FTX is liquidating many crypto assets to expedite the restitution process for users impacted by its collapse two years ago.

Still, certain FTX users are offloading their claims against the exchange. This has resulted in a surge in both transaction volume and prices of these claims.

FTX Moves Over $700 Million in Crypto

Crypto analytics firm Spot On Chain disclosed that FTX and Alameda Research have systematically moved 91 different cryptocurrencies across various networks, including Ethereum, Solana, and Avalanche. This strategic token transfer amounted to $707 million over the preceding three months.

In the most recent transaction, the failed entities sold digital assets, including Ethereum, OKX’s OKB Coin, and others, for $8 million.

These findings align with a recent report stating that FTX was selling crypto for cash. Notably, the firm’s cash reserves nearly doubled to an impressive $4.4 billion from $2.3 billion during the last quarter of the previous year.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

It is worth noting that FTX’s divestment strategy extends beyond cryptocurrencies alone. The company sold nearly 75% of its Grayscale Bitcoin Trust Shares (GBTC) in a matter of days, fetching approximately $600 million.

Users Trade over $1 Billion in Claims

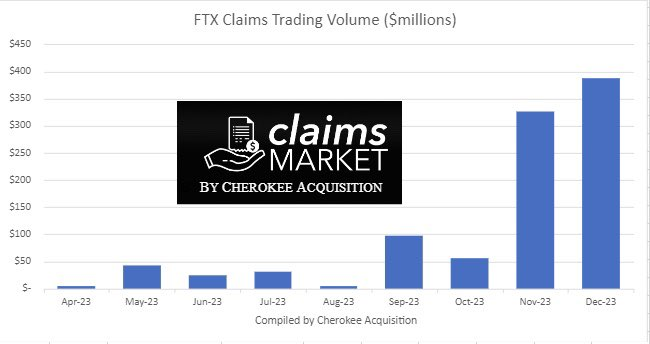

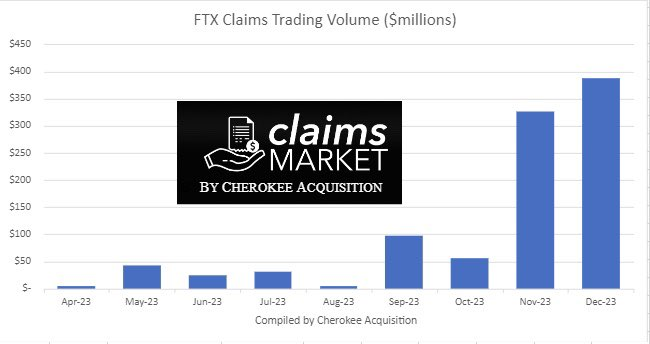

FTX claims trading has exceeded the $1 billion mark. This shows that despite the bankrupt company’s efforts to repay its customers, some are actively trading their claims against it.

Indeed, the trading volume for FTX claims experienced a significant surge in the fourth quarter of last year. Between November and December alone, around $700 million was traded.

“Amazing that $1.1 billion FTX claims have traded,” Vladimir Jelisavcic, the founder Cherokee Acquisition, said.

This surge can be attributed to the concurrent increase in the value of FTX claims. Data indicates that over $1 million in customer claims were trading at over 70 cents on the dollar. This marks a significant increase from the October figure of approximately 38 cents on the dollar.

The upswing reflects the heightened confidence among FTX creditors about receiving substantial repayments from Sam Bankman-Fried’s failed crypto empire.

![]()

Prime XTB

Explore →

![]()

DeGate

Explore →

![]()

iTrustCapital

Explore →

![]()

Coinbase

Explore →

![]()

UpHold

Explore →

Explore more

The post This Company Sold Over $700 Million in Crypto in Just 3 Months appeared first on BeInCrypto.