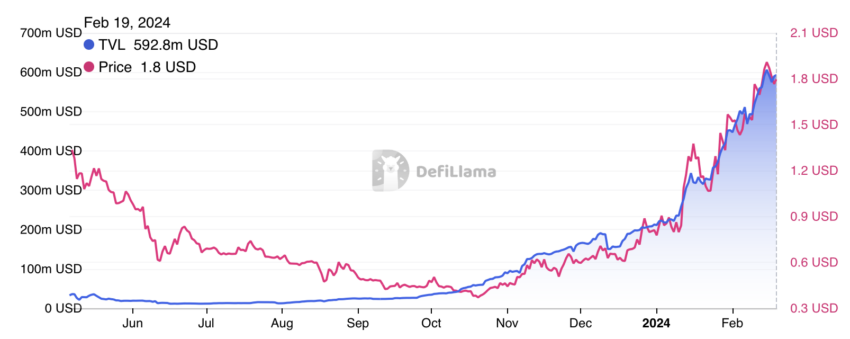

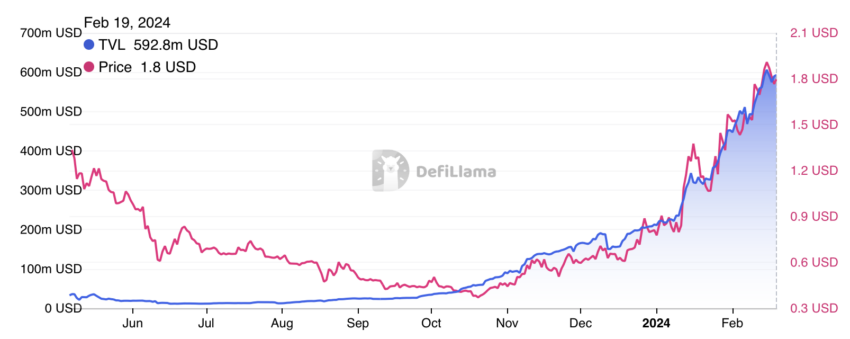

The SUI blockchain has surged ahead, securing a position above industry stalwart Cardano in terms of total value locked (TVL). Over the past month, a remarkable influx of $310 million into the network has propelled its TVL to an impressive $593 million.

This figure speaks volumes about the growing investor confidence and market dynamics favoring SUI.

Total Value Locked in SUI Nears $600 Million

The increasing capital allocation to SUI, a Layer 1 blockchain crafted by former Meta engineers, signifies a pivotal shift in the DeFi sector. The blockchain’s TVL reached $211 million at the year’s onset, only to experience a meteoric rise. This underlines the rapid adoption and trust in its technological infrastructure.

The performance of its native token mirrors the ascent of SUI’s TVL. Indeed, it has seen an astounding 131% increase in the same timeframe. SUI’s ability to outperform Cardano in terms of TVL, which stands at $407 million, marks a significant milestone in its growth trajectory.

Its high throughput and efficiency are key factors contributing to SUI’s ascendancy. This was demonstrated by its peak of 6,000 transactions per second (TPS) and the production of 13.8 million blocks in a single day in December.

Such performance metrics exemplify SUI’s scalability and capacity to handle massive volumes of transactions. It can achieve such performance while maintaining lower gas prices, which distinguishes it from other Layer 1 blockchains like Ethereum.

Read more: A Guide to the 9 Best SUI Wallets in 2024

Despite SUI’s remarkable surge in recent months, cautionary tones have been sounded by some market observers regarding a possible price adjustment ahead. Technical analyst Trader XO reflected on his decision to lock in gains at around $1.50. He noted a premature exit but expressed a strategy to re-enter the market should more favorable conditions arise.

Similarly, Adrian Zduńczyk has outlined a prospective scenario for a downward correction, pinpointing specific levels of concern.

“In case the $1.63 support breaks down, and there is an immediate aggressive correction, you could anticipate SUI to find support around $1 or $0.72,” Zduńczyk said.

This cautious outlook underscores the volatile nature of cryptocurrency investments, where significant gains are often accompanied by the risk of sudden corrections.

![]()

PrimeXTB

Explore →

![]()

Coinbase

Explore →

![]()

AlgosOne

Explore →

![]()

Wirex App

Explore →

![]()

KuCoin

Explore →

![]()

Margex

Explore →

Explore more

The post Total Value Locked in SUI Nears $600 Million, Outperforming Cardano appeared first on BeInCrypto.