Coinbase has addressed recent rumors that it was issuing Bitcoin IOUs to BlackRock for its spot exchange-traded fund (ETF) product.

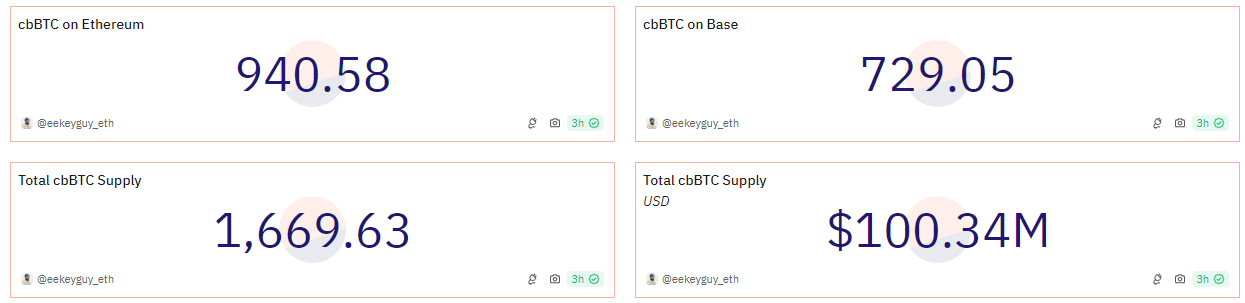

These rumors emerged as TRON blockchain founder Justin Sun criticized the firm’s wrapped Bitcoin product, cbBTC.

