JPMorgan Chase & Co. recently expressed concerns over the expanding market share of Tether Holdings’ USDT, the largest stablecoin, as it approaches a groundbreaking $100 billion in circulation.

This development, while marking a significant milestone for Tether, raises critical questions about the broader implications for the cryptocurrency market.

Why JPMorgan Took a Dig at USDT

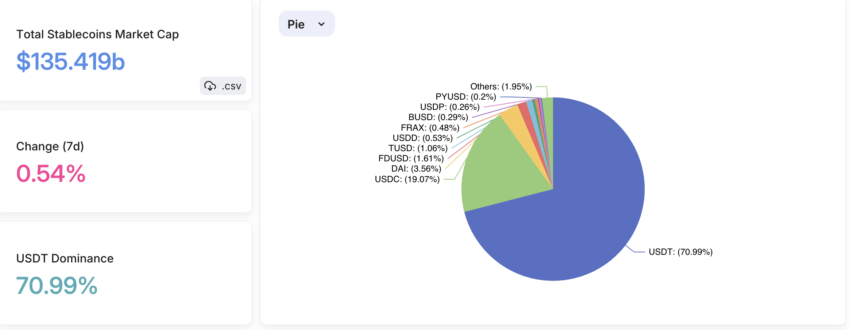

The rising dominance of USDT and Tether’s alleged “lack of regulatory compliance and transparency” poses a risk. This could impact the entire crypto ecosystem, as per a JPMorgan report.

Stablecoins such as USDT are crucial in the crypto world. They supposedly provide a stable haven for traders and an easy way to move between digital assets. Tether’s growing market share in the last two years has solidified its lead. Yet, it also brings to light the regulatory hurdles facing the sector.

Read more: A Guide to the Best Stablecoins in 2024

Despite the scrutiny, Paolo Ardoino, Tether’s CEO, maintains a positive outlook. He argues that Tether’s market leadership is not detrimental to the industry but rather essential for the markets that heavily rely on it.

“Tether’s market domination may be a ‘negative’ for competitors including those in the banking industry wishing for similar success but it’s never been a negative for the markets that need us the most. We’ve always worked closely with global regulators to educate them on the technology and provide guidance on how they must think about it,” Ardoino said.

The impending regulatory changes in the United States and Europe signal a significant shift in the stablecoin arena. The United States is considering the Clarity for Payment Stablecoin Act, while the European Union is set to partially implement the Markets in Crypto-Assets Regulation (MiCA) by mid-year.

These regulatory developments underscore the increasing attention on stablecoins and the need for robust compliance frameworks.

Read more: What Is a Stablecoin? A Beginner’s Guide

The entry of traditional financial institutions like JPMorgan into the stablecoin market could reshape the industry’s dynamics. With their established infrastructure, compliance savvy, and the trust they’ve garnered over decades, these banking giants pose a formidable challenge to existing players like Tether. The possibility of a “JPMorgan Coin” plaguing current stablecoins could dramatically alter the competitive landscape.

Arthur Hayes, the co-founder of crypto exchange BitMEX, captures this sentiment, suggesting that the endorsement of stablecoin initiatives by figures like Janet Yellen could empower traditional banks to launch their own stablecoins, directly threatening Tether’s market presence.

![]()

PrimeXTB

Explore →

![]()

DeGate

Explore →

![]()

AlgosOne

Explore →

![]()

Wirex App

Explore →

![]()

KuCoin

Explore →

![]()

Margex

Explore →

Explore more

The post JPMorgan Voices Concern as Tether’s USDT Nears $100 Billion Circulation appeared first on BeInCrypto.