Binance Labs, the venture capital and innovation incubator of the global cryptocurrency titan Binance, has invested significantly in Babylon. This innovative Bitcoin staking protocol enables Bitcoin holders to leverage their assets on proof-of-stake (PoS) blockchains.

Consequently, they earn yields without relying on third-party custody, bridge solutions, or wrapping services.

Why Binance Labs Invested in Babylon

Babylon distinguishes itself by providing PoS chains with slashable economic security guarantees and promoting efficient stake unbonding, thus boosting liquidity for Bitcoin investors. Addressing a core challenge, PoS chains traditionally depend on native tokens for security. This reliance can be problematic, given the volatility associated with new tokens.

Hence, Babylon’s Bitcoin Staking Protocol uses Bitcoin’s vast market cap to mitigate the inflationary pressures on PoS chains. Moreover, it enhances the utility of their tokens. This innovative approach alleviates economic challenges for nascent chains and transforms Bitcoin from a static store of value into an active, yield-generating asset.

Developed using the Cosmos SDK, Babylon’s technology facilitates Bitcoin timestamping for PoS chains. It serves as a conduit, ensuring seamless operation between the Bitcoin network and PoS ecosystems. This setup supports BTC staking, finality round participation, and validator staking information tracking. It also fosters a productive dialogue between Bitcoin’s proof-of-work (PoW) framework and the PoS domain.

“Bitcoin staking introduces a crucial new use case for the industry, marking a significant stride in the integration of Bitcoin with the Proof-of-Stake economy. Binance Labs’ investment in Babylon represents our commitment to supporting innovative projects leading the Bitcoin narrative and advancing its use cases,” Yi He, Head of Binance Labs said.

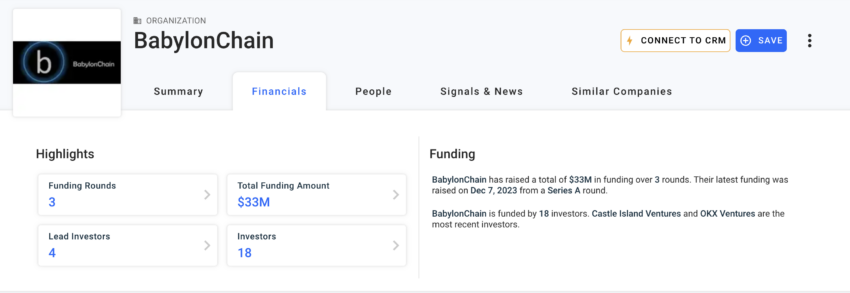

Before Binance Labs’ involvement, Babylon had successfully raised $33 million across three funding rounds. This achievement underscores the market’s confidence in Babylon’s novel solution, backed by 18 investors, including Castle Island Ventures and OKX Ventures. Moreover, the investment from Binance Labs, though undisclosed in size, adds to the war chest that underpins Babylon’s innovative thrust.

Babylon CMO Shalini Wood told BeInCrypto that the firm would utilize the funding to hire more developers. Its testnet goes live tomorrow. However, the project has no plan for the native token launch yet.

Read more: How To Fund Innovation: A Guide to Web3 Grants

Binance Labs’ investment strategy is a testament to its commitment to groundbreaking projects that redefine the Web3 ecosystem. With a stellar 14x return on investment from 250 projects across 25 countries, Binance Labs is a pivotal force in the Web3 sector.

Despite a downturn in the crypto market in 2023, Binance Labs persisted in its investments, focusing on infrastructure, decentralized finance (DeFi), and Web3 gaming.

This strategic vision extends to recent investments in three platforms, i.e., Ethena Labs, NFPrompt, and ShogunFi. Each reflects Binance Labs’ dedication to fostering projects that enhance the crypto ecosystem through utility, security, and innovation.

The post Binance Backs a Bitcoin Staking Solution: The Next Big Thing in Crypto? appeared first on BeInCrypto.