Bitcoin miner Marathon Digital enjoyed a surge in its stock price on February 28 after revealing an annual profit of $151.8 million in Q4 last year. Its MARA shares in the Nasdaq briefly surged past $31 as its CEO outlined the company’s plans after the Bitcoin halving.

The price of MARA topped at $31, following an increase of 154% in the last three months.

Marathon Digital Excited About New Chapter

Marathon Digital revealed a Q4 2023 net income of $151.8 million per share in its earnings call. This profit followed a net loss of $391.6 million a year earlier. The company’s revenue increased roughly 452% from $28.4 million to $156.8 million in the same period.

Marathon’s CEO, Fred Thiel, said the firm’s momentum and evolving technology stack positioned it for some of the most exciting times in its history. Thiel revealed plans to expand Marathon’s Bitcoin mining hash rate to 50 exahashes per second by the end of the year.

“Given our momentum, our strong balance sheet, and the differentiators we are building with our technology stack, we are optimistic that the most exciting times for our organization are still to come,” Thiel said.

Read more: The 7 Best Cryptocurrency Mining Hardware for 2023

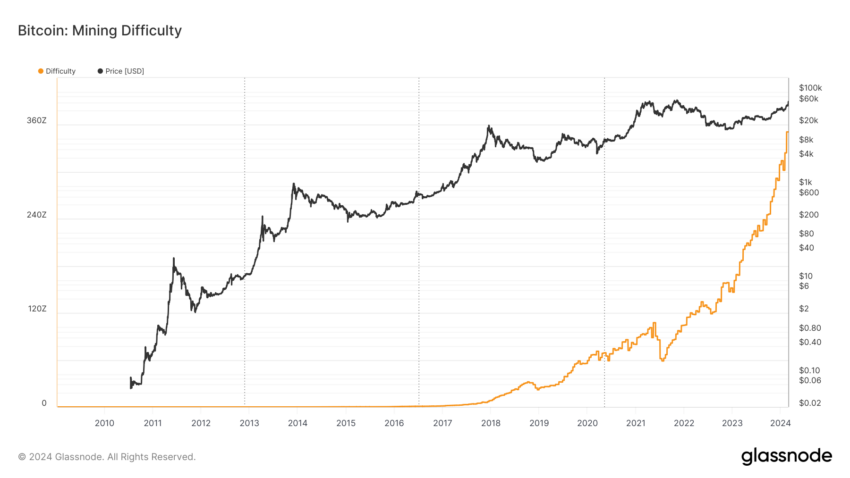

The upcoming Bitcoin halving scheduled for April 19, 2024, will reduce the number of BTC awarded per mined transaction block. After this, miners will receive a 3.125 BTC block reward instead of the current reward of 6.25 BTC. This event has seen miners stock up on mining computers to increase the chance of solving a Bitcoin block correctly.

How Bitcoin Miners Prepare for the Halving

Before the Bitcoin halving, miners must be prepared for dips in profitability. They do this by using existing equipment to mine BTC, which they can sell if Bitcoin’s price drops.

Marathon Digital appears well positioned after reporting that it mined 1,853 BTC in December 2023. This mined Bitcoin is worth roughly $115 million at today’s prices. But being well-capitalized is only one piece of the puzzle.

While Marathon appears to mine more BTC daily than its rival, Riot Platforms, it does so at a higher cost. Marathon pays $22,000 to mine one BTC, while Riot Platforms pays almost 90% less at $2,000 per coin.

Read more: Is Crypto Mining Profitable in 2023?

Riot’s location in Texas means it can sell power to the grid if electricity demands or Bitcoin prices change. BeInCrypto reached out to Marathon and Riot for comment on their fiscal outlook but had not heard back at publication.

The post This Bitcoin Mining Stock Leads the Pack as Next Halving Approaches appeared first on BeInCrypto.