With institutional interest surging and technological advancements paving the way, the demand for Bitcoin is unprecedented.

This surge in demand and finite supply could result in a staggering 6,300% price rally over the next 15 years.

Growing Institutional Demand for BTC

The simple yet profound principle of supply and demand is at the heart of this prediction. Bitcoin’s architecture ensures that only 21 million BTC will ever be minted. Today, approximately 93.5% of these have already been mined. This scarcity is a key driver behind Bitcoin’s value proposition.

Michael Saylor, co-founder and executive chairman of MicroStrategy, emphasized that miners will have mined 99% of all Bitcoin by 2035. This could usher in a new era of growth fueled by scarcity, igniting a “Bitcoin gold rush.” It will spurred by the advent of spot Bitcoin exchange-traded funds (ETFs), marking a new phase of high-growth institutional adoption.

“I think that we’re in the Bitcoin gold rush era. It started in January of 2024 and will run until about November of 2034… You’re going to see resistance drop. There will be a day where Bitcoin blasts past gold [and] trade more than the S&P index ETFs,” Saylor said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

The spotlight on Bitcoin ETFs, particularly with BlackRock’s iShares Bitcoin Trust crossing $10 billion in assets under management in record time, starkly contrasts the trajectory of traditional gold ETFs, accelerating momentum behind Bitcoin.

The dramatic inflows into Bitcoin ETFs, dwarfing those of gold funds, further evidence this institutional fervor and signal a shift in the value storage paradigm. Reflexivity Research co-founder Will Clemente highlighted the unprecedented pace of these inflows, suggesting a tectonic shift in investor preference from gold to Bitcoin.

“Bitcoin ETF inflows have absolutely blown gold’s out of the water. Not even close, utterly dwarfed, decimated,” Clemente emphasized.

Institutions and banks are increasingly accommodating Bitcoin transactions, spurred on by pressure from their largest clients, paving the way for widespread institutional entry into the cryptocurrency market.

How Bitcoin Price Can Rally 6,300%

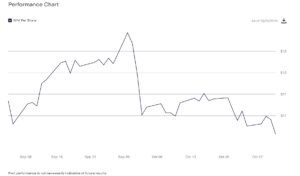

Beyond institutional adoption and technological facilitation, Bitcoin’s potential price trajectory’s theoretical underpinning lies in Giovanni Santostasi’s “power law” model. This model, embracing the mathematics of natural phenomena, forecasts a Bitcoin bull rally toward $10 million by 2045.

Unlike traditional linear models that often present a chaotic view of Bitcoin’s price action, the power law model offers a logarithmic perspective. Therefore, it suggests a more predictable and orderly growth pattern.

“The linear chart that they usually show in TV — what [Jim] Cramer is talking about — looks messy. When do you the log of the y-axis, and you start to see some regularity there, it doesn’t look that messy, it looks like a very nice pattern. But the human eye is not able to look at a curve and say ‘that is a power law,’” Santostasi explained.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

| Intercept | 0.01 | |

| Exponent | 5.8 | |

| model | ||

| time | time ^ n | |

| 2009 | 0 | 0 |

| 2010 | 1 | 0 |

| 2011 | 2 | 1 |

| 2012 | 3 | 6 |

| 2013 | 4 | 31 |

| 2014 | 5 | 113 |

| 2015 | 6 | 326 |

| 2016 | 7 | 797 |

| 2017 | 8 | 1,730 |

| 2018 | 9 | 3,425 |

| 2019 | 10 | 6,310 |

| 2020 | 11 | 10,967 |

| 2021 | 12 | 18,166 |

| 2022 | 13 | 28,898 |

| 2023 | 14 | 44,416 |

| 2024 | 15 | 66,272 |

| 2025 | 16 | 96,360 |

| 2026 | 17 | 136,963 |

| 2027 | 18 | 190,801 |

| 2028 | 19 | 261,078 |

| 2029 | 20 | 351,539 |

| 2030 | 21 | 466,522 |

| 2031 | 22 | 611,015 |

| 2032 | 23 | 790,718 |

| 2033 | 24 | 1,012,104 |

| 2034 | 25 | 1,282,484 |

| 2035 | 26 | 1,610,072 |

| 2036 | 27 | 2,004,056 |

| 2037 | 28 | 2,474,666 |

| 2038 | 29 | 3,033,251 |

| 2039 | 30 | 3,692,354 |

| 2040 | 31 | 4,465,785 |

| 2041 | 32 | 5,368,709 |

| 2042 | 33 | 6,417,721 |

| 2043 | 34 | 7,630,934 |

| 2044 | 35 | 9,028,065 |

| 2045 | 36 | 10,630,520 |

Despite the optimism surrounding the power law model, it is crucial to acknowledge the inherent uncertainties of the cryptocurrency market. Critics of mathematical models in finance caution against overreliance on these predictions. They highlight the unpredictable nature of markets and the potential for external events to disrupt even the most solid forecasts.

While the journey to a 6,300% bull rally is uncertain, the laws of supply and demand position Bitcoin as a transformative force in the financial system.

The post Why Growing Bitcoin Demand Could Ignite a 6,300% Bull Rally in 15 Years appeared first on BeInCrypto.