Recent significant Ethereum (ETH) transfers to cryptocurrency exchanges have caught the market’s attention. This move has raised speculation about potential profit-taking, portfolio rebalancing, or market speculation.

These developments coincide with the US Securities and Exchange Commission (SEC) nearing a decision on the Vaneck Ethereum exchange-traded fund (ETF), which has heightened expectations within the industry.

Investors Transfer ETH to Exchanges

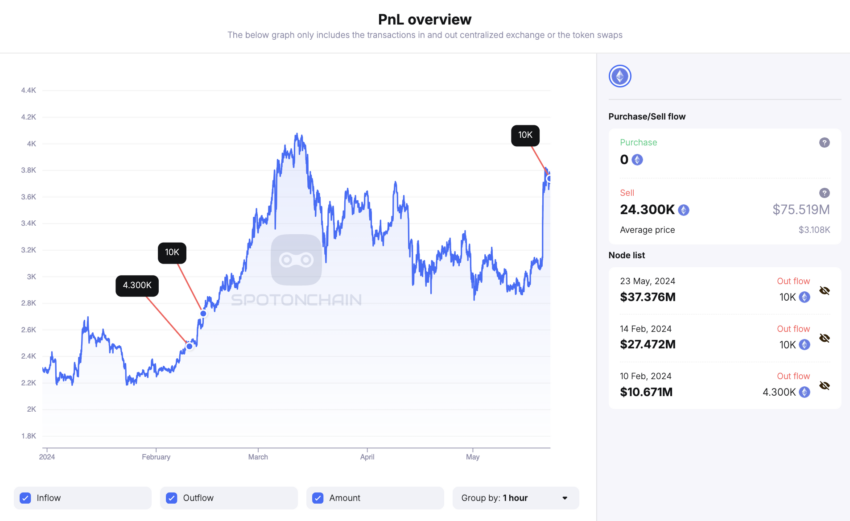

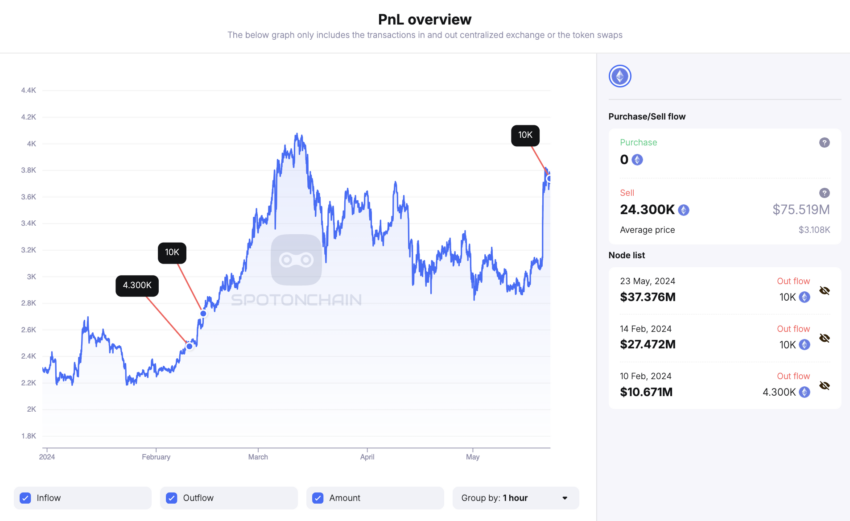

Jeffrey Wilke, one of the founders of Ethereum, has transferred 10,000 ETH, worth around $37.38 million, to the cryptocurrency exchange Kraken. While the motive behind such a significant transfer is unclear, a few hypotheses can be derived from it.

- Profit Taking: Wilke may be selling off his tokens to realize profits. This could be due to achieving his desired return on investment or anticipating a potential downturn in the market.

- Rebalancing Portfolios: Wilke might be rebalancing his portfolios by selling some tokens and buying others. This could be based on changes in market conditions, project developments, or his investment strategy.

- Market Speculation: Wilke might be speculating on short-term price movements or taking advantage of arbitrage opportunities between different cryptocurrency exchanges.

