Despite soaring expectations of a meme coin supercycle, recent performance data reveals significant downturns among these assets, challenging the bullish forecasts.

Over the past month, popular meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have seen declines ranging from 8% to 31%.

Meme Coins Dip as Interest Shifts to Bitcoin

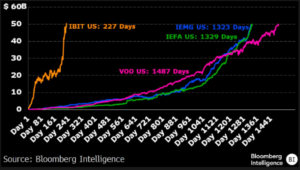

Market analysts attribute the downtrend in meme coins to a shift in investor focus towards Bitcoin following its latest halving and the increasing popularity of exchange-traded funds (ETFs). While some investors had anticipated a surge across all cryptocurrencies, the reality has been more nuanced.

The market capitalization of meme coins as stands at $54.639 billion, experiencing a daily drop of 2.7%. This decline is echoed in their trading volume, which is reported at $5 billion over the past 24 hours.

Despite the general downturn, not all meme coins have suffered losses. PEPE and BONK have bucked the trend, registering gains of 15.5% and 4.3% over the last month, respectively. These outliers highlight the volatile and unpredictable nature of meme coin investments.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

The broader narrative among investors suggests that the onset of a supercycle, fueled by Bitcoin’s halving and ETFs, could eventually benefit the meme coin sector. This optimism is based on the expectation that Bitcoin’s reduced supply post-halving could drive up its price, potentially leading investors to seek higher returns in more speculative assets.

However, serious market analysts and entities such as venture capital firm a16z have expressed concerns about the sustainability of meme coins, citing them as potential risks to the cryptocurrency market’s credibility. Even Crypto Koryo, a data scientist, suggests that the meme coins have turned into high-risk, low-reward.

“Considering the vast majority of these new meme coins will go to $0, you need a lot of diversification if you want to play that game. If there is too little diversification, your portfolio could go to $0 anytime. Too much diversification, and even a 20x on one of them, wouldn’t impact the PnL by much,” Koryo explains.

In light of these dynamics, the future of meme coins remains uncertain. While some predict a rebound driven by broader cryptocurrency gains and increased investment in high-risk assets, others caution against the speculative nature of such investments.

The post Meme Coins Dip Despite Hopes of Supercycle appeared first on BeInCrypto.