In the cryptocurrency market, the allure of fast profits, fueled by viral trends and social media hype, has attracted millions of investors to meme coins.

However, the reality is sobering. Around 97% of meme coins fail within a short period. Understanding the factors behind the success or failure of these altcoins is crucial for investors looking into this sector.

Most Meme Coins Fail

Meme coins often capitalize on viral trends and social media buzz to gain rapid traction. However, this approach typically lacks long-term viability.

In an exclusive interview with BeInCrypto, Alvin Kan, COO of Bitget Wallet, said the primary reason for meme coin failures lies in short-term thinking.

“Most meme coin developers release a token just to capture the market hype for a short period—weeks or maybe months. Once that initial hype is over and investors’ FOMO wears down, the token’s presence almost ceases to exist in the broader crypto market,” Kan explained.

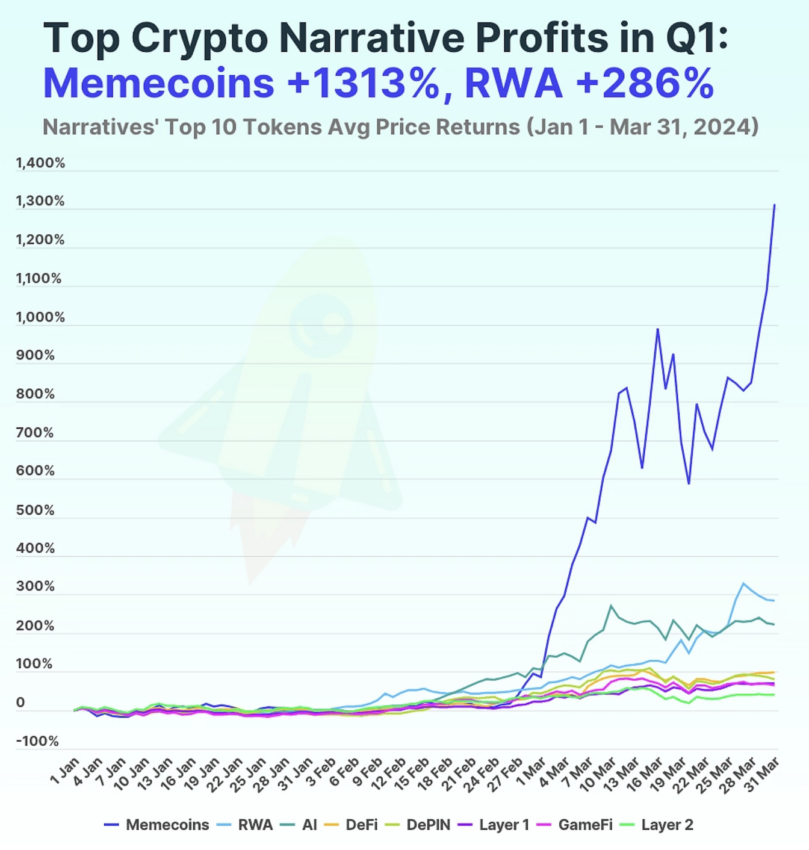

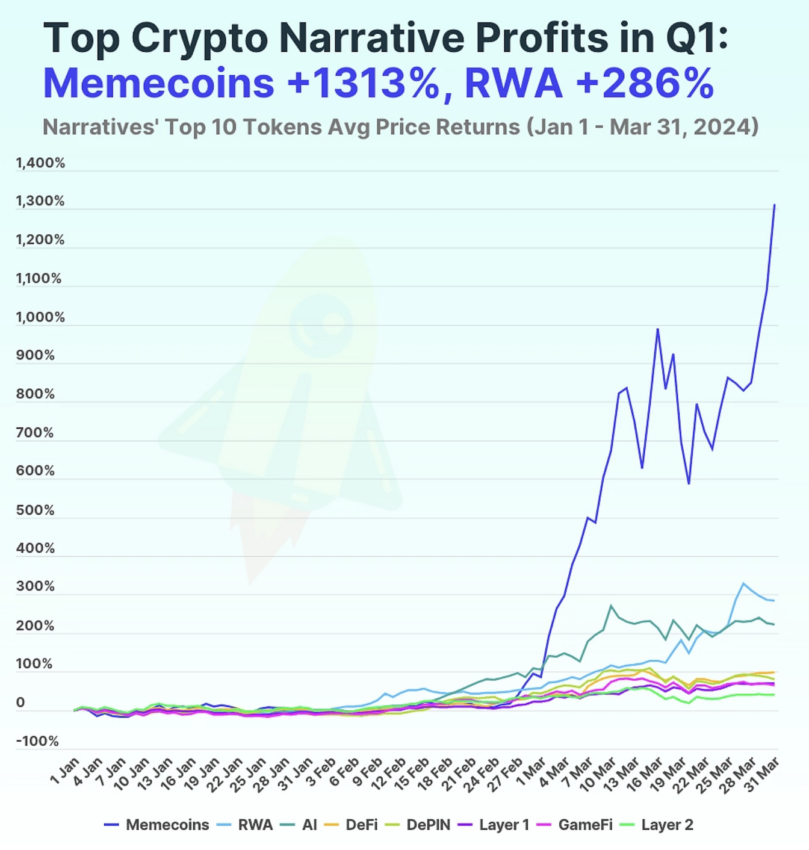

After a significant success in Q1 2024, nearly all meme coins have crumbled this year because of a lack of foresight. Indeed, many meme coins are built purely on hype, with no inherent value or long-term strategy. After an initial rush of enthusiasm, the absence of sustained engagement and utility leads to their downfall.

Therefore, once the hype fades, meme coins disappear from trading platforms and investors’ portfolios. As of 2024, a staggering 97% of meme coins have failed, reflecting the speculative and short-lived nature of these tokens. On average, a meme coin only survives for about one year, compared to three years for other crypto projects.

