Solana’s (SOL) stronghold this cycle has not been limited to its price; data shows that other parts of the ecosystem continue to dominate the market.

The latest one observed is a key area Ethereum (ETH) controlled in previous bull markets. But Solana is not just beating the Vitalik Buterin-led blockchain this time, as another notable chain is involved.

Solana Sees Significant Growth In Two Key Areas

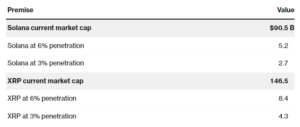

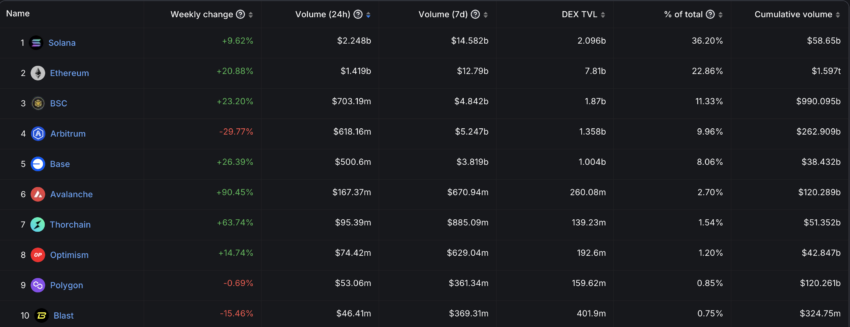

According to DeFiLlama, Solana’s Decentralized Exchange (DEX) volume was more than that of Ethereum and BNB Chain combined in the last 24 hours.

Both Ethereum and BNB Chain registered higher weekly increases, but that was not enough to keep Solana from the top spot.

As seen below, Solana’s DEX volume is $2.24 billion. However, BNB Chain is $703.19 million, while Ethereum is $1.41 billion.

Read More: Solana vs. Ethereum: An Ultimate Comparison

As a result of the increase, Solana now holds roughly 36% of the total volume. The rise in the metric is linked to several reasons, such as staking and the utility of applications built on the chain.

Particularly, the increase in meme coin trading on the network’s decentralized applications has been crucial to this hike.

For much of this market cycle, meme coins built on the Solana blockchain have performed better than any other network. As such, demand for SOL and user activity has been hitting different peaks at different times.

Furthermore, data confirms that the Total Value Locked (TVL) has been on an upward run since July 3, when it fell.

TVL refers to the value of assets locked or staked in a protocol and measures a network’s health. At press time, Solana’s TVL is $5.29 billion, which is above the height it was before the bear market of 2022 began.

The hike in this metric implies that market participants perceive the network to be trustworthy. Should the value of the locked assets continue increasing, it may be the same for SOL’s price. But let’s look at the token’s potential.

SOL Price Prediction: Breakout to $210 Looms

Between July 18 and 21, SOL formed four consecutive green candlesticks, which caused the price to hit $185.21.

From our observation, the price increase has now helped the token form a double-rounding bottom pattern on the daily chart.

Typically, this pattern marks the end of a bearish trend, and with the neckline at $180.30, SOL’s price could be in line for a breakout.

If sustained, the price of SOL could increase by 13.05%. Should this happen, the token might surpass the $200 psychological level and hit $204.33. If the market conditions become intensely bullish, the price could reach $210.11. The last time it reached such levels was in March.

Read More: 6 Best Platforms To Buy Solana (SOL) in 2024

In addition, the Moving Average Convergence Divergence (MACD), which measures a cryptocurrency’s trend, supports this prediction. As of this writing, the MACD is positive, indicating a bullish trend.

If sustained, the momentum could help Solana validate the price increase. However, if the hype around the token drops, SOL may fail to reach the prices mentioned above. Should that occur, the value of the token may drop below $173.

The post Solana DEX Volume Surpasses Ethereum, BNB Chain, Boosting Bullish SOL Predictions appeared first on BeInCrypto.