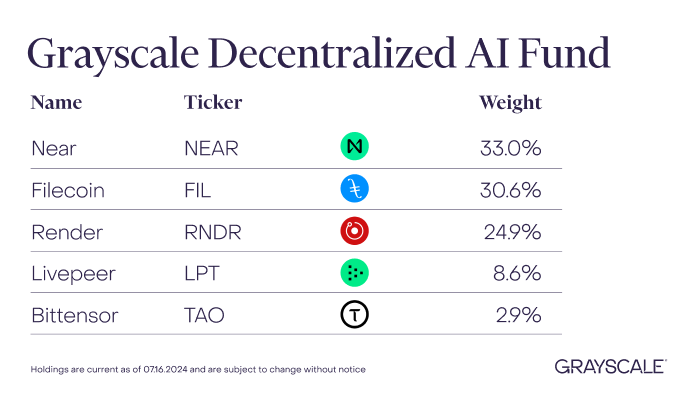

Grayscale Investments created and launched a decentralized artificial intelligence fund, Grayscale Decentralized AI Fund LLC. The fund features top altcoins and focuses on three primary categories of decentralized AI assets.

Like meme coins, AI tokens are becoming a bona fide sector in the industry as cryptocurrency adoption grows.

Grayscale Debuts Decentralized AI Fund

Grayscale’s announcement highlights “decentralized AI” as one of the promising opportunities for its customers. The fund, limited to eligible accredited investors, will provide access to the performance of AI protocols in the cryptocurrency industry.

“The blockchain-based AI protocols embody the principles of decentralization, accessibility, and transparency. The Grayscale team feels strongly that these protocols can help mitigate the fundamental risks emerging alongside the proliferation of AI technology,” said Grayscale’s Head of Product and Research Rayhaneh Sharif-Askary.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

At inception, only five top-weighted tokens were included in the fund. It is based on their general functions and purposes within AI technology development and deployment.

- Bittensor (TAO): Protocols building Decentralized AI services, such as chatbots and image generation services.

- Filecoin (FIL) and Livepeer (LPT): Protocols building solutions to centralized AI-related problems. This includes authenticity checks against bots, deep fakes, and misinformation.

- Near Protocol (NEAR) and Render (RNDR): Infrastructure and resources critical to AI technology development. This includes decentralized marketplaces for data storage, GPU computation, 3D rendering, and streaming services.

FIL and RNDR prices soared 7% on the news, while LPT and TAO climbed 13% and 11%, respectively. Meanwhile, NEAR is clinging to its 0.3% gains on the day.

Grayscale Decentralized AI Fund LLC comes after AI trends led the crypto market surge in the first half (H1) of 2024. Specifically, sectors such as “smart contract platforms and utilities” and “services crypto” demonstrated significant resilience and growth. This is while addressing AI-related challenges and supplying essential resources for AI development.

In a recent Grayscale research insight, the investment manager listed AI crypto coins among high-potential tokens across various digital asset sectors for Q3 2024. Some assets in its newly launched fund, like NEAR and RNDR, featured on the list, alongside others like Akash. Before that, the asset manager launched a NEAR-focused trust and another for Stacks (STX), giving investors diversified crypto exposure.

Grayscale Doubles Down on Crypto-Focused Funds

Earlier in the year, the firm launched Grayscale Dynamic Income Fund (GDIF), marking its foray into crypto staking, another crypto sector gaining momentum in decentralized finance (DeFi).

The GDIF features tokens such as Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), and Cosmos (ATOM). Others include NEAR, Osmosis (OSMO), Polkadot (DOT), SEI Network (SEI), and Solana (SOL).

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

These developments highlight Grayscale’s dedication to capitalizing on the crypto industry and the rising trend of artificial intelligence. Such a strategy strengthens its mission to deliver value to investors by harnessing the potential of both the AI and blockchain sectors, and the synergy between them.

The post Grayscale Launches AI Fund: Near, Render, Filecoin and More appeared first on BeInCrypto.