Yesterday, Binance co-founder Hi Ye announced new measures to combat insider trading after the Ronin (RON) token fell 40% before its listing on the exchange. An investigation revealed that some users anticipated RON’s listing by reading blockchain data.

Ye said Binance would do more to combat the insider trading that preceded the announcement of the RON/BTC, RON/USDT, RON/FDUSD, and RON/TRY trading pairs.

Binance Tightens Listing Plans and Offers Bounty

Ye said Binance would tighten the management of new token listings and ensure only necessary employees know listing details. Anyone responsible for a leak would be warned and fired going forward.

In addition, Binance will cancel the listing of tokens deemed to have been leaked through external business communications. Ye promised to strengthen the monitoring of scripts and welcomed information on crypto security vulnerabilities and staff leaks. People who provide successful tipoffs will receive a bounty of between $10,000 and $5 million.

“If you verify that Binance team members are corrupt, we will keep your identity confidential and provide you with a security vulnerability bonus of US$10,000 to US$5 million.”

Read more: Binance Review 2023: Is It the Right Crypto Exchange for You?

Yesterday, the price of Ronin fell 40% following its listing on Binance. Users had anticipated the listing by reading public blockchain data showing the aggregation of tokens. Community discussions around a potential listing caused a massive selloff when Binance officially announced the new Ronin trading pairs.

Read more: Top 6 Cryptocurrency Trading Strategies for 2023

Recently, a whale who claimed to be a Binance insider accumulated a Solana meme coin called Dogwifhat (WIF). They purchased $8.7 million WIF but lost $7.7 million due to crypto slippage. The incident highlighted how the price impact of insider trading can be more dramatic when the assets traded have a shallow market.

US Regulator Alleged Binance Insider Trading

The US Commodity and Futures Trading Commission (CFTC) investigated Binance for insider trading in September 2021. The CFTC said that Binance and its staff had exploited customers illegally using insider information to earn profits. Binance denied the allegations.

The US Securities and Exchange Commission has also alleged the crypto exchange listed unregistered securities. The first hearing for the trial occurred in January.

Hi Ye co-founded Binance with former CEO Changpeng Zhao in 2017. Last year, Zhao pleaded guilty to money laundering charges. The former CEO was denied passage from the US to Dubai despite pledging his $4.5B stake in Binance.US.

RON Price Analysis: A 32% Drop or 35% Rise?

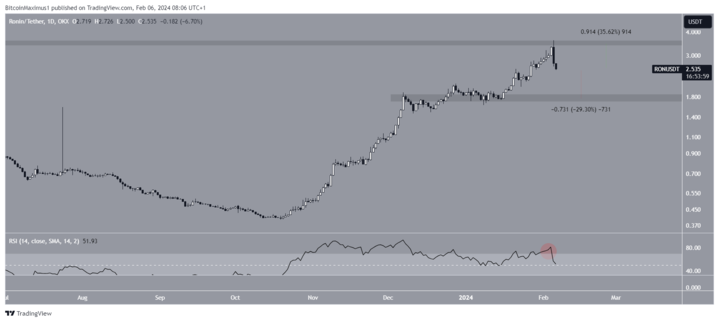

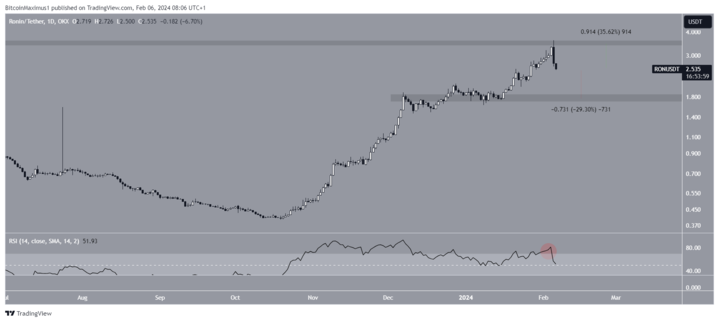

Since October 2023, there has been a steep rise in RON prices, leading to a high of $3.34 on February 4, 2024, just below its all-time high of $3.61. However, there has been a recent decline, confirming the $3.50 mark as a resistance level.

Yesterday, a bearish engulfing candlestick appeared. If the downtrend persists, RON could drop by 32% to reach the nearest support at $1.75. The daily RSI legitimizes this decrease since it fell below 70 (red circle) and is decreasing. Despite this bearish outlook, a strong rebound at current levels could lead to a 35% increase toward the $3.50 resistance zone.

![]()

PrimeXTB

Explore →

![]()

Coinbase

Explore →

![]()

AlgosOne

Explore →

![]()

UpHold

Explore →

![]()

iTrustCapital

Explore →

Explore more

The post Binance Co-Founder Has a Solution to Insider Trading Following Ronin (RON) Listing Dump appeared first on BeInCrypto.