Monochrome Asset Management is set to make history with the launch of Australia’s first spot Bitcoin (BTC) exchange-traded fund (ETF) that holds Bitcoin directly. The Monochrome Bitcoin ETF (IBTC) will begin trading on the Cboe Australia exchange on Tuesday, June 4, 2024, at 10:00 AEST (00:00 UTC).

This marks a significant milestone for the Australian crypto market. It also offers investors a regulated and transparent way to gain direct exposure to Bitcoin.

Direct Bitcoin Holdings: Monochrome’s ETF Debut

The introduction of IBTC addresses a gap in the market. This product is the first and currently the only ETF that holds Bitcoin directly in Australia.

Australia has two exchange-traded products on Cboe Australia that provide exposure to spot crypto assets. However, they do not hold Bitcoin directly.

“Before IBTC, Australian investors were only able to invest in ETFs that indirectly hold Bitcoin or through offshore Bitcoin products, both of which don’t benefit from the investor protection rules under the directly held crypto asset AFS licensing regime,” Monochrome said in a statement.

In March, Monochrome announced that IBTC would be the first to use the CME CF Bitcoin Reference Rate—Asia Pacific Variant (BRRAP) for its benchmarking. The BRRAP provides a reliable pricing benchmark for Bitcoin.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

It is designed to accurately reflect the market price, resist manipulation, and be verifiable by market participants. Additionally, Monochrome partners with crypto exchange Gemini as its Bitcoin custodian.

The company applied for a spot in Bitcoin ETF in April 2024. In Australia, firms require the approval of the regulator, the Australian Securities & Investments Commission (ASIC), and then the exchange listing the product, in this case, Cboe Australia. Monochrome had already won approval from ASIC for this product.

Monochrome’s IBTC launch came after ASX Ltd., Australia’s primary securities exchange, reportedly considered approving its first spot Bitcoin ETFs. Sources close to the matter suggest that these approvals could materialize before the end of 2024.

BeInCrypto previously reported that BetaShares is actively working towards launching its product on the ASX. A company spokesperson shared that they have already reserved ticker symbols for their spot Bitcoin and Ethereum ETFs.

Similarly, DigitalX Ltd., another Australian firm, disclosed in its half-year results that it has applied. At the same time, VanEck, a veteran in the ETF sphere with US and European products, reentered the Australian fray. The company submitted a renewed application earlier this year.

This marks the second wave of spot Bitcoin ETF launches in Australia. Sydney-based Cosmos Asset Management launched a spot Bitcoin ETF in 2022 but delisted the fund later that year after tepid inflows. However, with the buzz from spot Bitcoin ETFs in the US and Hong Kong, these products could potentially stay in the Australian market.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

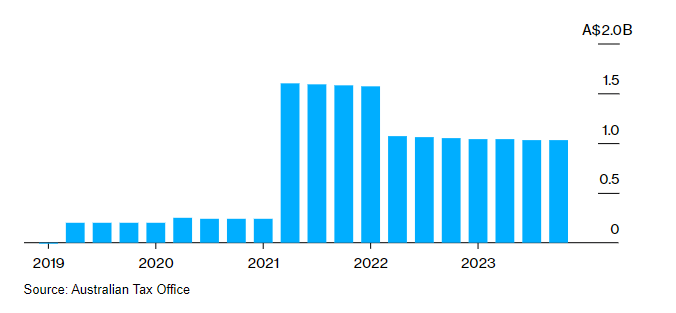

Australia’s pension system, valued at $2.5 trillion, has also shown growing interest in cryptocurrencies. The country’s pension funds have allocated approximately 1 billion Australian dollars ($664 million) to digital assets. If Australian pension funds follow the lead of their US counterparts to hold spot Bitcoin ETFs, this could strengthen the foundations for these products in the Australian market.

The post Monochrome Unveils Australia’s First Spot Bitcoin ETF with Direct Holdings appeared first on BeInCrypto.