The State of Michigan Retirement System recently invested $6.6 million in Bitcoin using the ARK 21Shares ARKB spot BTC exchange-traded fund (ETF).

This information was revealed in a 13-F Form filed with the Securities and Exchange Commission (SEC) yesterday.

Michigan Pension Fund Supports the Ongoing Trend

A 13-F Form is a quarterly report that institutional investors are required to submit to the SEC if they manage over $100 million in assets. This Bitcoin investment makes up 0.004% of the pension fund’s total assets, which amount to $143.9 billion.

“Just checked and yes looks like Michigan’s Pension bought up some $ARKB (altho we have it as $7.4m) which is small %-wise for them but its a start, they now third pension to report owning a btc ETF,” Bloomberg ETF analyst Eric Balchunas confirmed in an X post.

The difference in the investment amount stems from the State of Michigan Retirement System’s $6.6 million allocation being based on Bitcoin’s value of $62,000. As Bitcoin’s price has increased by over $5,000, the value of their investment has similarly risen.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Michigan’s Retirement System has joined the growing list of pension funds investing in Bitcoin. As reported by BeInCrypto, the State of Wisconsin Investment Board (SWIB) made a $99 million investment in Bitcoin through BlackRock’s IBIT ETF.

In addition, Jersey City Mayor Steven Fulop announced that the city’s pension fund is also exploring a Bitcoin investment through ETFs.

“The Jersey City pension fund is in the process of updating paperwork to the SEC to allocate % of the fund to Bitcoin ETFs. It will be completed by the end of the summer and I’m sure eventually it will be more common. I have been a long-time believer (through ups/downs) in crypto but broadly. Beyond crypto I do believe blockchain is amongst the most important new technology innovations since the internet,” Mayor Fulop stated.

Institutional Interest in Bitcoin is on Rise

Traditionally, pension funds have been cautious, sticking to strict risk management protocols. However, this cautious approach seems to be evolving.

BlackRock, the world’s largest asset manager, the world’s largest asset manager, had anticipated their growing demand months ago.

“Many of these interested firms — whether we’re talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices — are having ongoing diligence and research conversations, and we’re playing a role from an education perspective,” BlackRock’s head of digital assets Robert Mitchnick shared.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

