After a notable drawdown earlier in the week, Pepe’s (PEPE) price has increased by 12.24% in the last 24 hours. At press time, the frog-themed token and top meme coin on Ethereum changed hands at $0.0000087.

For some traders, the price increase is a welcome development. However, this jump could also scare others who did not expect the recovery. Here is how.

Pepe Bears Face a Big Task Against the Current Tides

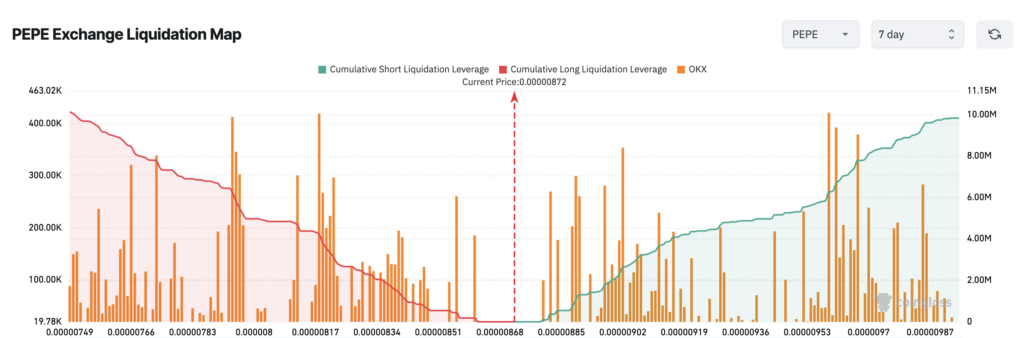

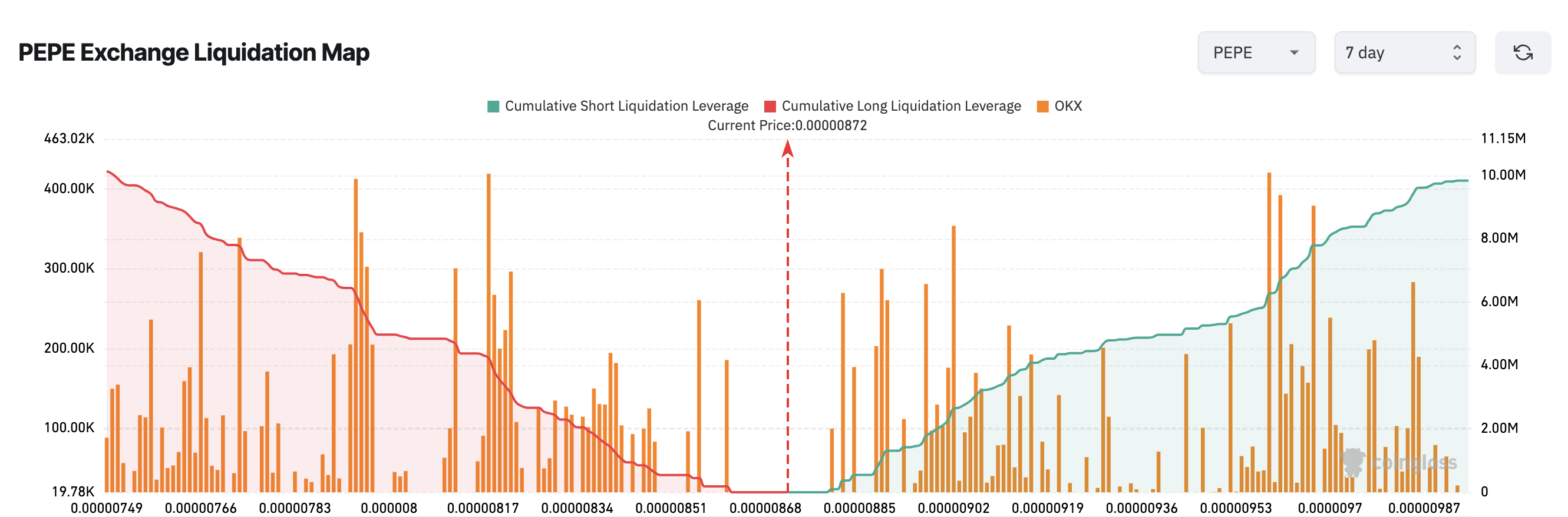

According to Pepe’s Exchange Liquidation Map presented via Coinglass, approximately $10 million worth of short positions will be liquidated if PEPE rises to $0.0000099. For context, shorts are traders betting on a price decrease.

Longs, on the other hand, are those confident in making profits off a rise in value. This liquidation map visualizes the risk associated with opening leverage positions at either end.

Specifically, the indicator shows the cascading effect on open positions if the price reaches a certain level. From the chart below, there is a higher number of cumulative short liquidation leverage, indicating that more traders are exposed to this risk.

