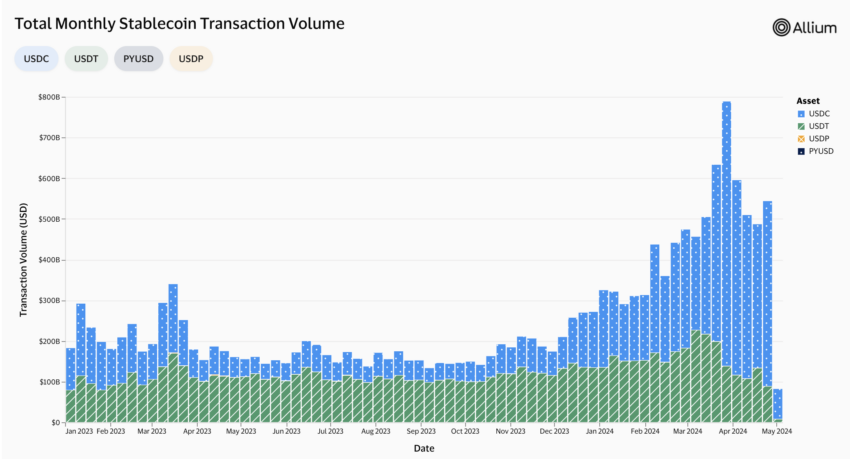

Circle Internet Financial’s stablecoin, USDC, now surpasses Tether’s USDT in transaction volume. Recent data from payment giant – Visa, developed with Allium Labs, shows that USDC is leading in the competitive stablecoin market.

Despite USDT being a stablecoin with the largest market capitalization, USDC leads the transaction volume.

Did USDC Outperform USDT?

According to Visa’s adjusted stablecoin metric, USDC recorded a remarkable $455.51 billion in transaction volume last week. In contrast, USDT registered only $88.52 billion.

Since the start of 2024, USDC has dominated with 50% of total transactions. This trend marks a significant shift from the previous market dynamics, where USDT was considered the dominant stablecoin. Despite USDT’s 69% dominance, as reported by DefiLlama, USDC’s performance is notable.

Noelle Acheson, a crypto analyst, suggests a reason for this shift.

“USDT is more held outside the US as a dollar-based store of value, while the USDC is used in the US as a transaction currency,” Acheson said.

Read more: A Guide to the Best Stablecoins in 2024

Stablecoins like USDC and USDT aim to mirror the stability of fiat currencies, especially the US dollar. They play essential roles in facilitating transactions within the crypto ecosystem, from cross-border remittances to token trading. However, the transaction data available on public blockchains can be misleading due to its complexity.

As Cuy Sheffield from Visa points out, transactions can vary, initiated either manually by users or programmatically through bots. When adjusting for bot-related activities, the total transfer volume over the last 30 days dropped significantly from $2.65 trillion to $265 billion.

Moreover, the rise of USDC follows a challenging period tied to last year’s US banking crisis. Its circulation dropped from $56 billion to $23 billion in December 2023 after revealing a $3.3 billion exposure to Silicon Valley Bank. However, USDC has rebounded to $32.8 billion in circulation.

Furthermore, Stripe, a leader in online payments, has recently re-introduced crypto payments, specifically choosing USDC. This decision, alongside PayPal launching its stablecoin PYUSD and Shopify enabling stablecoin payments, indicates a growing acceptance of stablecoins in mainstream transactions.

The integration of stablecoins is becoming more prevalent, with their annual volume nearing parity with Visa in just six years. Stripe leverages them as a settlement layer, enabling customers to pay for services swiftly and economically.

Read more: How To Buy PayPal Stablecoin (PYUSD)

As Congress considers stablecoin legislation, the potential for further adoption looms large. Proper legislation could accelerate this adoption, proving blockchain technology’s capacity to power a new financial system.

However, restrictive laws could delay this progress.

The post How USDC Surpassed USDT in Transaction Volume appeared first on BeInCrypto.