The Ethereum price shot up along with Bitcoin throughout February to see new yearly highs, but this did not seem to warrant any radical reaction from ETH holders.

Both retail and whale investors have been accumulating, awaiting the breach of a critical resistance zone that has been unchallenged since April 2022.

Ethereum Price Braces for Bullish Test

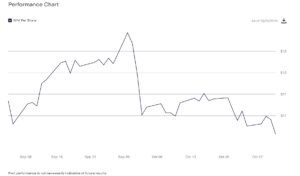

The Ethereum price, trading at $3,527 at the time of writing, has marked a 40% increase over the past three weeks, charting multi-month highs. The second-generation altcoin is now inching closer to testing the resistance zone between $3,582 and $3,829. This area has been a critical barrier for ETH for nearly three years.

Previous bull runs, such as the one in April 2021 and August 2021, noted the crypto asset breaching this resistance zone but failing to test it as support. The eventual test of the upper limit of $3,829 as a support floor resulted in ETH charting an all-time high of $4,626.

This is the second attempt at the altcoin in the past two years, as the Ethereum price failed once in March 2023. Another reason why this zone is important is because it marks the 50.0% and 61.8% Fibonacci Retracement, the latter of which is considered the bull run support floor.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

Thus, a breach and test as support of the resistance zone will prove to be a successful bull rally for ETH.

Profit Motive: Majority of ETH Investors Hold for Gains

ETH holders appear not to be selling and booking profits during the recent rise because not much of the supply turned profitable during this 40% increase. However, according to the Global In/Out of the Money (GIOM) indicator, about 3.62 million ETH worth over $12.69 billion is on the verge of profitability.

Bought at an average price of $4,076, this supply would be profitable if the aforementioned breach succeeds. This would also be the first time since November 2021 that more than 90% of the entire circulating supply of Ethereum is in profit.

The resilience of ETH holders is visible in their behavior. Neither has the supply on exchanges seen a surge in the past month, generally indicative of potential selling nor has the balance of whales (addresses holding between 100 to 100,000 ETH) noted a significant dip.

Thus, retail and whale holders will likely hold out their urge to book profits until the Ethereum price fails or succeeds in the breach.

ETH Price Prediction: Overbought Signal Indicates Possible Correction

If ETH fails to break through the $3,582 barrier again, it could see some correction. This is because, as observed on the Relative Strength Index (RSI), Ethereum is overbought, a phenomenon last noted in May 2021.

Overbought assets hint at saturation of the bullish sentiment in the market, suggesting a potential sell-off owing to profit booking. Therefore, if the breach fails, ETH holders may sell to secure their profits before the altcoin notes any decline.

Read More: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

The weekly chart could see a drop to $3,336. However, a weekly candlestick close below it would invalidate the bullish thesis and potentially send the ETH price to $3,031.

The post Ethereum (ETH) Investors Eye This Key Price Resistance Level Amid 40% Rally appeared first on BeInCrypto.