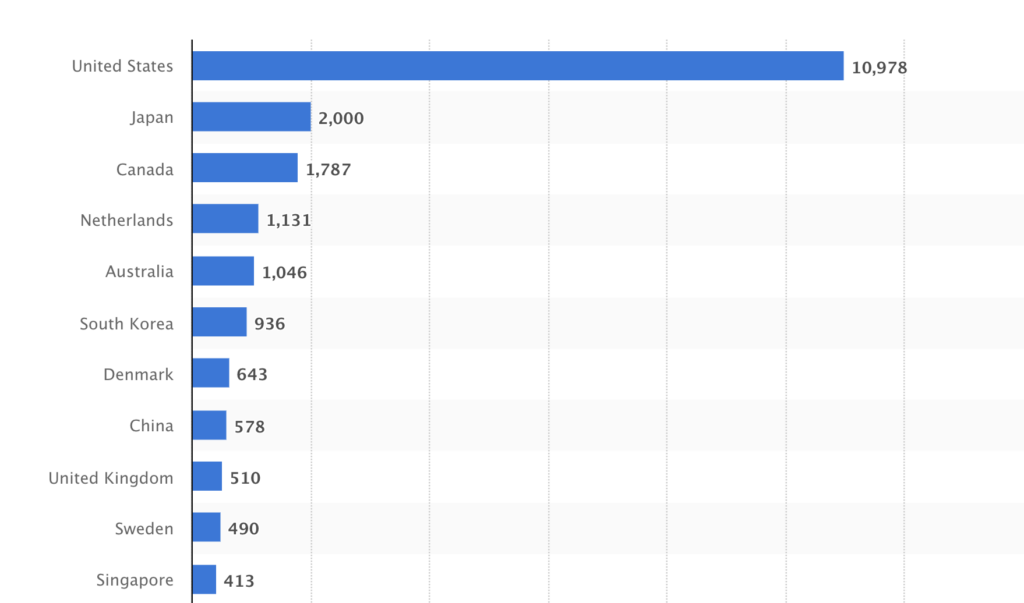

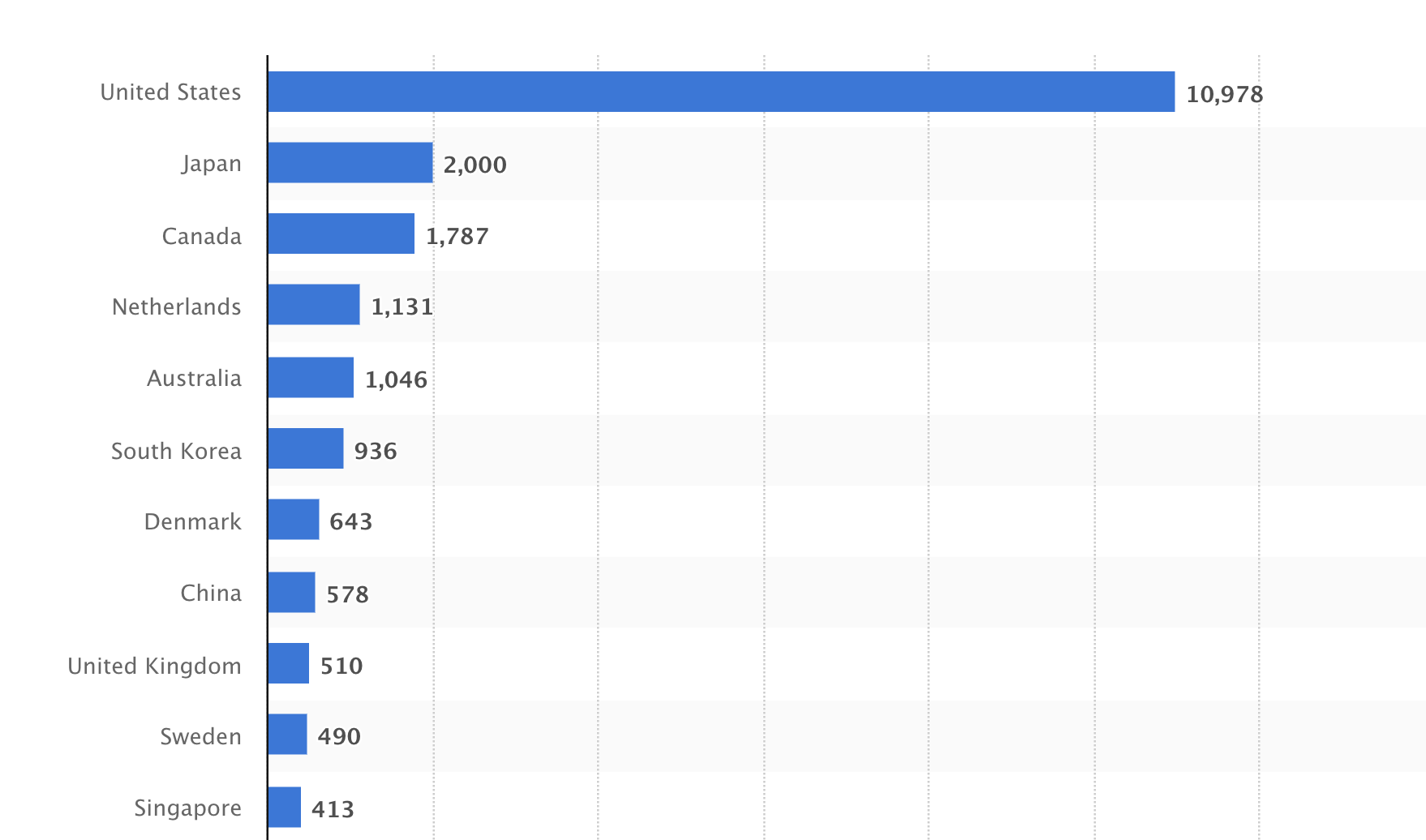

As of July 2024, the US leads the world in the total value of assets managed by public pension funds. The combined assets under management of all US PPFs reached nearly $11 trillion. If more pension funds follow Michigan, Wisconsin, and Jersey’s examples, it could bring substantial capital into the cryptocurrency market.

The post Michigan Pension Fund Allocates $6.6 Million to Bitcoin ETF appeared first on BeInCrypto.