Bitcoin (BTC) and the broader crypto markets are navigating challenging conditions, historically worsened by September’s seasonality struggles.

In a recent report, Kaiko researchers recently explored how a potential US rate cut and other key economic events could affect Bitcoin. These four charts provided by the analysts explain what to expect from BTC in the coming weeks.

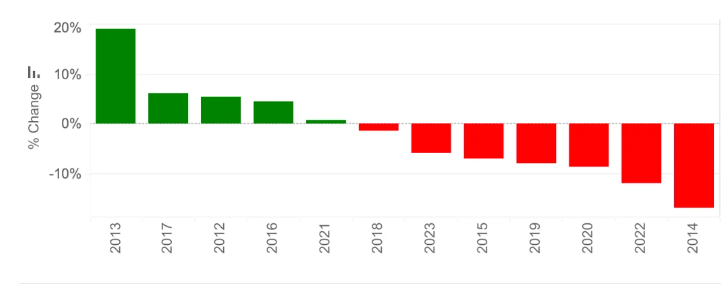

Monthly Change in Bitcoin Price in September

As BeInCrypto reported, the third quarter has historically been challenging for Bitcoin and the broader crypto market, with September often delivering the worst returns. Kaiko highlights that Bitcoin has declined in seven of the last twelve Septembers.

In 2024, this pattern continues, with Bitcoin down 7.5% in August and 6.3% so far in September. As of this writing, Bitcoin is trading over 20% below its recent all-time high of nearly $73,500, recorded more than five months ago.

Read More: How To Buy Bitcoin (BTC) and Everything You Need To Know

However, according to Kaiko Research, upcoming US rate cuts could provide a boost to risk assets like Bitcoin. Bitget Wallet COO Alvin Kan shares this stance.

“At the Jackson Hole meeting, Federal Reserve Chairman Jerome Powell hinted that it might be time for policy adjustments, leading to expectations of future interest rate cuts. The US Dollar Index responded by dropping sharply and is now fluctuating around 100. With a rate cut in September becoming a consensus expectation, the official start of rate cut trading could improve overall market liquidity, providing a boost to crypto assets,” Kan told BeInCrypto.

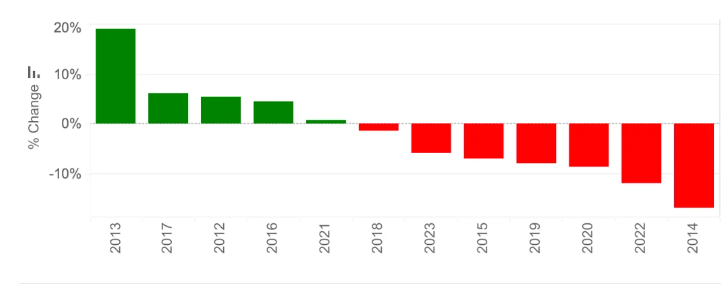

30-day Historical Volatility

According to the report, September is shaping up to be highly volatile, with Bitcoin’s 30-day historical volatility surging to 70%. This metric measures the fluctuation in an asset’s price over the past 30 days, reflecting how dramatically its price has moved within that period.

Bitcoin’s current volatility is nearly double last year’s levels and is approaching the peak seen in March, when BTC hit an all-time high of over $73,000.

Ethereum (ETH) has also experienced heightened volatility, surpassing both March’s levels and Bitcoin’s, driven by ETH-specific events such as Jump Trading’s liquidations and the launch of Ethereum ETFs.

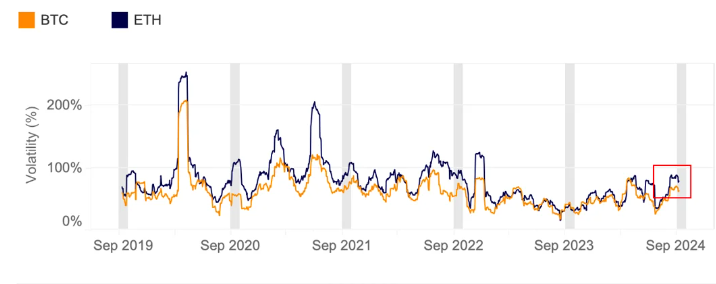

BTC Implied Volatility by Expiry

Since the start of September, Bitcoin’s implied volatility (IV) has risen after dipping in late August. The IV indicator measures market expectations for future price fluctuations based on current options trading activity. Higher IV suggests that traders anticipate larger price swings ahead, though it doesn’t specify the direction of the move.

Notably, short-term options expiries have seen the sharpest increase, with the September 13 expiry jumping from 52% to 61%, surpassing end-of-month contracts. For the layperson, when short-term implied volatility exceeds longer-term measures, it indicates heightened market stress, referred to as an “inverted structure.”

Risk managers often see an inverted structure as a signal of heightened uncertainty or market stress. As a result, they may interpret this as a warning to de-risk their portfolios by reducing exposure to volatile assets or hedging against potential downside.

“These market expectations align with last week’s US jobs report, which dampened hopes for a 50bps decrease. However, upcoming US CPI data could still sway the odds,” Kaiko researchers note.

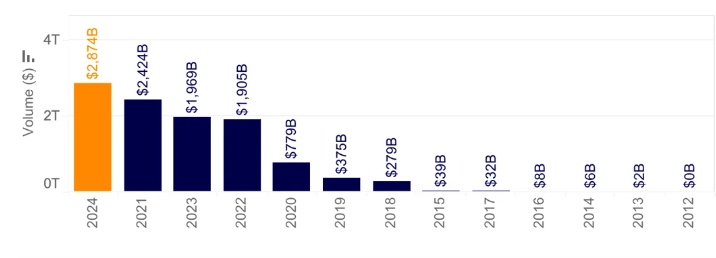

Trade Volume

The Bitcoin trade volumes chart also highlights the current market volatility, showing increased trader participation. Cumulative trade volume is nearing a record $3 trillion, up nearly 20% in the first eight months of 2024 after its last peak in 2021.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Traditionally, Bitcoin investors see a rate cut as a positive market catalyst. However, concerns remain about how the market might interpret a larger-than-expected cut. Markus Thielen, founder of 10X Research, cautions that a 50 basis points rate cut could be perceived as a sign of urgency, potentially triggering a retreat from risk assets like Bitcoin.

“While a 50 basis point cut by the Fed might signal deeper concerns to the markets, the Fed’s primary focus will be mitigating economic risks rather than managing market reactions,” Thielen said in a note to clients.

Alongside rate cut speculations, other factors contributing to crypto market fluctuations include the upcoming US elections. As BeInCrypto reported, the Donald Trump versus Kamala Harris debate is expected to trigger movement, particularly in Bitcoin and Ethereum.

The post These 4 Charts Explain Bitcoin (BTC) Price Performance Amid US Rate Cut Speculation appeared first on BeInCrypto.