The effect of Bitcoin’s impending halving extends broader, triggering a surge in mining investment and sparking regulatory debates worldwide.

The event, which slashes rewards for miners in half, is undeniably a pivotal moment for the future of Bitcoin itself and possibly the broader crypto market.

Will the 2024 Bitcoin Halving Squeeze Miners or Spark Innovation?

In the US, Auradine, a Bitcoin mining machine company focused on security and AI, recently secured $80 million in Series B funding. This move marks a significant milestone for the company and signals investor confidence in the sector despite the challenges posed by the halving.

Other major mining companies aren’t sitting idle. Bitfarms Ltd., a North American player, boldly invested $240 million into upgrading its mining capabilities. BeInCrypto also reported earlier that CleanSpark announced similar infrastructure investments in early February. These activities are demonstrating widespread proactive preparation.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks Ahead of 2024 Halving

Miners aren’t the only ones taking notice. Regulators are also paying close attention to the potential impact of the halving.

In Paraguay, a recent bill proposed a sweeping ban on crypto mining. Fourteen Paraguayan senators proposed the bill due to concerns over exploiting the country’s hydroelectric resources.

However, the senators have now halted progress on the ban. The senators recognized the potential economic advantages of harnessing surplus energy from the Itaipu hydropower plant for crypto mining rather than exporting it.

Senator Salyn Buzarquis declared Paraguay’s support for crypto mining investment.

“Today we approved a Declaration whereby the Senate of Paraguay supports local and foreign investments in infrastructure and urges the Ministry of Industry to study the economic advantages of selling our surplus energy to the crypto mining industry,” Senator Buzarquis wrote on X (formerly Twitter).

This shift highlights the complex interplay between crypto and national energy policy.

Read more: Bitcoin Halving Countdown

The halving cuts the reward for mining a Bitcoin block from 6.25 to 3.125 BTC, significantly impacting miner profitability. As a result, miners face pressure to innovate and find ways to reduce costs while maintaining or increasing their Bitcoin output.

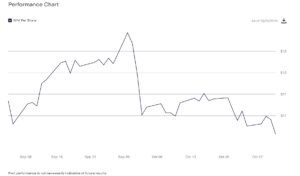

Additionally, with profitability at stake, the industry’s gaze turns to Bitcoin’s market performance, hoping for price increases to counterbalance the reduced rewards. CryptoQuant reports that miner hash prices have declined by 30% since the last halving, a trend likely to continue.

The post From Paraguay to Wall Street: Bitcoin Halving Drives Mining Strategy and Policy appeared first on BeInCrypto.