Bitcoin-backed lending has experienced steady growth over the past few years, but new deals and increasing market interest signal that this could be the start of a massive surge.

With institutional backing and rising adoption rates, this market may soon undergo exponential growth, fundamentally transforming credit markets on a global scale.

Bitcoin-Backed Lending: A Growing Market Opportunity

The Bitcoin-backed lending and credit market has quietly gained momentum within the crypto industry. Although several firms have explored this concept for a few years, it is only now receiving wider recognition.

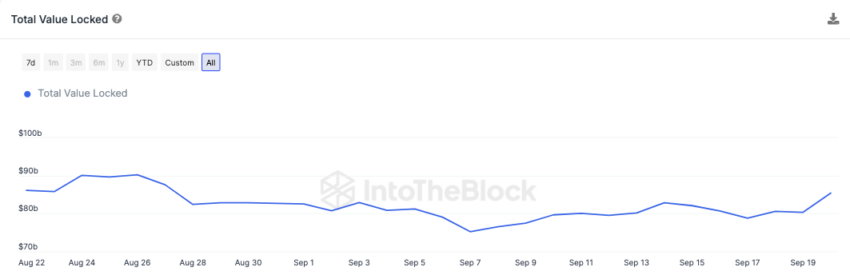

Crypto lending is one of the most widely-used services in decentralized finance (DeFi), with the potential for significant growth. The broader DeFi ecosystem, for instance, grew from $21 billion in total value locked (TVL) in early 2021 to over $85 billion today, showing the massive appetite for blockchain-based financial services.

This type of lending opens new doors for borrowers who wish to access liquidity without selling their Bitcoin. More importantly, it gives lenders new avenues to tap into crypto markets while securing loans with a highly fungible and decentralized asset.

For example, in August 2023, Sygnum, a Swiss digital asset bank, issued a $50 million syndicated loan to crypto lender Ledn. This deal was significant not only because it was one of the first major Bitcoin-backed loans in fiat currency, but also because the loan’s collateral was Bitcoin.

Institutional players from Sygnum’s client base were involved, marking a shift in how traditional finance engages with digital assets .

Market research firms like Messari predict that the overall DeFi lending market will grow exponentially, with Chainalysis estimating that crypto-backed loans could represent a significant portion of the total crypto market by 2026. Moreover, a report from Fidelity Digital Assets indicated growing institutional participation in crypto lending, highlighting how traditional lenders are increasingly interested in offering crypto-backed loans.

In line with this optimism, Kevin Charles, co-founder and CEO of Open Bitcoin Credit, foresees explosive growth in the Bitcoin-backed credit market.

“In five years, the Bitcoin-backed credit market could grow into a multi-billion-dollar industry, with estimates reaching $100-200 billion in outstanding loans as Bitcoin adoption expands. With broader acceptance and improved infrastructure, we could see Bitcoin-backed loans becoming a standard offering at major banks and fintechs, serving millions globally,” Charles told BeInCrypto.

Read More: How to Take Out a Decentralized Loan with Crypto

According to Chain, regions where traditional banking services are limited—particularly in Latin America and Africa—are seeing the fastest Bitcoin adoption rates. These underserved markets represent untapped opportunities for Bitcoin-backed lending to provide liquidity to individuals and businesses that would otherwise be excluded from traditional credit markets.

Yield Comparison and DeFi Synergies

Yield generation in DeFi platforms such as Aave and BlockFi further illustrates the appeal of Bitcoin-backed loans. Current yield offerings on DeFi platforms can range from 4% to 10%, depending on market conditions and asset types.

In comparison, traditional financial institutions typically offer much lower yields on secured loans, making DeFi a more attractive alternative for crypto holders looking to leverage their assets.

However, these lucrative yields often come with risks, particularly when interest rates fluctuate or when markets experience significant volatility. A Bernstein report indicated that while high interest rates can stifle DeFi lending growth, impending rate cuts could serve as a catalyst, reinvigorating demand for Bitcoin-backed loans.

“With a rate cut likely around the corner, DeFi yields look attractive again. This could be the catalyst to reboot crypto credit markets and revive interest in DeFi and Ethereum,” Gautam Chhugani, Mahika Sapra and Sanskar Chindalia wrote.

