The Bitcoin (BTC) price has increased over the past two weeks after falling to a low of $38,505 on January 23.

Despite the increase, BTC trades slightly below a critical horizontal and Fib resistance level. Will it break out or get rejected?

Bitcoin Struggles With Long-Term Resistance

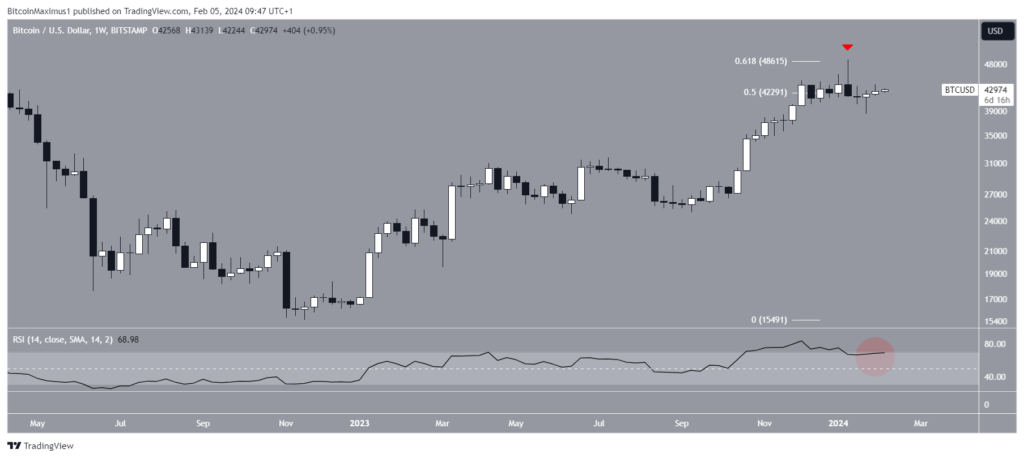

The weekly time frame technical analysis shows that the Bitcoin price has fallen since reaching a high of $49,050 in January. The high was made right at the 0.618 Fib retracement resistance level.

The same week, Bitcoin created a bearish weekly candlestick (red icon) and has fallen since. While BTC bounced slightly in the past two weeks, it still trades at the 0.5 Fib retracement resistance level.

The weekly Relative Strength Index (RSI) gives a bearish reading. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. The weekly RSI fell below 70 (red circle) after reaching overbought territory, a sign of a weakening trend.

Read More: Where To Trade Bitcoin Futures

What do Analysts Say?

Cryptocurrency traders and analysts on X have a mixed view of the future BTC trend. CryptoMichNL believes the price will increase to $50,000 before correcting.

Fred Krueger suggests a new all-time high will be reached before the halving, which will be in April. He tweeted:

GBTC selling pressure on BTC price is largely over. The 1 Billion in Gemini selling will be returned as coin, so that’s market neutral. On the other hand, the New9 is accumulating pretty relentlessly. They are at a total of 175K coins, valued at 7.5 Billion. This in 18 trading sessions. Over the next 30 to 60 days, there are 20 to 40 trading sessions. I would bet this results in between 4 and 6 Billion new USD in inflows. At a market cap of 850 Billion, it’s pretty easy to see this

XForceGlobal believes BTC will first sweep its highs and then fall to its lows. BluntzCapital has the exact same idea, and they both use Elliott Wave Theory to come to this conclusion.

Read More: Who Owns the Most Bitcoin in 2024?

BTC Price Prediction: Is the Correction Over?

The technical analysis of the daily time frame shows that the BTC price trades below a critical confluence of resistance levels between $43,600 and $44,800.

The resistance is created by the 0.5-0.618 Fib retracement resistance levels, a horizontal resistance area, and the support trend line of an ascending parallel channel. The daily RSI legitimizes this resistance area. The indicator has reached the bearish divergence trend line (green line) that preceded the entire downward movement.

Read More: What is a Bitcoin ETF?

So, the BTC trend is considered bearish unless the price breaks out and closes above the $43,600 – $44,800 confluence of resistances. A breakout from that area can trigger a 16% increase to the channel’s resistance trend line at $49,500.

However, should Bitcoin fail to reclaim the key resistance area, the bearish Bitcoin price prediction could see a 16% drop to the closest support at $35,500.

For BeInCrypto‘s latest crypto market analysis, click here.

![]()

PrimeXTB

Explore →

![]()

DeGate

Explore →

![]()

AlgosOne

Explore →

![]()

Wirex App

Explore →

![]()

KuCoin

Explore →

![]()

Margex

Explore →

Explore more

The post Bitcoin (BTC) Faces Deadlock After Mixed January – Will Price Rally or Tumble in February? appeared first on BeInCrypto.