The Secret to Success

Despite the dismal statistics, some meme coins have defied the odds, thriving long after the initial buzz fades. Kan believes that successful meme coins share common traits, such as utility beyond the hype, innovative tokenomics, and strategic marketing.

For instance, Shiba Inu (SHIB) started as a simple Dogecoin (DOGE) rival but has since evolved into a multifaceted project with DeFi integrations, staking, and Web3 gaming features. Others like Bonk (BONK) and Floki (FLOKI) have also demonstrated that offering real-world applications can propel a meme coin beyond its novelty status.

“If you look at the top-performing tokens of this year, such as BONK, FLOKI, or SHIB, they all have an extensive ecosystem that creates a broader utility for the token. Developers who value long-term success ensure their meme coins have a strong distribution layout and they engage in discussions with key opinion leaders, host AMA sessions with the developers, and promote the project through partnerships and collaborations,” Kan added.

This evolution from simple memes to useful tokens is crucial for survival in the highly competitive and speculative cryptocurrency market.

In addition to utility, successful meme coins often have tokenomics that prioritize long-term value. BONK, for instance, allocated 40% of its supply for community incentives. By creating clear rewards for holders, it encourages continued engagement and support from its user base.

Marketing is another area where the line between success and failure is drawn. According to Kan, a “pump-and-dump” meme coin engages in viral marketing campaigns that are viral but shallow. These tactics might involve low-quality media coverage or bot-driven social media activity, which can lead to a spike in interest followed by a rapid decline.

The Double-Edged Sword

Platforms like X (formerly Twitter) play an outsized role in driving the meme coin craze. Prominent figures in the industry, such as Elon Musk, have been known to spark meme coin price surges with a single tweet. In an unregulated social media environment, rumors and speculative enthusiasm can quickly drive prices up—or down.

Recently, TikTok has emerged as another powerful platform for meme coin promotions. Viral challenges encouraging users to buy specific tokens have led to short-term price spikes. While this strategy can bring significant attention to a coin, it often results in extreme volatility, and the token’s price can plummet just as quickly.

Coordinated community-driven efforts to push a coin’s popularity can be a double-edged sword. While these campaigns can lead to price surges, they also carry the risk of market manipulation.

Retail investors often find themselves at a disadvantage when a few large holders orchestrate a price pump, only to exit the market after making significant profits, leaving smaller investors with depreciated assets.

“The sense of belonging to a community, combined with the fear of missing out on the “next big thing,” drives more investors to buy in. As more people see posts and discussions about the coin’s rising value, they jump in, hoping to catch the wave. Investors must be aware of these trends, understanding they are betting purely on the community’s ability to drive hype, making these coins speculative and risky,” Kan told BeInCrypto.

In fact, one of the biggest risks is the prevalence of scams and rug pulls. About 55.24% of meme coins are classified as malicious, with blockchains like Base showing the highest scam rates at 59.15%, followed closely by Ethereum at 55.59%. This high prevalence of fraudulent projects emphasizes the need for diligent research.

Learning from Previous Mistakes

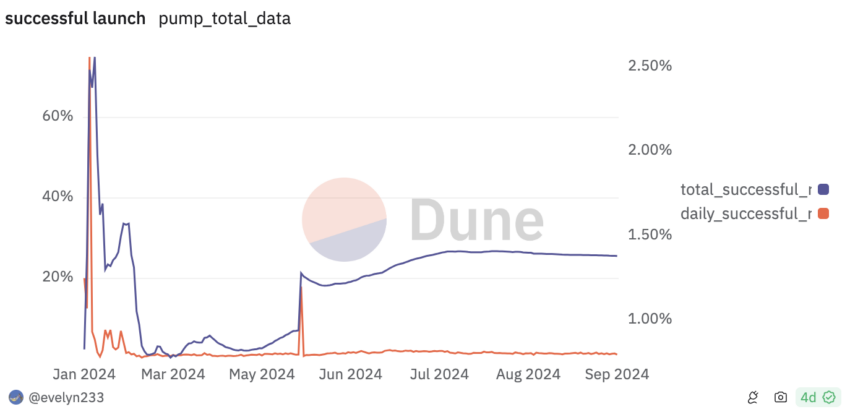

Another critical statistic reveals that 98.6% of meme coins on certain platforms, like Solana’s Pump.fun, fail to even launch successfully. This reflects how easy it is to create meme coins but also the challenges in bringing them to market and maintaining long-term value

Investors should be aware of these risks and trends. In most cases, meme coins are speculative assets, and their value is largely determined by the community’s ability to sustain hype. When interest wanes, the coin’s value can collapse, often to near-zero levels.

Read more: 11 Top Solana Meme Coins to Watch in September 2024

Conversely, developers who aim for success must prioritize transparency, build credibility with their community, and adopt mature marketing strategies.

“If you look at the recent successful meme coins, they have several DeFi components. Developers create an ecosystem where these coins can be leveraged for staking, gamification, or NFT integration. These initiatives create passive earning opportunities for the holders. So, even in a bear market, there’s always an ongoing utility and transaction for the tokens,” Kan concluded.

Understanding the factors behind success—and failure—can make all the difference. Investors should remain cautious, recognizing that the meme coin market is highly speculative and prone to extreme volatility.

Meanwhile, new projects aiming to establish credibility amid market skepticism must prioritize transparency. Third-party audits, industry partnerships, and consistent communication can help build a trustworthy reputation.

The post 97% of Meme Coins Fail: The Secret to Success appeared first on BeInCrypto.

:max_bytes(150000):strip_icc()/Bitcoin-7c580bcd389d4aef8f5a7bdb42cd26bb.jpg)