Decentralized physical infrastructure network finance (DePinFi) is transforming the DePin community by addressing significant challenges in resources and liquidity. This synergy of DePin and DeFi isn’t merely a trend; it’s a solution for critical supply and demand issues.

Analysts explain the pressing problems faced by DePin projects and how DePinFi could solve them.

DePin’s Challenges From the Supply and Demand Side

According to PINGPONG, a DePinFi money market, the primary hurdle in the DePin sector is the high barriers to entry and maintenance. Engaging in DePin network mining demands high-end hardware and advanced technical skills to establish mining nodes.

The process is cumbersome, involving manual integration of nodes or networks, constant updates, and complex device configurations. Consequently, DePin mining remains a domain for expert miners, leaving average enthusiasts sidelined due to these formidable barriers.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Additionally, the rewards for mining fail to motivate wider participation. Miners can only connect their devices to a select few DePin networks, leading to underused computing resources. The mining rewards are too low to entice individuals to dedicate their machines to DePin mining extensively.

On the demand side, developers encounter a fragmented development experience. Each DePin network offers different services necessary throughout an application’s lifecycle, written and packaged with diverse tech stacks.

Thus, developers must manage multiple client connections. This setup extends development time and significantly increases infrastructural costs.

DePin networks also struggle with unpredictable uptime and limited compute resource depth. These challenges, combined with geolocation-based latency and volatile service pricing in native tokens, complicate efforts to deliver stable, efficient applications. These issues hinder the adoption and growth of DePin-based services, deterring potential users.

DePinFi: A Promising Solution?

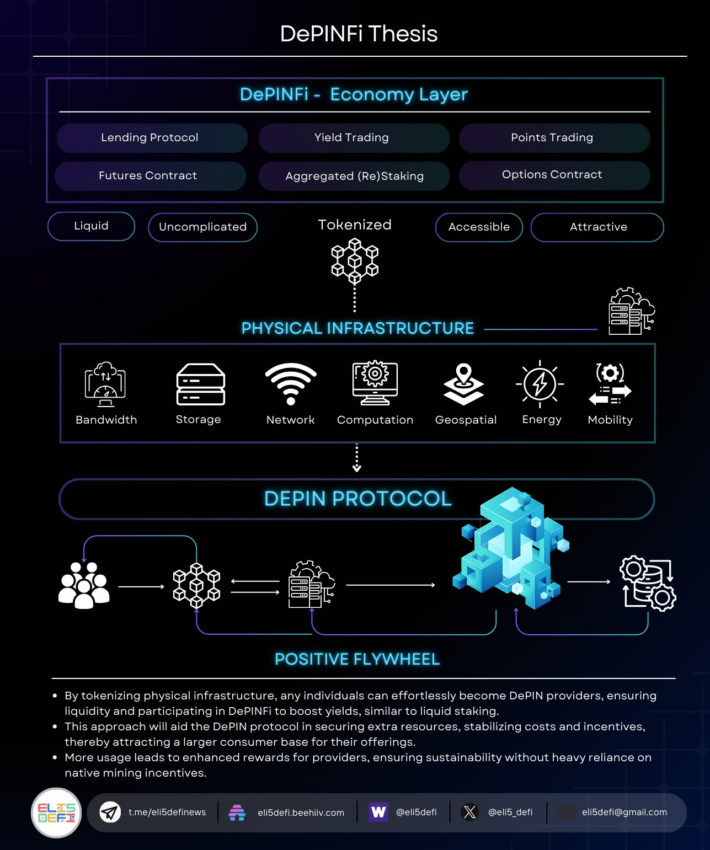

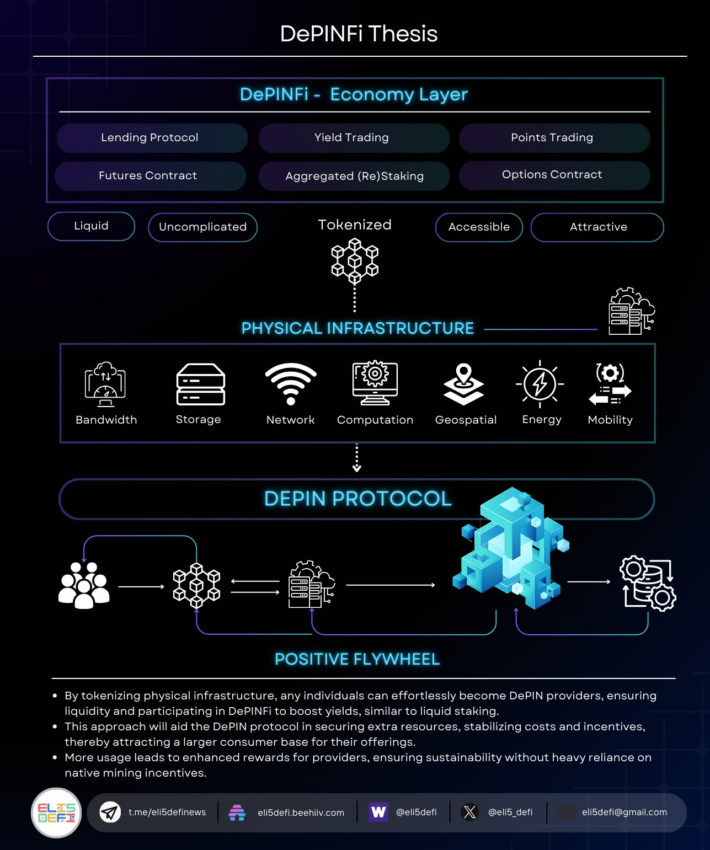

According to Eli5DeFi, a notable Web3 analyst, DePinFi proposes a compelling remedy to these issues. By tokenizing physical infrastructure, DePinFi enables individuals to easily become DePin providers, ensuring liquidity and facilitating participation in DePinFi to boost yields, similar to liquid staking.

In an interview with BeInCrypto, Eli5DeFi likened DePinFi to Lido for DePin projects. He cited examples of DePin projects such as io.net or Aethir to explain the use cases of DePinFi.

“If the GPU is tokenized, you can provide the GPU by buying the token at a fraction of the cost without complexities,” Eli5DeFi told BeInCrypto.

This approach secures additional resources, stabilizes costs, and improves the attractiveness and sustainability of incentives. As a result, it draws a larger consumer base to DePin offerings, leading to more usage and enhanced rewards for providers. Thus, it ensures sustainability without heavy reliance on native mining incentives.

Read more: Top 4 Crypto Passive Income Ideas That Really Work in 2024

Moreover, io.net has teased that it is building an emerging DePinFi ecosystem around its services. DePin company IoTeX also supports the idea of combining DePin and DeFi.

“DePin projects are focused on building in the real world – they might overlook onchain liquidity. That’s what DeFi for DePIN protocols are for,” IoTeX said.

As DePinFi gains traction, it is poised to become the next big narrative in the coming months. The nascent DeFi ecosystem being developed on platforms like io.net marks just the beginning of this journey in decentralized networks.

The post DePinFi Creates Buzz: Analysts Discuss Solutions to DePin’s Challenges appeared first on BeInCrypto.