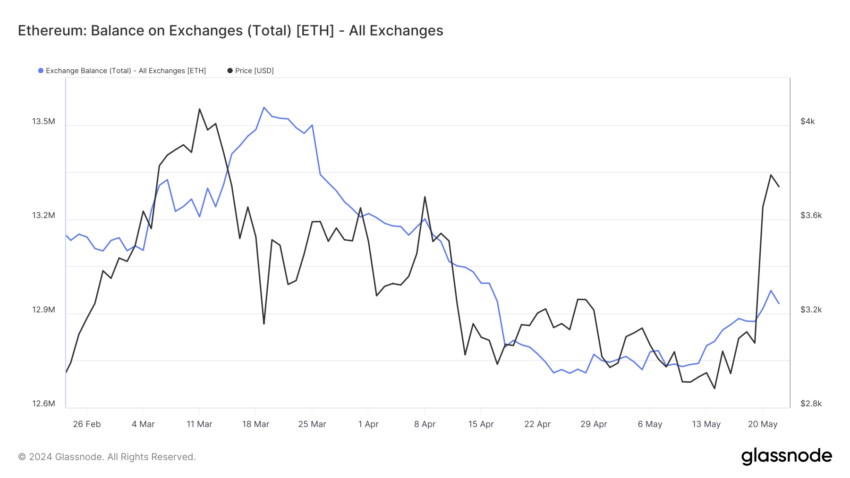

Whether Wilke aims to book profits, rebalance his portfolio, or speculate on the market, he appears not the only one. Looking at Ethereum’s balance on exchanges reveals a spike in the tokens available to sell.

- Balance on Exchanges: This refers to the total amount of Ethereum held in cryptocurrency exchange wallets.

Over the last two weeks, more than 242,000 ETH have moved to cryptocurrency exchange wallets. This indicates increased trading activity on exchanges that can contribute to price volatility.

Ethereum ETF Approval Looms

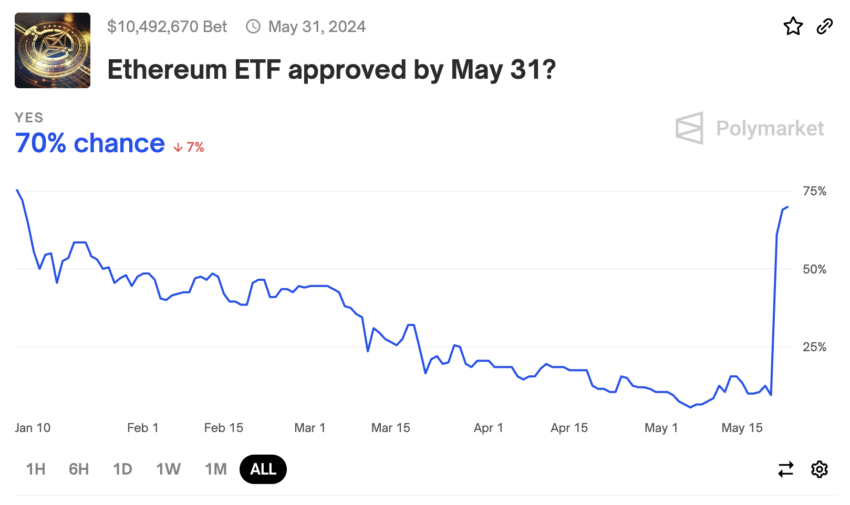

The timing of these transfers is notable, as it aligns with today’s SEC final ruling regarding the Vaneck Ethereum ETF. Interestingly, on May 20, the SEC requested Nasdaq, CBOE, and NYSE to refine their applications for listing spot Ethereum ETFs, hinting at a potential approval of these filings.

In response to this regulatory development, Eric Balchunas and James Seyffart, ETF analysts at Bloomberg Intelligence, remarked that the likelihood of approval has substantially increased, shifting from only 25% to a considerable 75%.

“Hearing chatter this afternoon that the SEC could be doing a 180 on this increasingly political issue, so now everyone is scrambling. But again, we cap it at 75% until we see more, e.g., filing updates,” Balchunas wrote.

Read more: Ethereum ETF Explained: What It Is and How It Works

Similarly, Polymarket, a decentralized prediction market platform that allows users to place bets on world events, shows a significant increase in approval odds, which have risen from 10% to 70% over the past 72 hours.

Warning Signal for Traders

Although industry leaders like Anthony Pompliano see the Ethereum ETF approval as an “approval of the entire industry” and as “the last dam to be broken,” traders must be cautious. The increasing ETH deposits to cryptocurrency exchange wallets hint at the possibility of a sell-off or a spike in profit-taking.

