Binance Labs, Binance’s venture arm, has invested an undisclosed amount in OpenEden, a platform focused on tokenizing real-world assets (RWAs).

This move aims to integrate traditional financial products, such as US Treasury Bills (T-Bills), into decentralized finance (DeFi). Moreover, it will create new investment opportunities for institutional and retail investors.

Why Tokenized US Treasury Bills Are Gaining Popularity Among Investors

With Binance Labs’ recent investment, OpenEden is set to broaden the availability of yields backed by RWAs across the DeFi ecosystem. This expansion will involve launching new products, forging partnerships with new channels, and venturing into new markets.

“We believe OpenEden has the capability to drive further adoption of tokenized real-world assets,” Andy Chang, Investment Director at Binance Labs, said.

Read more: What is Tokenization on Blockchain?

OpenEden’s core objective is to bring traditional financial assets onto blockchain networks, providing a bridge between traditional finance and DeFi. Through the TBILL product—which US Treasury Bills back, OpenEden offers investors a way to earn yields on stablecoins, with daily liquidity available for participants.

This setup appeals to institutional investors, such as decentralized autonomous organizations (DAOs) and crypto treasury managers. They are looking for secure and regulated yield-generating products.

By handling the entire token issuance process, asset management, and operational activities, OpenEden aims to provide efficient and cost-effective access to tokenized treasuries. The platform is designed to meet the needs of investors seeking a blockchain-based way to access traditional assets.

This latest investment from Binance Labs follows a similar move by Ripple earlier this year. BeInCrypto reported that in August 2024, Ripple invested $10 million into OpenEden’s TBILL product. At the time of writing, data shows that TBILL has a market capitalization of $102.8 million.

Backings from both Binance Labs and Ripple toward OpenEden further showcase the growing interest in this segment. Tokenized RWAs, especially US Treasury Bills, are increasingly popular as investors seek to utilize blockchain technology for stable, regulated assets. These digital versions of traditional US Treasury securities provide a streamlined way for investors to trade assets with enhanced liquidity and efficiency.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

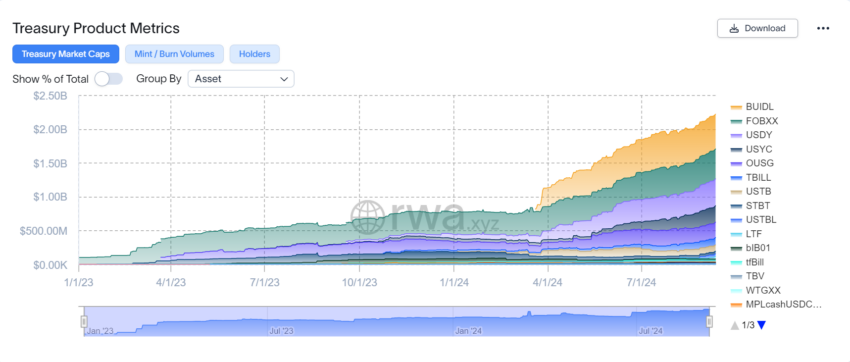

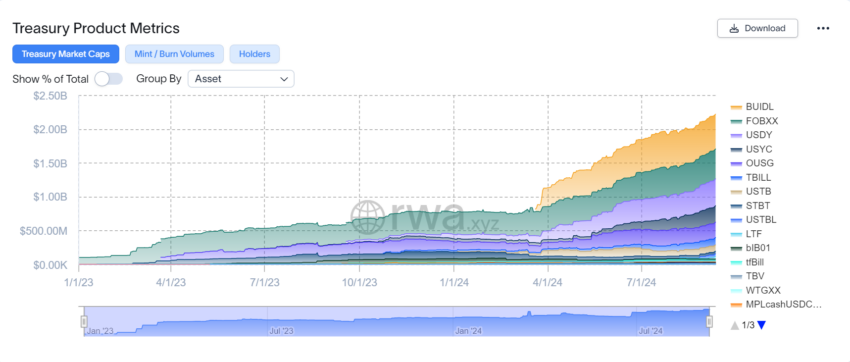

Within the broader market, other key players, including Franklin Templeton and BlackRock, have also explored tokenized treasury solutions. RWA.xyz data reveals that by September 2024, the total value of these tokenized assets will have reached $2.22 billion. This rise in value highlights their growing appeal among private and institutional investors, who value the stability and regulatory compliance of US T-Bills, making them a preferred option for tokenization.

The post Binance Labs Backs OpenEden to Boost Real-World Asset Tokenization appeared first on BeInCrypto.