Coinbase Clarifies ETF Operations Amid Bitcoin IOU Rumors

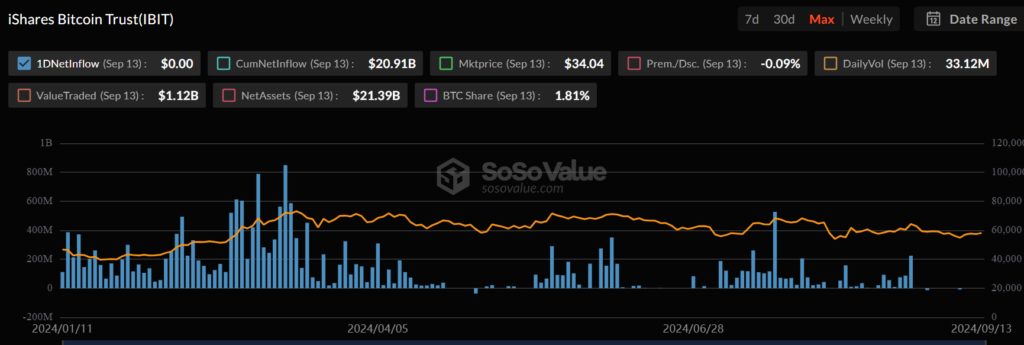

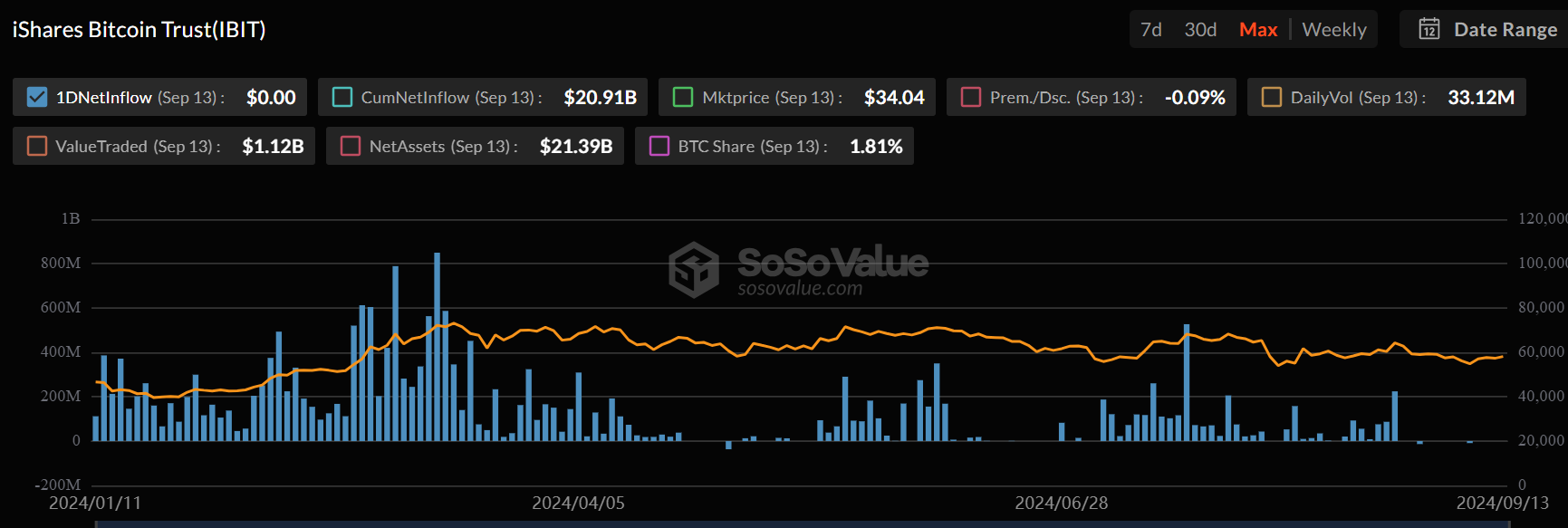

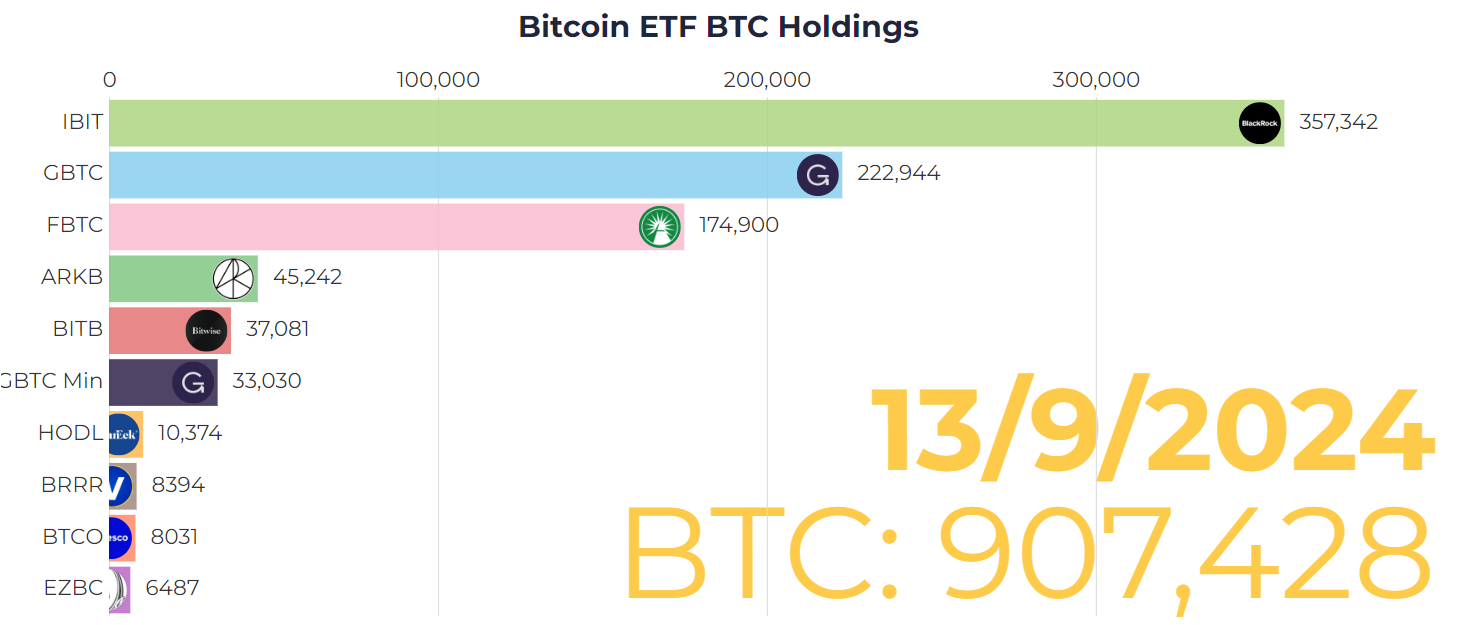

On September 14, crypto analyst Tyler Durden suggested that Coinbase was issuing BTC IOUs to BlackRock. This would mean BlackRock could borrow Bitcoin to short it without proving they held a 1:1 ratio.

Durden referenced Cryptoquant data, asserting that Coinbase was the largest buyer and seller at market highs and lows. He speculated that BlackRock might use its position to negatively influence Bitcoin’s price, either by capping it or causing a major pullback.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Meanwhile, Tron network founder Justin Sun further had earlier sparked controversies over Coinbase’s new wrapped Bitcoin product, cbBTC. Sun claimed cbBTC lacked Proof of Reserve, had no audits, and could freeze balances at any time. He described cbBTC as “trust me” Bitcoin, implying that a US government subpoena could seize all Bitcoin held through it.

“cbbtc=central bank btc. There is no more ridiculous combination in the world than putting central banks and Bitcoin together. I imagine this is a day Satoshi Nakamoto could never have envisioned when creating Bitcoin,” Sun added.

Coinbase CEO Brian Armstrong responded to these allegations by clarifying how ETFs function and addressing concerns about cbBTC. He explained that ETF mints and burns typically settle on-chain within one business day. He also noted that the firm’s institutional clients use trade financing and OTC options before settling trades on-chain.

Further, Armstrong stated that his firm was not authorized to disclose institutional client addresses, including those of BlackRock.

“If you want audits, Deloitte audits us annually, we’re a public company. I doubt our institutional clients want people dusting all their addresses, and it’s not our place to share for them. This is what it looks like if you want a bunch of institutional money to flow into Bitcoin,” the Coinbase CEO emphasized.

Regarding cbBTC, Armstrong noted that its users trust a centralized custodian to manage the underlying Bitcoin, and Coinbase has never claimed otherwise.

Notably, other market experts have also refuted the IOU claims. Nate Geraci, president of The ETF Store, dismissed the rumors, emphasizing that the ETFs fully own the assets they claim.

“Whatever Coinbase is or isn’t doing, rest assured the ETFs 100% own underlying BTC. It’s real. And it’s spectacular. That simple. Period. End of story. Heard same thing back in the day w/ physical gold ETFs. Anyone perpetuating this stuff doesn’t understand how ETFs work,” Geraci wrote.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Meanwhile, Bloomberg analyst Eric Balchunas pointed out that people find it hard to accept that actual market participants, rather than ETFs, are responsible for Bitcoin’s recent price fluctuations.

“I get why these theories exist and people want to scepegoat the ETFs. [Because] it is too unthinkable that the native HODLers could be the sellers. But they are. The call is coming from inside the house. All the ETFs and BlackRock have done is save BTC’s price from the abyss repeatedly,” Balhcunas stated.

The post Coinbase CEO Brian Armstrong Counters Bitcoin IOU and cbBTC Controversy appeared first on BeInCrypto.