Read more: How To Buy Pepe (PEPE) and Everything You Need To Know

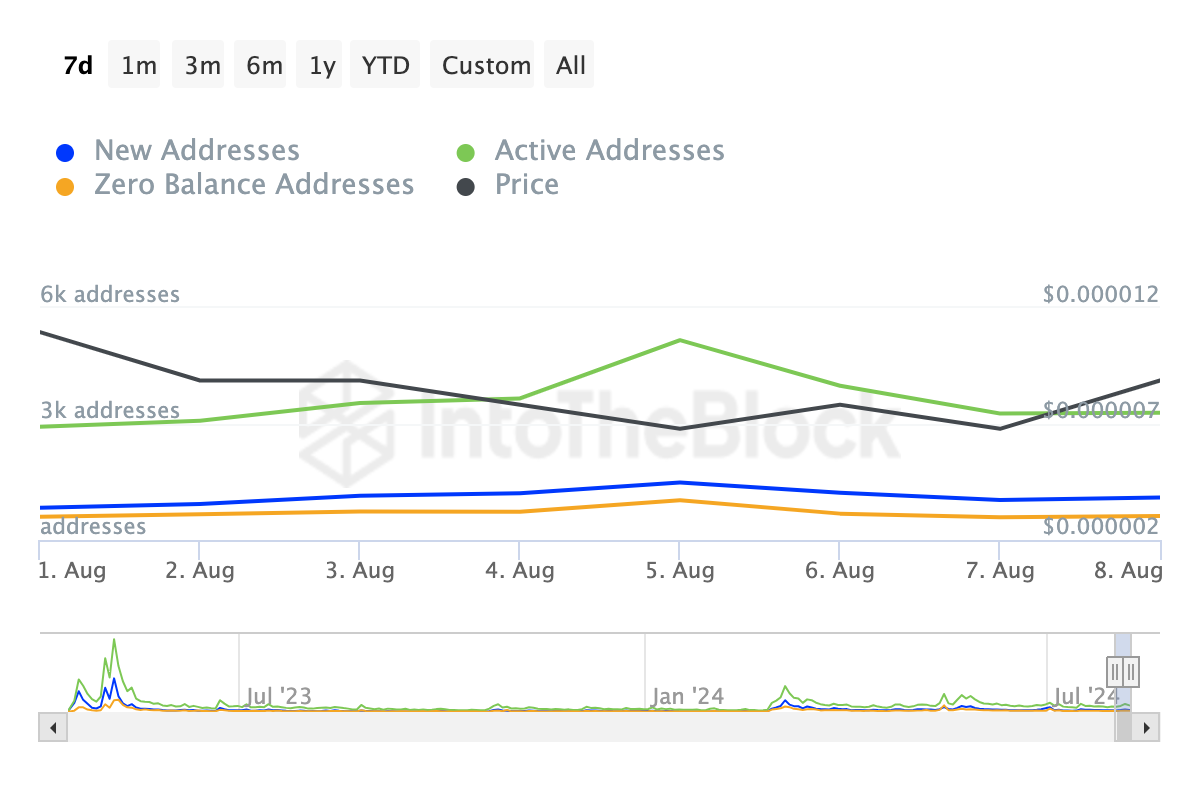

This warning may be valid, given the rise in user interaction with PEPE. As of this writing, the number of active addresses has increased by 31.77% over the past seven days.

New addresses, representing market participants making their first transactions, have also surged. Even zero-balance addresses — those yet to engage in transactions — are seeing an uptick.

When these addresses increase alongside the price, it implies that the rise in value is not artificial. Instead, it is backed by concrete user engagement. If sustained, this could strengthen the price increase while adding fuel to the threat shorts face.

PEPE Price Prediction: Is This Just the Beginning?

According to the daily chart, PEPE is forming a trend that foreshadows the rally in May. During this period, bulls camped at $0.0000087 support. Within two weeks, the price of the token has increased to $0.000017.

The Supertrend indicator is signaling a sell at $0.000010, suggesting that the token may encounter resistance at this level. The Supertrend helps identify entry and exit points; when the green segment of the indicator is below the price, it signals a buy, while the red part above the price indicates a sell.

Based on this analysis, the token’s price could continue its upward move toward the $0.000010 region. However, for this bullish bias to be confirmed, the Relative Strength Index (RSI) needs to rise above the neutral zone at 50.00.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

Currently, the RSI, which measures momentum, is below the midpoint, indicating that bulls are not fully in control yet. However, if the RSI crosses above it, the upswing to the previously mentioned price could become a reality.

However, the inability to sustain this momentum could force a rejection. If this happens, PEPE’s price could drop to $0.0000085

The post PEPE Price Climbs 12%, Threatens $10 Million Worth of Short Positions appeared first on BeInCrypto.