Ethereum’s price has experienced a notable 10% rise in the past week, pushing the altcoin back above the support level of $2,344.

While this increase has provided some optimism for investors, ETH is unlikely to break through the critical resistance at $2,681. The altcoin king is now facing potential selling pressure, making a price correction more likely in the coming days.

Ethereum Investors Look to Sell

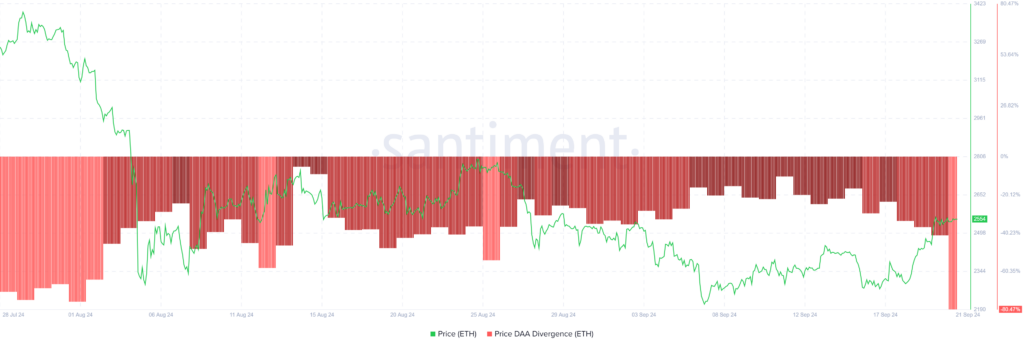

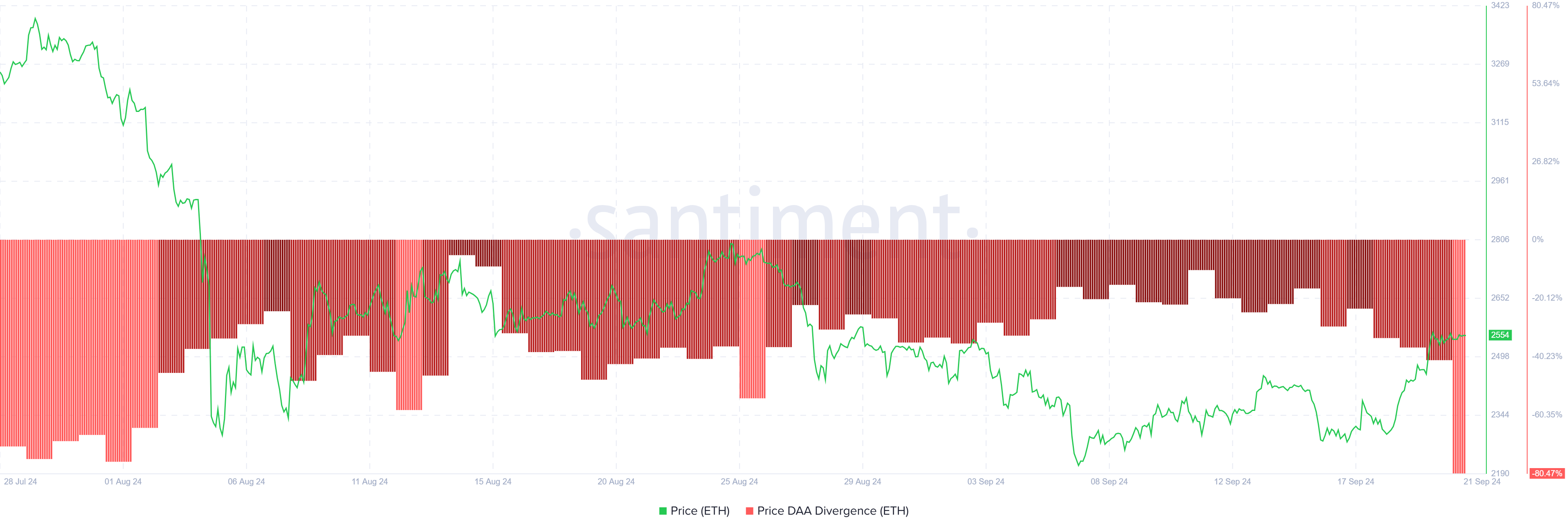

The Price Daily Active Addresses (DAA) Divergence indicator is currently flashing a sell signal, suggesting that the Ethereum price’s recent rally may soon face a pullback. This signal often occurs when participation declines during a price rise, indicating waning confidence among investors. A shrinking number of active addresses can create a disconnect between price action and actual market interest, which typically leads to a reversal or correction.

This declining participation highlights a lack of strong buying interest, even as Ethereum’s price climbs. Without significant new demand, the price rally may stall, making it more susceptible to downward pressure as sellers move to take profits.

Read more: How to Invest in Ethereum ETFs?

