Bonk (BONK), the meme coin based on Solana, is one of this month’s highest gainers. However, according to recent data, the token could lose some of its gains from the last few weeks.

As of this writing, BONK trades at $0.000028. This on-chain analysis dives into why the price may no longer be at the aforementioned price in the short term.

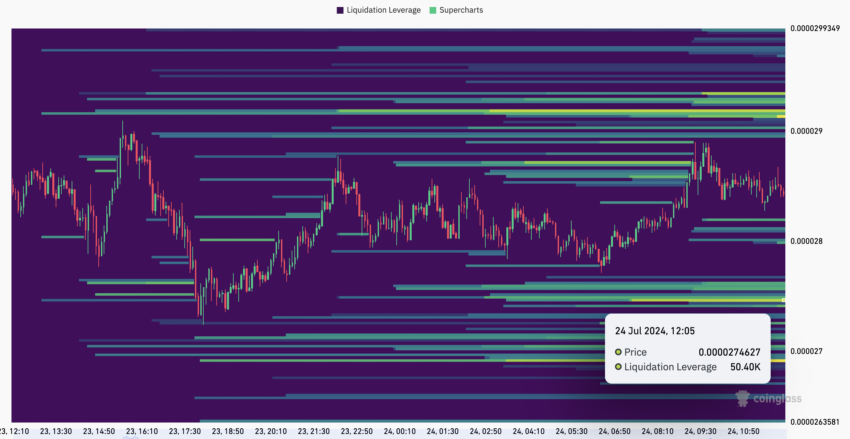

Bonk’s Liquidation Heatmap Signals Potential Decline to High Liquidity Areas

Leading this bearish bias is the liquidation heatmap. In non-technical terms, the liquidation heatmap predicts price levels where large-scale liquidations may occur.

However, it is important to note that liquidation occurs when an exchange forcefully closes an open position due to insufficient balance, extremely high leverage, or price moving in the opposite direction of prediction amid high volatility.

Furthermore, the heatmap does not just show liquidation levels. It also shows areas where prices can move. In most cases, if liquidity is concentrated at a point, then price may be attracted to that point.

Read More: 11 Top Solana Meme Coins to Watch in July 2024

For BONK’s price, the heatmap above shows that the liquidation levels have changed from purple to yellow around $0.000027. Another one is around $0.000026, implying that these points are high liquidity areas, and the price can converge toward the regions.

Beyond the heatmap, social dominance is one of the metrics buttressing the potential decline. Social dominance measures the share of discussion around a cryptocurrency compared to other assets in the top 100 per market capitalization.

At press time, Bonk’s social dominance has fallen from a peak of 0.396% in late June to 0.103%.

The decline here clearly indicates a decrease in the hype surrounding the meme coin and reduces the chances of a notable price bounce.

BONK Price Prediction: Weak Buyers Equal Lower Prices

On the daily chart, BeInCrypto observes that BONK has formed a bearish flag. This technical pattern appears when the price of cryptocurrency declines over a period. But in between, there is a brief consolidation period that eventually helps form a slant vertical flagpole.

Usually, sellers get exhausted from the decline while bullish take advantage of the fatigues and drive a breakout.

This breakout results in the formation of two parallel trendlines, as seen on the BONK/USD chart. Further, the indications below suggest that the uptrend is short-lived. Hence, BONK may return to a bearish continuation that sees its price decline.

Read More: How to Buy Solana Meme Coins: A Step-By-Step Guide

This prediction is also supported by the Money Flow Index (MFI). The MFI is a technical oscillator that measures the flow of liquidity into a cryptocurrency. As shown in the chart above, the decline in the MFI rating implies that buying pressure has become low.

If it drops further, BONK’s price may follow, and a short-term target of $0.000026 could be plausible.

To negate this possibility, a high concentration of liquidity may have to come in at a higher price. If this happens, BONK could reverse the trend and possibly surpass $0.000030.

The post BONK Price May Shed More of Its Monthly Gains Due to These Indicators appeared first on BeInCrypto.