The tokenization of real-world assets (RWAs) is transforming the financial sector in 2024. It has captured interest from both web3 enthusiasts and traditional finance giants like BlackRock and Franklin Templeton.

This shift introduces assets such as equities, bonds, and real estate into the blockchain, aiming to eliminate barriers like information asymmetry and high transaction costs prevalent in traditional finance.

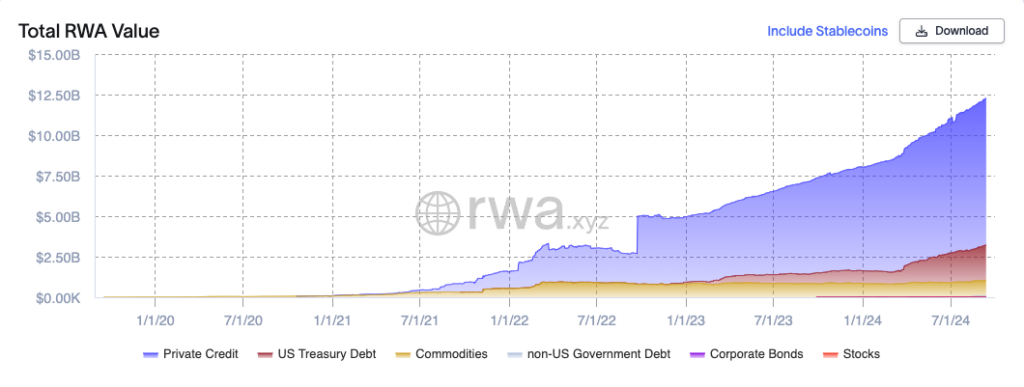

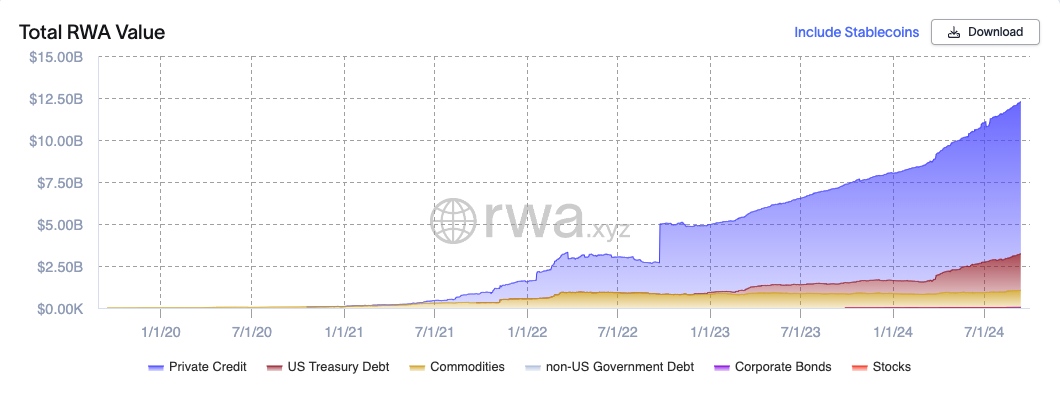

Total Tokenized RWA Market Crosses $12 Billion

The growth of the tokenized RWA market has skyrocketed in 2024. According to data from rwa.xyz, the valuation of total RWA on-chain has surpassed $12 billion, with 62,597 holders.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

However, Binance Research identifies significant challenges in tokenizing real-world assets.

A primary hurdle in RWA tokenization is centralization. Unlike the decentralized ethos of blockchain, RWA protocols often show a high degree of centralization due to the nature of real-world assets and strict regulatory demands. This centralization can restrict the autonomy blockchain solutions usually offer, marking a significant risk for RWA protocols.

Moreover, a substantial risk stems from the dependency on third-party intermediaries for asset custody. Blockchain promises decentralization, but tokenized assets’ actual custody and verification often rely on traditional systems. This reliance introduces potential vulnerabilities that the technology seeks to overcome.

Furthermore, yield considerations pose a third risk. The novelty and complexity of RWA token systems often come with expectations of high yields.

However, given the intricate and costly nature of maintaining these platforms, these yields may not always justify the investments. This gap can deter potential investors seeking stable returns.