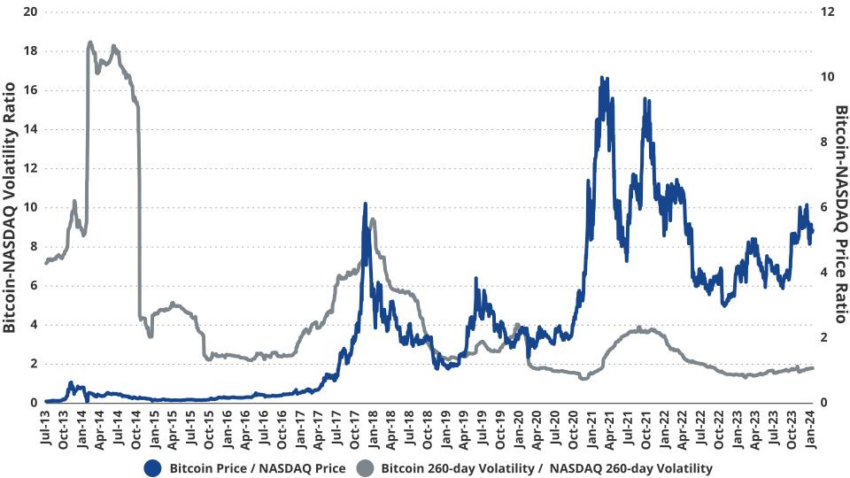

As with any new financial product, risks remain. Bitcoin’s notorious price volatility poses challenges for both borrowers and lenders. For borrowers, sudden price drops could trigger margin calls, forcing the liquidation of their Bitcoin holdings. According to VanEck, Bitcoin has experienced price swings as large as 30% within a single week, underscoring the difficulty in managing collateral.

Lenders face their own challenges as well. Managing the value of Bitcoin collateral is an ongoing process, and market illiquidity during downturns could leave lenders with devalued collateral. BeInCrypto reported that liquidations across DeFi platforms reached $5.55 billion in April, illustrating the potential risks when markets turn sour.

However, blockchain security firms like Fireblocks have developed advanced collateral management systems to mitigate these risks, offering real-time data monitoring and multi-layer security protocols to ensure the integrity of loans.

The participation of institutional investors, fintech companies, and even traditional banks in the Bitcoin-backed lending market is likely to provide much-needed liquidity and stability. CoinShares reports that institutional inflows into crypto-related assets reached over $436 million last week, highlighting how institutions are increasingly viewing Bitcoin-backed loans as viable investment options.

“Traditional banks will play an essential role in Bitcoin-backed lending by providing credibility, capital, and innovation. They will push the industry forward by integrating decentralized models that lower costs and increase efficiency in lending,” Charles emphasized.

Read more: Crypto-Secured Loans: An Explainer on How They Work

Moreover, Bitcoin adoption continues to grow, especially in regions underserved by traditional banks. According to Chainalysis, Bitcoin adoption in Africa increased by over 1,200% between 2020 and 2022, signaling that Bitcoin-backed lending could become a primary financial tool in these regions as the infrastructure improves.

Future Success and Roadblocks

While Bitcoin-backed lending presents numerous opportunities, the industry still faces challenges. Unclear regulatory frameworks, lacking infrastructure, and security concerns remain significant obstacles.

Fireblocks and other security platforms are working to address these challenges by implementing stronger custody and collateral management protocols. Additionally, Charles believes that future regulatory efforts will enhance consumer protection, improve legitimacy, and increase adoption.

Ultimately, Bitcoin-backed lending has the potential to revolutionize traditional credit markets by offering a more flexible, secure, and decentralized form of collateralized lending. This could drive innovation and push traditional banks to adopt decentralized models that lower costs and speed up loan processes.

Despite the hurdles, the adoption of Bitcoin-backed credit could significantly “expand access to credit, diversify financial products, and create a more efficient global lending system,” Charles concluded.

The post $1.5 Trillion Credit Market Is Ripe for Bitcoin’s Takeover appeared first on BeInCrypto.

:max_bytes(150000):strip_icc()/Bitcoin-7c580bcd389d4aef8f5a7bdb42cd26bb.jpg)