For many weeks, Ethereum’s (ETH) price has been eyeing a return to $3,000. Unfortunately, that has not happened due to several rejections and a rather quiet broader market.

However, the underwhelming price action is not the only challenge facing the blockchain, ranked as the second-most valuable crypto project. This on-chain analysis highlights the other parts and what could become of ETH price in the short term.

Ethereum Earnings Down, Some Whales Out

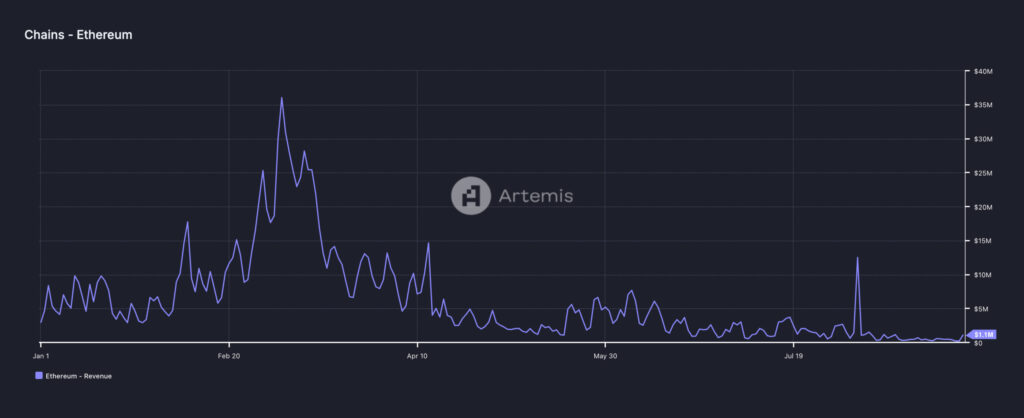

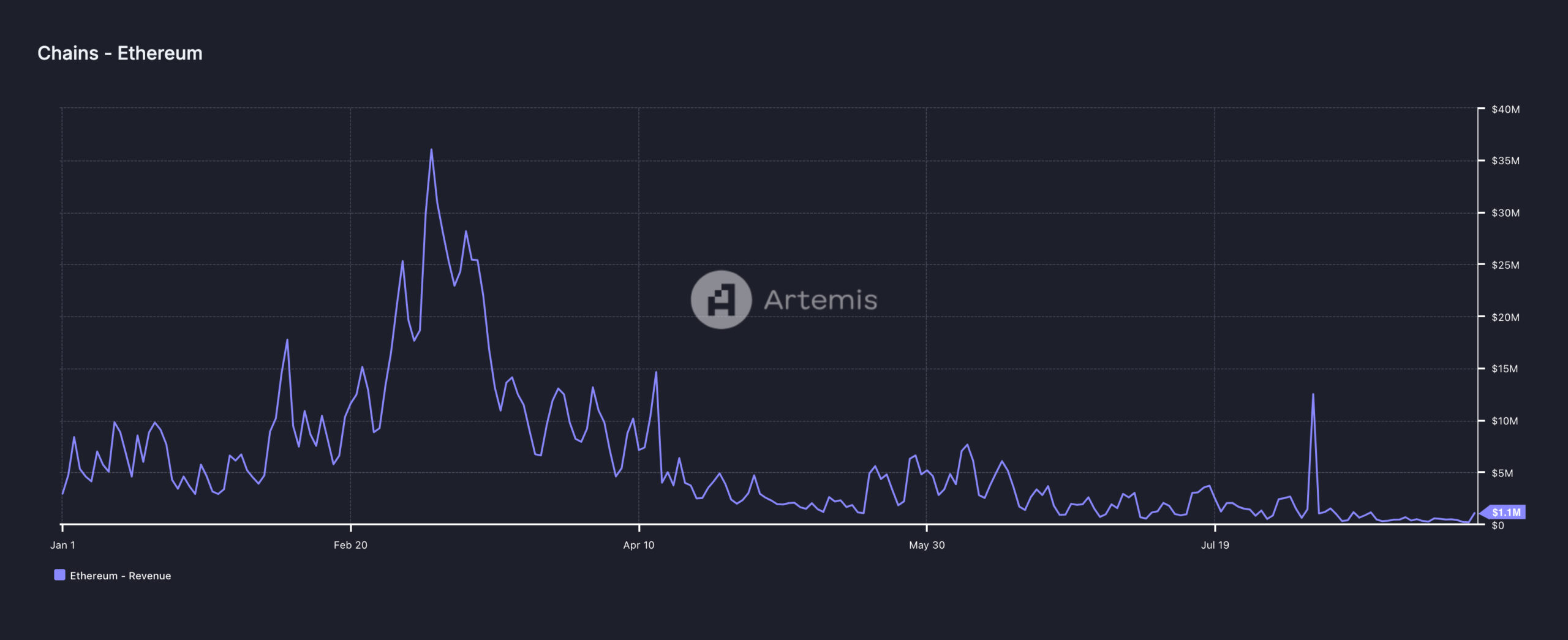

According to Artemis data, Ethereum’s revenue has plunged to its lowest point this year. This dramatic decline is a stark contrast to the value in March. During that period, the blockchain’s revenue surged to $36 million.

As of this writing, the same metric is $1.10 million and risks falling below the seven-figure value. The sharp decline could be attributed to the March 13 Dencun upgrade.

The upgrade, geared at reducing transaction fees, ensured that users no longer have to pay ridiculous comissions. Besides the fact that fees are a crucial part of Ethereum’s revenue, the massive fall in demand for ETH also contributed to it.