Additionally, integrating Oracle solutions is crucial and challenging. Oracles bridge on-chain protocols with off-chain real-world data, a necessity for the accurate functioning of RWAs.

Industry leaders like Chainlink are expanding their services to meet these needs. Nonetheless, developing reliable oracle solutions for RWAs remains a resource-intensive endeavor.

Privacy and compliance constitute the fifth risk. Emerging zero-knowledge technology offers a potential solution to balance regulatory requirements with user privacy. However, implementing this sophisticated technology to meet compliance, ensure user autonomy, and protect data is a complex task requiring continuous development and security measures.

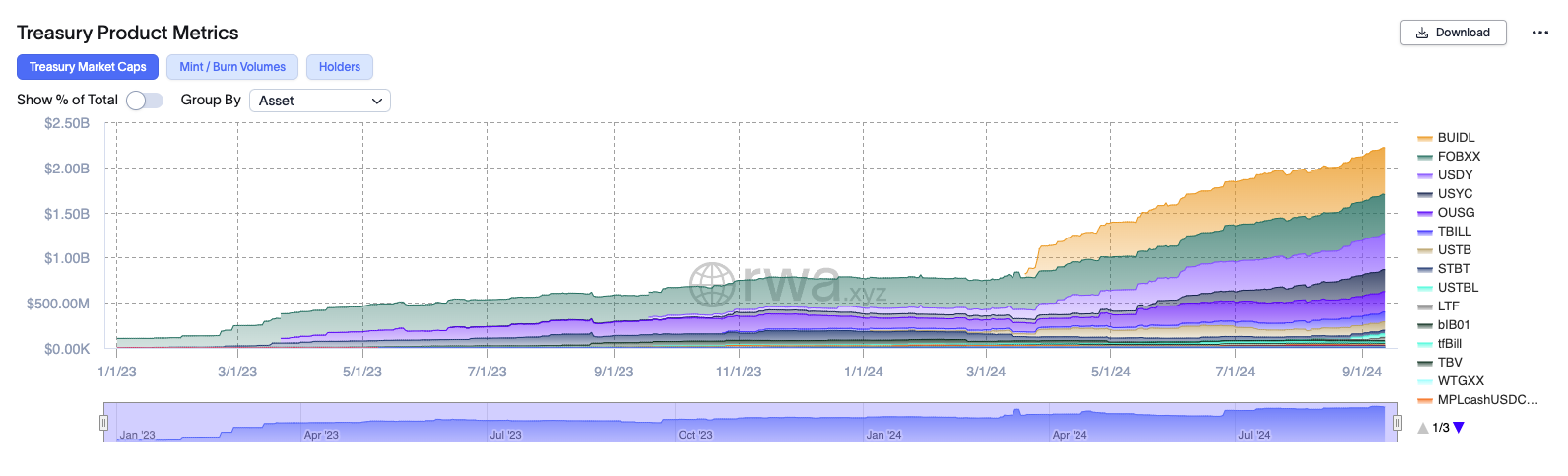

Can Upcoming Rate Cuts Impact Tokenized US Treasuries?

High US Fed interest rates have bolstered the RWA sector’s growth in 2024, enhancing traditional yields and driving the tokenization market forward.

“US interest rates have been held at a 23-year high since July 2023. This has made off-chain yield attractive to on-chain users and contributed to the explosive growth that tokenized US Treasuries have experienced this year,” Binance said in a document shared with BeInCrypto.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

However, Binance notes that the expected rate cuts from the US Federal Reserve, starting September 18, might change this situation. This is because the yield for tokenized US treasuries might get lower.

On a positive note, although yields might decrease, the inherent benefits of RWAs—such as diversification, transparency, and accessibility—will likely continue to attract investors.

It is worth mentioning that Binance Labs, the company’s investment arm, is also exposed to the tokenized RWA sector. On September 12, Binance Labs invested an undisclosed amount in OpenEden.

This platform focuses on tokenizing RWAs and aims to integrate traditional financial products like US Treasury Bills into the decentralized finance (DeFi) sphere.

The post Binance Discusses 5 Key Risks With Tokenization of Real-World Assets appeared first on BeInCrypto.