Hong Kong authorities have focused on the over-the-counter (OTC) crypto services. The city, a major East Asian hub for digital asset exchanges, hosts approximately 450 shops, ATMs, and websites facilitating OTC crypto trades.

These services have become crucial to the city’s $64 billion digital asset flow. Yet, growing concerns over illicit transactions and financial instability are prompting the government to enforce stricter controls.

Hong Kong Ramps Up Crypto Regulation Efforts

Under new regulations led by the customs department, OTC crypto providers in Hong Kong must now adhere to rigorous customer record-keeping and enhance monitoring for misconduct. This move signals a broader intent to direct the flow of digital asset transactions through regulated crypto exchanges.

These exchanges face a critical February 29 deadline to secure or apply for permits, as per the Securities & Futures Commission’s mid-2023 guidelines.

“The planned OTC framework will lead to consolidation and a reduction in the use of these platforms as on-ramps into crypto,” Chengyi Ong, APAC policy head at Chainalysis said.

The Financial Services and the Treasury Bureau also launched a consultation on OTC regulations to deter money laundering, terrorism financing, and fraud. However, the appointment of the customs department as the regulatory authority has sparked debate.

A legal expert, Jason Chan, expressed concern that this might reflect a fragmented regulatory approach. Despite this, the Financial Services and the Treasury Bureau defend its decision, highlighting the customs department’s vast experience as crucial for overseeing the new framework.

For OTC businesses like One Satoshi, these developments pose significant hurdles. Roger Li, the co-founder, noted that while his firm already implements necessary anti-money laundering and know-your-customer checks, the new regulations will undoubtedly increase operational costs. With these challenges, OTC companies must decide whether to adapt or exit the crypto business.

Interestingly, Huobi has withdrawn its application amidst these regulatory changes. This move underscores the challenges faced by crypto businesses under the new framework.

Read more: Crypto OTC: How OTC Cryptocurrency Trading Works

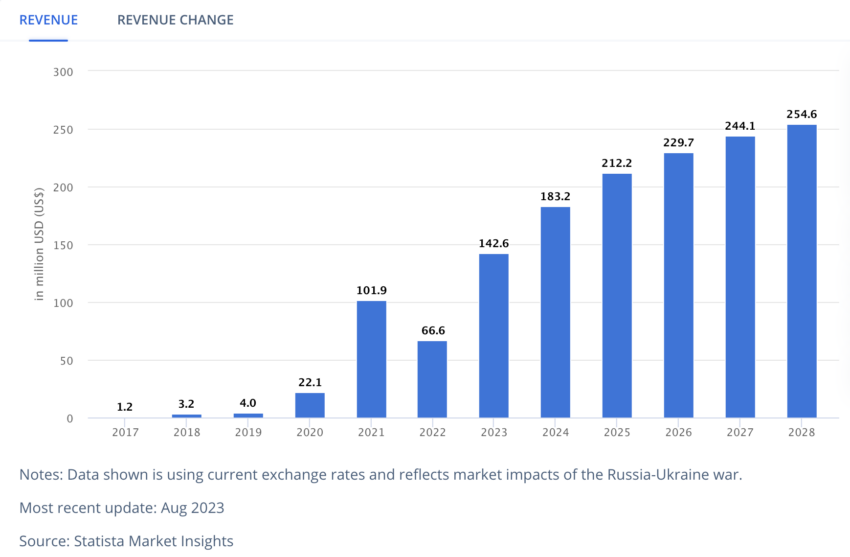

This regulatory pivot is part of Hong Kong’s broader strategy to cement its position as a global crypto hub. Due to Hong Kong’s crypto regulation drive, revenue in the crypto market is forecasted to hit $254.6 million by 2028.

Amid concerns over Beijing’s increasing influence, the city is keen on promoting a regulated and safe crypto environment. The Hong Kong Monetary Authority’s recent guidelines on crypto custody further emphasize this commitment. It sets a high standard for digital asset management.

The post Hong Kong Targets Over-the-Counter (OTC) Crypto Services in Regulatory Clampdown appeared first on BeInCrypto.