The Deutsche Börse Group recently unveiled the Deutsche Börse Digital Exchange (DBDX). This regulated platform offers cryptocurrency trading, settlement, and custody services specifically designed for institutional clients.

The initiative marks a significant development in the integration of digital assets within the traditional financial sector. The platform provides a fully regulated ecosystem for the handling of cryptocurrencies.

Deutsche Börse Offers Crypto to Corporate Clients

The launch of DBDX fills a notable gap in the market by providing institutional clients with a secure and regulated environment for crypto asset transactions. This new platform will facilitate greater participation of institutional investors in the digital asset space, potentially increasing liquidity and stability in the market.

The initial phase of the exchange’s operations will focus on a Request for Quote (RFQ) trading system, with plans to expand to multilateral trading in the future. Operations are supported by the collaboration between Deutsche Börse and Crypto Finance (Germany) GmbH, with the latter handling the settlement and custody aspects of transactions.

“Our new offering is a game changer for digital ecosystems. We want to offer institutional clients in Europe trustworthy markets for crypto assets characterized by transparency and security and where operations comply with regulatory requirements. This strengthens the integrity and security of the entire market,” Head of FX & Digital Assets at Deutsche Börse Carlo Kölzer said.

The initiative also highlights the evolving regulatory environment surrounding digital assets. Earlier this year, the German Federal Financial Supervisory Authority (BaFin) granted Crypto Finance (Germany) GmbH four licenses. The approvals subsequently allowed the firm to offer regulated trading, settlement, and custody services for digital assets.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

These licenses are crucial for operating platforms like DBDX. Meeting the regulatory requirements essential for institutional participation would not be possible without them.

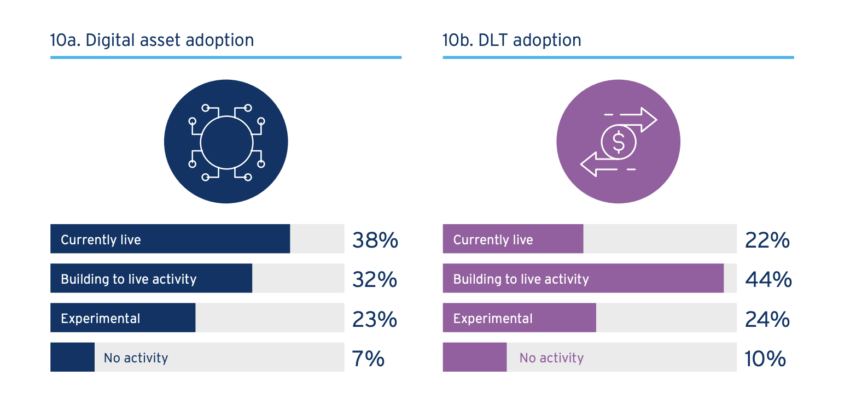

Institutions Start Embracing Crypto

Deutsche Börse Group’s move is part of a wider trend of traditional financial institutions exploring the digital asset management space. For instance, Baanx, a UK-based cryptocurrency payments specialist, secured $20 million in a recent funding round, signaling increasing investor interest in crypto payment solutions.

Major payment networks such as Mastercard and Visa also investigate applications of blockchain technology and cryptocurrency in their operations. This further proves the growing intersection between traditional finance and digital assets.

“Over the past 12 months, we have been building out a series of non-custodial, on-chain products, creating a whole new type of crypto payment. Allowing the user full control of their funds whilst enabling real-world spend, we hope to power the next generation of crypto payments,” Baanx Chief Commercial Officer Simon Jones said.

Launching regulated platforms will likely play a pivotal role in the broader adoption of cryptocurrencies. In time, they will offer institutional investors a secure and compliant gateway into the digital asset market.

The post German Multinational Enables Crypto Trading For Institutional Clients appeared first on BeInCrypto.