Read more: How to Invest in Ethereum ETFs?

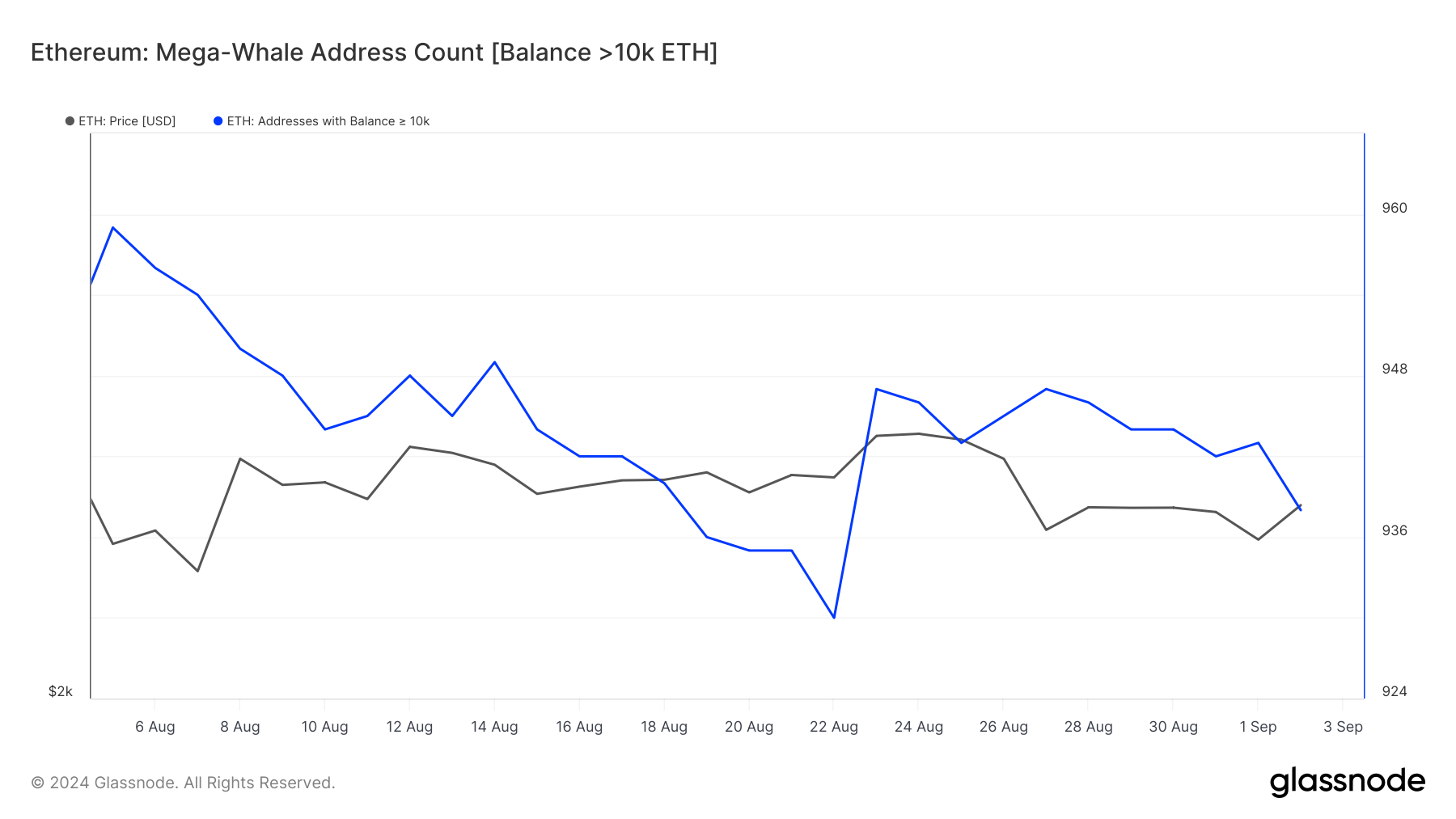

Furthermore. ETH’s price might continue to struggle. For instance, BeInCrypto examined the balance of the Mega-Whale ETH addresses using on-chain data from Glassnode. These addresses, holding over 10,000 ETH each, play a crucial role in price movements.

When the balance of these large holders increases, it often signals a potential price rise. However, if their balance decreases, it could indicate a looming price drop. On August 23, the number of addresses holding 10,000 ETH or more stood at 947.

As of now, this figure has dropped to 938, indicating that these whales have sold approximately 90,000 ETH in the past two weeks. If this trend continues, ETH’s price could soon fall below $2,500.

ETH Price Prediction: Not Going to $3,000 Anytime Soon

Analysis of Ethereum’s daily chart reveals that the cryptocurrency’s price has been volatile. ETH has repeatedly tried to break the $2,800 mark, but each attempt has met with rejection.

This struggle is largely due to insufficient buying volume. If this trend continues, ETH’s price could drop below $2,500.

Adding to the bearish outlook, ETH’s price is currently below the 20-day Exponential Moving Average (EMA), a key indicator of trend direction. When a cryptocurrency trades above the EMA, it typically signals a bullish trend.

However, ETH’s current position below the 20-day EMA suggests it is susceptible to further bearish pressure. In a highly bearish scenario, the price could fall to $2,496 or even $2,341.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Despite these concerns, the forecast could change if ETH sees a significant increase in volume and buying pressure. Under these conditions, the price could rise to $2,794.

The post ETH Price Struggles at $2,500 as Key Metric Hits Yearly Low appeared first on BeInCrypto.