Crypto investments outflows increased last week to record thresholds last seen in March. The turnout came as a reaction to the Federal Open Market Committee (FOMC) meeting.

The upside potential for the Bitcoin price remains limited as investors’ risk appetite drops.

Crypto Investments Outflows Hit $600 Million

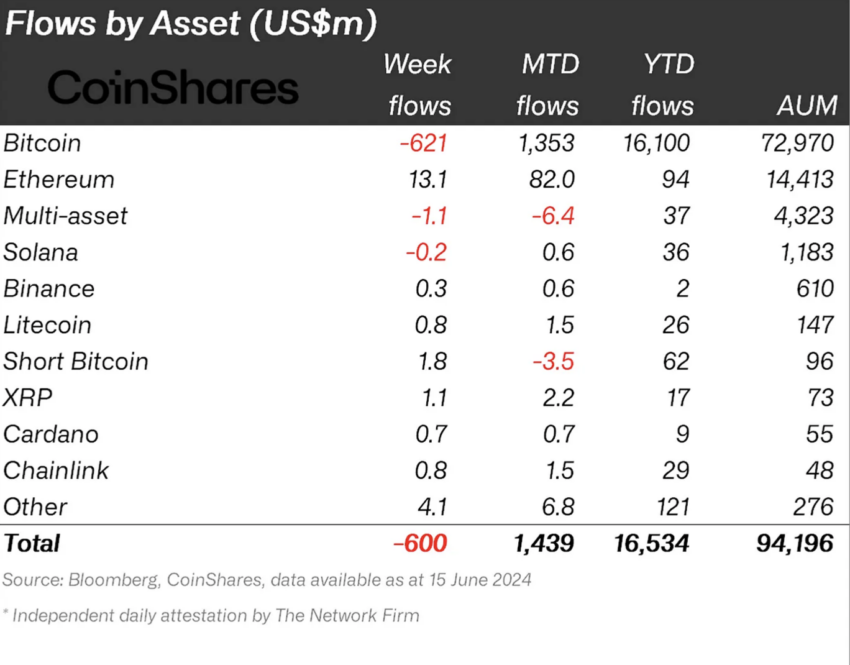

Digital asset investment products saw outflows of $600 million last week, levels last seen on March 22, according to a CoinShares report. Bitcoin accounted for most of the negative flows with $621 million in outflows. Conversely, altcoins like Ethereum (ETH) and Ripple (XRP) recorded net positive inflows, with $13 million and $1 million respectively.

“These outflows and recent price sell-off saw total assets under management (AuM) fall from above $100bn to $94bn over the week. The outflows were entirely focused on Bitcoin, seeing $621m outflows; the bearishness also prompted $1.8m inflows into short-bitcoin,” CoinShares analysts reported.

CoinShares analysts attribute the negative flows to the US Federal Reserve taking a “more hawkish-than-expected” stance in last week’s FOMC meeting. After cheering the softer US Consumer Price Index (CPI) print on June 12, which allowed digital assets to recoup some losses, tables turned ultra-fast as the Fed put out hopes of a more accommodative policy in the near term.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2024

The Fed’s updated dot plot suggested one rate cut for the year, down from three in its previous version. For the layperson, the prospect of fewer rate cuts is negative for cryptocurrencies. The FOMC meetings are crucial events where key decisions on the interest rate at which banks lend to each other and monetary policy are made.

From a regional perspective, the US saw the most outflows, reaching $565 million. However, Canada, Switzerland, and Sweden also recorded net negatives, with their respective outflows reaching $15 million, $24 million, and $15 million, respectively.

Ethereum Among Altcoins With Positive Flows

As indicated, Ethereum managed up to $13 million in positive flows, sidestepping the negative outlook in the BTC market. Sentiment in the Ethereum market remains bullish amid speculation that ETH spot ETFs will launch soon. Bloomberg analyst Eric Balchunas expects the financial instrument to launch on July 2.

“UPDATE: we are moving up our over/under date for the launch of spot Ether ETF to July 2nd, hearing the Staff sent issuers comments on S-1s today, and they’re pretty light, nothing major, asking for them back in a week. Decent chance they work to declare them effective the next week and get it off their plate bf holiday weekend. Anything possible but this is our best guess as of now,” noted Balchunas.

Balchunas’ optimism came after US Securities and Exchange Commission (SEC) Chair Gary Gensler confirmed that ETH spot ETFs would launch “over the course of this summer.”

Read more: Ethereum ETF Explained: What It Is and How It Works

In a Senate hearing last week, Gensler highlighted that the 19b-4 forms approved in May were from the stock exchanges expected to list the ETFs. He also indicated that the registration process for issuers was still underway. Nevertheless, Gensler hoped the issuers would conclude them within the summer.

The post Crypto Investments See $600 Million Outflows Amid Fed’s Hawkish Shift appeared first on BeInCrypto.