The Cardano (ADA) market is currently witnessing a tug-of-war between holders in profit and those experiencing losses, which could lead to a period of stagnation for ADA prices. Since the onset of March, there’s been a significant reduction in the number of transactions exceeding $100,000, indicating a slowdown in high-value activity within the ADA ecosystem.

However, the presence of strong support levels could provide a safety net for ADA valuation, laying the groundwork for the cryptocurrency to initiate a new phase of upward momentum.

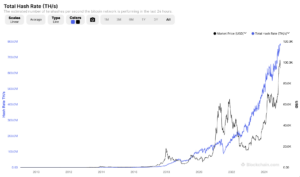

Whale Transactions Just Detached From ADA Price

Over the past three months, a detailed analysis reveals a clear correlation. This correlation exists between ADA high-value transactions and its market price. Specifically, we’re looking at transactions exceeding $100k.

Yet, this established pattern took a surprising turn recently. In just the past few days, the volume of whale transactions shifted as ADA price saw an uptick. From March 6, with 1,192 transactions, to March 14, it dropped to 953. This marks a significant 20% decrease within merely a week.

Monitoring these large-scale transactions offers valuable insights. It serves as an effective measure for understanding investor behavior regarding ADA. Throughout the last quarter, a trend was evident. As transactions over $100k increased, ADA price mirrored this growth. This pattern suggests a strong investor confidence linked to transaction volumes.

However, this correlation faced a deviation previously in November 2023. ADA prices entered a stagnant phase that lasted 15 days during that period. Following this lull, a remarkable surge occurred. The price skyrocketed by 41% in just five days.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

Cardano Battlefield Looks Interesting

Delving into the current state of ADA through the lens of address profitability offers a fascinating snapshot. By examining which addresses are currently profitable versus those at a loss, given ADA’s current price, we can uncover intriguing dynamics.

Currently, a majority, or 54.85%, of ADA holders find themselves in the green, enjoying profitability. In contrast, 43.21% are navigating through losses, with a slim margin of 1.94% teetering on the break-even edge.

This landscape sets the stage for a compelling tug-of-war. Each faction is motivated to shift the price towards their favorable terrain. Those incurring losses might opt for patience, holding onto their assets with hopes of an ADA value increase to flip their fortunes. Conversely, those in profit are incentivized to sell off some of their holdings, aiming to capitalize on their gains.

However, this narrative presents just one of many unfolding scenarios. It’s plausible that both the winners and losers in this scenario choose to hold steadfast, betting on ADA’s future appreciation. Should this collective resolve hold, we could witness a resurgence in ADA price, illustrating the complex interplay of decisions within the cryptocurrency ecosystem.

ADA Price Prediction: Support Re-Test Before Targetting $0.84

Analyzing the ADA In/Out of the Money Around Price chart shows that strong support is around $0.72, followed by another one at $0.70. If ADA cannot resist these support zones, it could keep falling as low as $0.63.

The IOMAP (In/Out of the Money Around Price) chart is a financial analysis tool used primarily in cryptocurrency markets to visualize price levels at which a significant amount of the asset’s supply was previously bought or sold. This tool aggregates large datasets to show where the holders of the asset are likely to experience profit or loss based on the current price compared to their acquisition price.

The IOMAP can be instrumental in identifying support and resistance levels, as it highlights price points where many investors might decide to buy or sell based on their positions being in profit (In the Money) or at a loss (Out of the Money).

This information helps traders and investors make more informed decisions by understanding potential price consolidation or breakthrough areas.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

ADA doesn’t appear to have strong resistance ahead. The biggest one sits at $0.75. If ADA can break it, even if its number of whale transactions decreases, it could continue climbing new resistances until $0.84. This would represent a 12% growth.

The post Cardano (ADA) Price Halts: Crucial Support Test Before More Upside? appeared first on BeInCrypto.