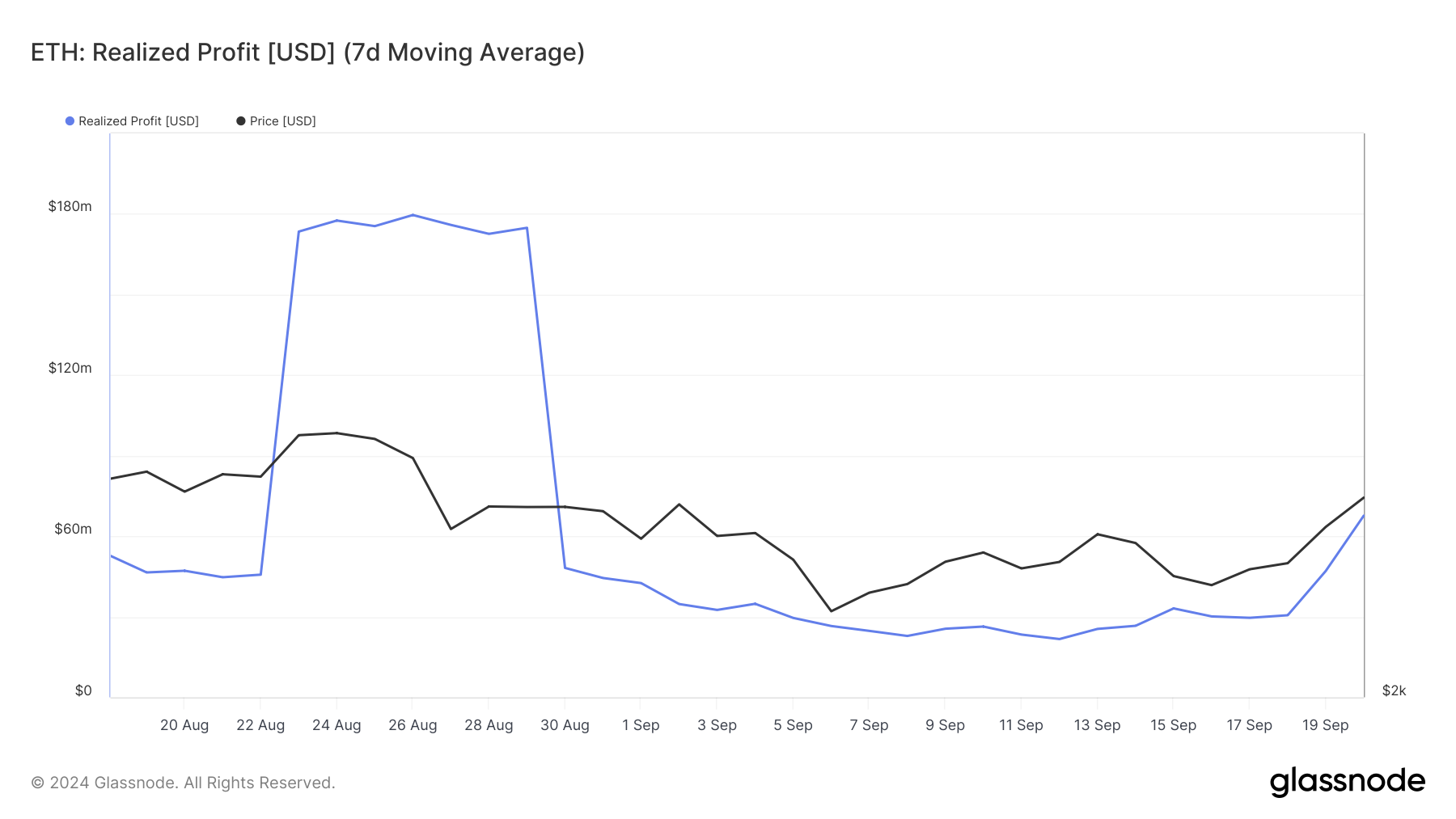

Additionally, the overall macro momentum for Ethereum also supports the likelihood of a price correction. The realized profits metric further confirms the sell signal from the Price DAA Divergence.

Over the last two days, investors have sold nearly $40 million worth of ETH, marking the first significant selling activity in three weeks. This sudden surge in realized profits is a clear indication that some investors are cashing out to capitalize on the recent price increase.

The uptick in selling reflects a loss of confidence in Ethereum’s ability to maintain its upward momentum. As more investors take profits, ETH could see additional downward pressure, leading to a potential price correction.

ETH Price Prediction: Coming Back Down

Ethereum’s price is currently trading at $2,552 after a 10% rise over the last few days. However, ETH is barely holding above the local support of $2,546, leaving it vulnerable to a potential correction.

Based on current indicators, Ethereum could face a drop to the next crucial support level at $2,344. If ETH falls below this level, a further decline toward $2,170 may follow, signaling a more substantial correction.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if Ethereum manages to withstand the selling pressure and breach the $2,681 resistance barrier, it could continue its rise toward $3,000. Such a move would invalidate the current bearish outlook and suggest a stronger recovery for the altcoin.

The post Ethereum (ETH) Price Rally at Risk as First Sell Signals Appear in 3 Weeks appeared first on BeInCrypto.

:max_bytes(150000):strip_icc()/Bitcoin-7c580bcd389d4aef8f5a7bdb42cd26bb.jpg)