Today, a wallet labeled as “German Government (BKA)” by Arkham, a crypto on-chain analytics firm, initiated substantial Bitcoin (BTC) transactions. These activities have sparked widespread curiosity within the crypto community.

The crypto community speculates that the German government might liquidate some of its BTC assets.

German Government Sends 1,000 Bitcoin (BTC) to Centralized Crypto Exchanges

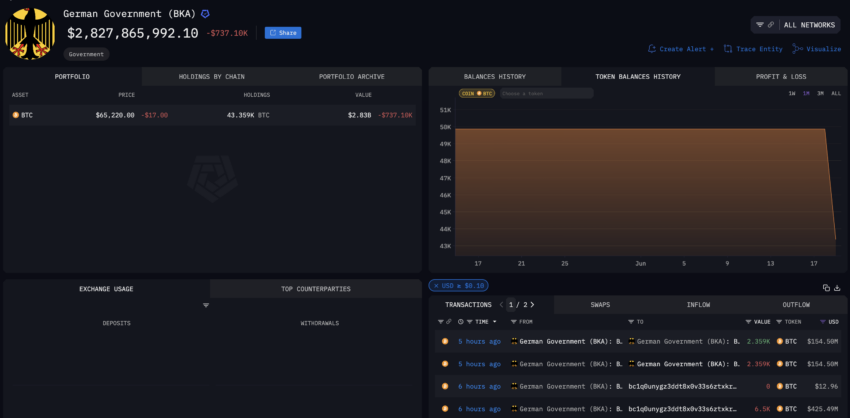

The Bitcoin wallet transferred approximately 6,500 BTC, with a staggering value exceeding $425.49 million. Previously, the German government’s Bitcoin wallet maintained a balance close to 50,000 BTC.

Arkham’s analysis suggests that these funds were likely seized from the operator of the defunct pirated movie site, Movie2k. Similar to other governments worldwide, Germany seizes digital assets from criminal activities and occasionally auctions them off. For example, the US government has auctioned significant amounts of Bitcoin previously seized from the infamous Silk Road dark web marketplace.

Around six hours ago, the German government-affiliated wallet executed three significant transactions. Initially, it sent 6,500 BTC to a new wallet address labeled “bc1q0.” Additionally, it transferred 2,359 BTC within its own addresses.

Read more: How To Make Money With Intel-To-Earn on Arkham Intelligence

Subsequently, the bc1q0 wallet moved 2,500 BTC to another address, “bc1qq.” This wallet then distributed 500 BTC each to various recipients, including the crypto exchanges Kraken and Bitstamp, as well as two unknown Bitcoin addresses. However, it still holds the remaining 500 BTC worth $32.64 million.

Despite these large transactions, the primary wallet still holds 43,359 BTC, valued at approximately $2.83 billion. Intriguingly, only 1,000 BTC has been moved to centralized exchanges, presumably for selling. Crypto trader Daan suggests that this action caused a slight dip in Bitcoin prices.

“The actual BTC sent to Bitstamp and Kraken was about 500 BTC each, so far so nothing crazy there. The post was just meant to highlight not to call for a massive pump/dump or anything,” Daan elaborated.

Although these transactions did not significantly impact Bitcoin’s price, other market dynamics hint at potential selling pressures. According to Ki Young Ju, co-founder of CryptoQuant, long-term Bitcoin holder whales have sold off $1.6 billion worth of assets in the last two weeks, likely through brokers.

“If this ~$1.6 billion in sell-side liquidity isn’t bought over-the-counter, brokers may deposit BTC to exchanges, impacting the market,” Ju warned.

Read more: Who Owns the Most Bitcoin in 2024?

Furthermore, there has been notable activity in spot Bitcoin ETFs. Specifically, spot Bitcoin ETFs saw a net outflow of $152.4 million on Tuesday.

The bulk of this movement originated from Fidelity Wise Origin’s Bitcoin ETF (FITB), with an $83.1 million outflow. Grayscale’s Bitcoin Trust (GBTC) followed, recording a $62.3 million decrease.

The post German Government’s $425 Million Bitcoin Transaction Stirs Market appeared first on BeInCrypto.