Bitcoin whales have accumulated $3 billion as industry attention was focused on launching several Bitcoin exchange-traded funds (ETFs). Whales, defined in this case as addresses that own 1,000 BTC or more, took their total holdings to roughly 76,000 BTC this month, according to on-chain analysis.

Whales boosted their holdings by buying BTC at a lower valuation on the Bitfinex exchange. Bargain-seekers caused the asset to trade at a premium to the price of Bitcoin on Binance and Coinbase last week.

What Bitcoin Whales Could be Seeing

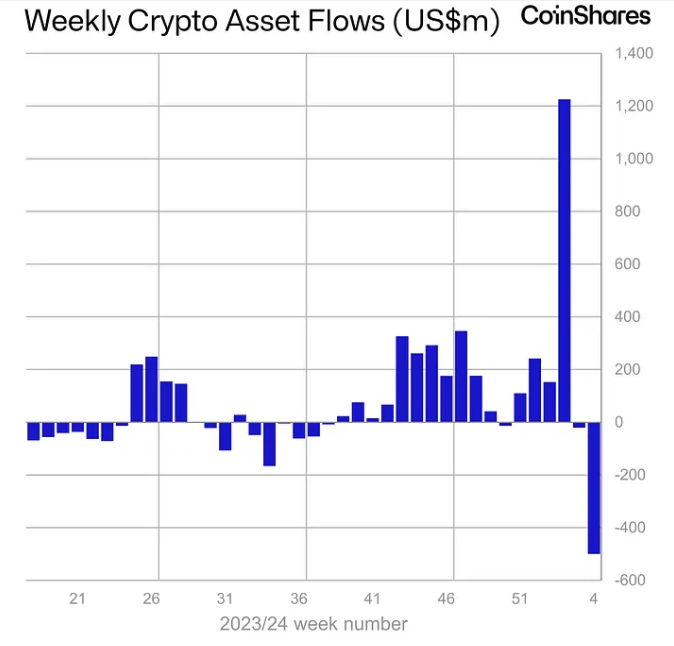

The accumulation has dwarfed flows into Bitcoin exchange-traded funds, which stood at roughly $744 million as of Friday. The Grayscale Bitcoin Trust (GBTC) has seen the highest outflows of $5 billion in January, according to CoinShares.

The increase in whale activity exploited the fluctuations in the Bitcoin price after the US Securities and Exchange Commission (SEC) greenlighted several ETFs. Following the approvals, Bitcoin’s volatility increased as investors cashed out or moved money between funds. Many investors were suspected of cashing out of GBTC because of its 1.5% management fee.

Read more: What Causes Bitcoins Volatility?

Whales may have chosen to accumulate ahead of the next major event in the Bitcoin calendar: the 2024 halving. Every four years or so, the Bitcoin whitepaper mandates an adjustment of the subsidy paid per mined block. This year’s Bitcoin halving will lower the number of BTC released per block to 3.25, reducing the profit margins of Bitcoin miners.

How Whales Can Bring Bitcoin ETF Risks

The SEC delayed the approval of spot Bitcoin ETFs amid market manipulation concerns. Whales can cause the price of Bitcoin to swing dramatically if they sell or buy Bitcoin in large transactions. Therefore, several ETF issuers have enlisted the help of companies that can surveil markets for any sign of contrived price swings.

Read more: How to Sell Bitcoin (BTC) in Four Easy Steps — A Beginner’s Guide

Large swings could cause problems for ETF issuers, who rely on market makers to keep ETF share prices close to the Bitcoin each share represents. Market makers buy and sell shares to close this discrepancy.

Together with other players called authorized participants, they ensure that investors get the shares they want at the right prices. Otherwise, the ETF will trade at a premium or a discount to the Bitcoin asset value and reduce the long-term benefits for investors.

Bobby Blue of Morningstar said the discount would have lowered returns for investors when Grayscale’s shares traded at a discount. The company recently converted the Bitcoin Trust into an ETF.

“An investor that top-ticked the [GBTC] premium on Dec. 22, 2020, would have pocketed a 64% return through October 2021–not bad by any stretch of the imagination. However, if that investor had invested directly in Bitcoin, their 160% gain over the same stretch would have been 2.5 times larger. That has had profound impacts on the longer-term returns of each asset.”

![]()

PrimeXTB

Explore →

![]()

DeGate

Explore →

![]()

iTrustCapital

Explore →

![]()

Coinbase

Explore →

![]()

UpHold

Explore →

Explore more

The post Why ETF Investors Should Worry About $3 Billion In Bitcoin (BTC) Whale Accumulation appeared first on BeInCrypto.