In the rapidly evolving world of cryptocurrency, Bitcoin (BTC) continues to make headlines, with industry experts like Samson Mow and Cathie Wood predicting a surge in price beyond the $1 million mark.

Their insights shed light on the dynamics driving Bitcoin’s potential exponential growth.

Can 20X Demand Push Bitcoin to $1 Million

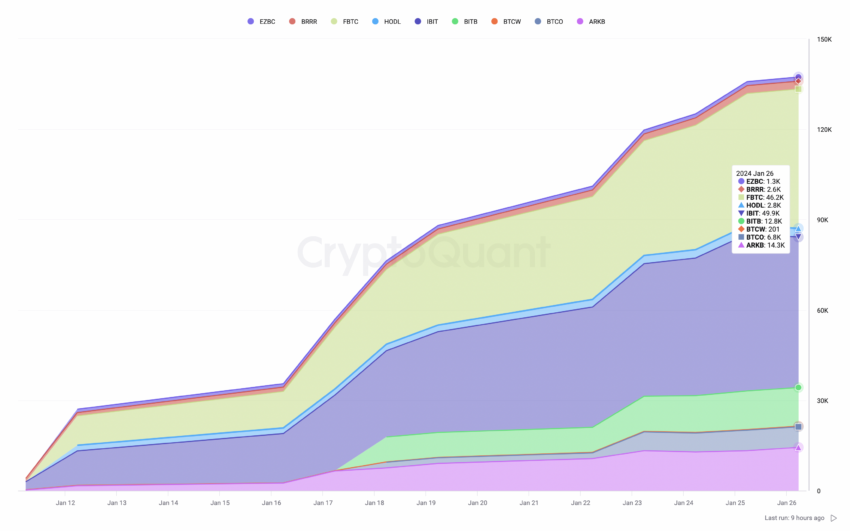

Bitcoin maxi Samson Mow points to the role of spot Bitcoin exchange-traded funds (ETFs) in driving BTC demand. He notes these ETFs’ aggressive acquisition of Bitcoin.

iShares Bitcoin ETF (IBIT) and Fidelity Advantage Bitcoin ETF (FBTC), two major ETFs, have been buying large amounts of BTC daily. Their demand far exceeds the daily supply of mined Bitcoin.

The IBIT/FBTC intake is approximately 9000 BTC a day. Mining only supplies 900 a day. So demand from 2 ETFs alone is 10x supply. Supply is going to get cut in half in less than 3 months, which means this demand will be 20x supply. And this demand is just 2 ETFs. Don’t forget MicroStrategy (MSTR), Tether, and many more corps are also accumulating, along with nation-states, HNWIs, and plebs, said Mow.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Cathie Wood of ARK Invest stands firm on her $1 million Bitcoin forecast. She sees Bitcoin as a solid inflation hedge due to the recent economic turbulence.

“The more uncertainty and volatility there is in the global economies, the more our confidence increases in Bitcoin.

One of the reasons is we’ve just been through an inflationary scare. We think it was very much supply-chain driven, and Bitcoin is a hedge against inflation,” said Wood.

Bitcoin’s current trend supports this optimism. The cryptocurrency is on track for its fifth consecutive month of gains, with a 3% gain in January 2024, a streak not seen since the 2020-21 period.

Read more: Bitcoin Price Prediction 2024/2025/2030

Bitcoin’s resilience and potential for substantial growth are not just based on speculative demand but are underpinned by tangible market dynamics, including the increasing adoption by institutional investors, corporations, and even nation-states. Indeed, with limited supply and increasing acceptance, experts believe that Bitcoin’s future is bright.

As the digital asset landscape continues to mature, Bitcoin stands at the forefront, embodying the potential for incremental gains and a paradigm shift in wealth storage and value transfer.

![]()

FXGT.com

Explore →

![]()

Bitrue

Explore →

![]()

BYDFi

Explore →

![]()

KuCoin

Explore →

![]()

Kraken

Explore →

The post Why Bitcoin Can Surge Beyond $1 Million: Industry Experts Weigh In appeared first on BeInCrypto.

(@Vivek4real_) January 29, 2024

(@Vivek4real_) January 29, 2024