Crypto whales recently transferred a total of $1.3 billion in USD Coin (USDC) to the major exchange platform, Coinbase. Market analysts are viewing these transfers as a potential giant buy signal.

This massive influx of funds occurred in synchronized transactions from five different addresses. Consequently, this development has ignited speculation of an impending bullish phase for cryptocurrencies, particularly Bitcoin and Ethereum.

How Crypto Whales Sent Funds to Coinbase

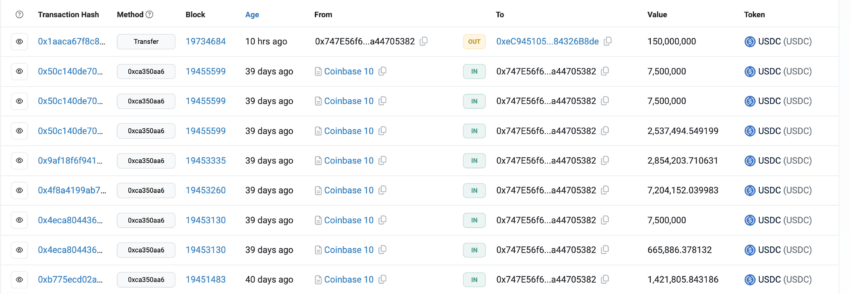

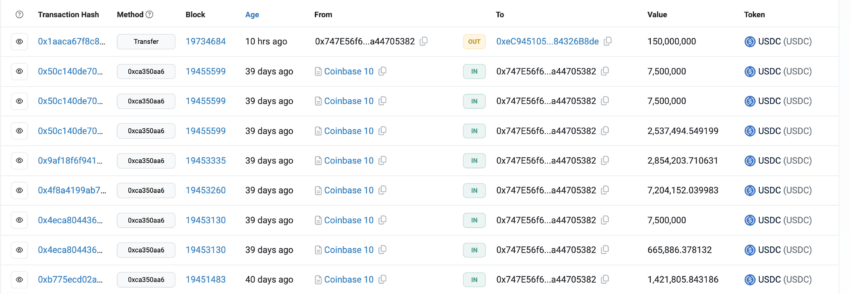

The details of these transactions reveal a coordinated effort among the crypto whales. The transfers were nearly simultaneous, suggesting a single entity might control the five addresses.

Specifically, address 0x45a sent 295.86 million USDC to Coinbase. Subsequently, addresses 0x29d and 0x41d each transferred 350 million USDC. Furthermore, addresses 0xbdE and 0xeC9 contributed 150 million USDC each, culminating in nearly $1.3 billion.

Investigations into these crypto wallet addresses suggest that a single entity might control these wallets. Moreover, all five crypto wallets follow a consistent pattern.

For instance, before sending 150 million USDC to Coinbase, wallet 0xeC9 received funds from another wallet, 0x747. Interestingly, 0x747 itself was replenished with USDC from Coinbase around mid-March when the market peaked.

Read more: How To Use Etherscan

This cyclical transfer pattern raises the possibility that these crypto whales had previously liquidated positions at the market’s peak and moved to self-custody their assets in USDC. Their return to the crypto exchange platform may signal their belief that the market has reached a local bottom and is now preparing for a new bullish run.

“USDC moving onto exchanges is a giant buy signal, as the saying goes on the internet money printer go brr,” crypto trader Blockchain Mane said.

The concept of crypto whales using large stablecoin deposits as a harbinger of significant buy orders is well-established in the trading community.

“If this is indeed a whale buying and at current prices then yes, it can have a big impact on the price of the asset they are buying, which at that level is almost certainly only Bitcoin and Ethereum,” Lark Davis said.

However, despite the excitement, seasoned analysts advise caution. Brian Jung, a crypto trader, suggested that the impact depends heavily on how and where the crypto whales deploy the funds.

Jung speculated that if the capital were concentrated on a single, smaller altcoin, it could drastically manipulate the market price. Nonetheless, given the potential for overexposure, he doubts a savvy investor would take such a risk.

Read more: A Comprehensive Guide on Tracking Smart Money in the Crypto Market

Further complicating predictions, Davis mentioned that these crypto whales might opt for limit orders, which do not immediately purchase assets but create a buy wall. These could strengthen the support for cryptocurrencies, stabilizing or even increasing their prices sustainably.

The post Crypto Whales Channel $1.3 Billion to Coinbase, Sparking Bullish Speculations appeared first on BeInCrypto.