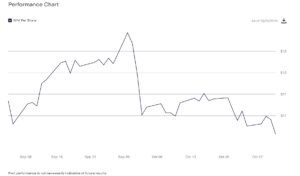

Meanwhile, the Tom DeMark (TD) Sequential indicator presents a sell signal on Ethereum’s daily chart.

- TD Sequential Indicator: This is a technical analysis tool used to identify potential market trend exhaustion points and upcoming price reversals.

- Setup Phase: This involves counting a series of nine consecutive price bars, where each bar closes higher (for an uptrend) or lower (for a downtrend) than the bar four periods earlier.

- Countdown Phase: Following the setup phase, a countdown begins where a series of thirteen additional price bars are counted if they close lower (in a downtrend) or higher (in an uptrend) than the close two bars earlier.

The current green nine candlestick on the daily chart suggests that a spike in selling pressure could see Ethereum retrace for one to four daily candlesticks or even start a new downward countdown phase before the uptrend resumes.

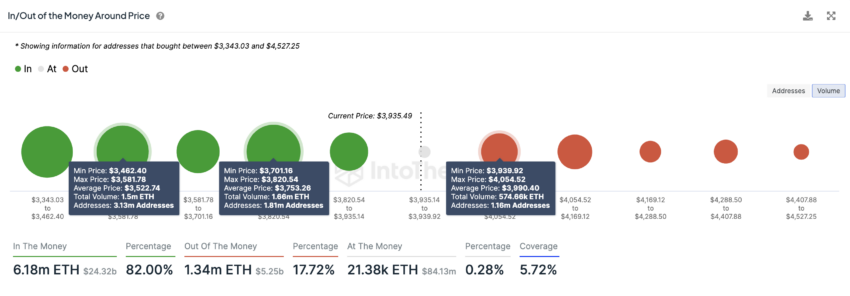

Despite the bearish signals seen from an on-chain and technical perspective, the In/Out of the Money Around Price (IOMAP) indicator suggests that Ethereum is above significant areas of support that could hold in the event of a correction.

- IOMAP: This metric helps analyze and visualize the distribution of holders’ positions relative to the current price. It helps understand the potential support and resistance levels based on the number of addresses holding a particular cryptocurrency at different price levels.

- In the Money: Refers to addresses that acquired the cryptocurrency at a price lower than the current market price, indicating potential support levels as holders are likely to sell at a profit.

- Out of the Money: Refers to addresses that acquired the cryptocurrency at a price higher than the current market price, indicating potential resistance levels as holders might want to break even or minimize losses.

Based on the IOMAP, over 1.81 million addresses bought around 1.66 million ETH between $3,820 and $3,700. This demand zone could keep Ethereum’s price at bay amid increasing selling pressure. But if it fails to hold, the next key area of support is between $3,580 and $3,462, where 3.13 million addresses purchased over 1.50 million ETH.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, the most important resistance barrier for Ethereum is between $3,940 and $4,054. Here, over 1.16 million addresses had previously purchased around 574,660 ETH.

If Ethereum overcomes this hurdle and prints a daily candlestick close above $4,170, the bearish outlook will be invalidated. This could result in a new upward countdown phase toward $5,000.

Summary and Conclusions

Ethereum co-founder Jeffrey Wilke’s recent transfer of 10,000 ETH to Kraken is indicative of broader market activities, where investors are moving significant amounts of ETH to exchanges. This trend aligns with increased trading activity, suggesting potential profit-taking, portfolio rebalancing, or market speculation among Ethereum holders. The balance of ETH on exchanges has spiked, indicating a potential rise in market volatility.

This market movement comes at a critical time, as the SEC is about to make a final ruling on Vaneck’s Ethereum ETF. Analysts have noted a substantial increase in the likelihood of approval, which has surged from 25% to 75%. Such regulatory developments are seen as a positive signal for the broader cryptocurrency market, potentially paving the way for further institutional investment.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Despite technical indicators suggesting a possible short-term bearish trend, the IOMAP indicator shows strong support levels for Ethereum. This suggests that while there may be short-term corrections, the underlying demand for Ethereum remains robust. Long-term holders appear confident, continuing to accumulate ETH, which bodes well for its future price stability and growth.

The post Ethereum Co-Founder Could Sell Over $37 Million in ETH Ahead of ETF Decision appeared first on BeInCrypto.