monero (XMR) Price Prediction 2023/2025/2030

The gap between the EMA lines isn’t significantly wide yet. That indicates that the correction could still be in its early stages. If the downtrend persists, XMR could soon test key support levels at $133 or even as low as $116. This would mark a further potential drop of 16.5%.

However, if the trend somehow reverses, Monero would need to break through resistance at $143. Should it succeed, the next targets would be $165 and $178, signaling potential recovery.

The post Monero (XRM) Price Faces 7% Drop After Kraken’s Delisting in Europe: What’s Next appeared first on BeInCrypto.