Gerhard van Deventer, the head of Divisional enforcement at South Africa’s Financial Sector Conduct Authority (FSCA), confirmed that crypto service providers would start receiving Financial Service Provider (FSP) licenses soon. He said the licenses would protect users from scams as the number of users in South Africa using Bitcoin (BTC) and other cryptos reaches almost 10% of the population.

Van Deventer revealed the FSCA’s progress in approving crypto licenses on a recent South African crypto podcast, Moneyweb Crypto.

FSCA Will Rule on Crypto FSP Licenses Soon

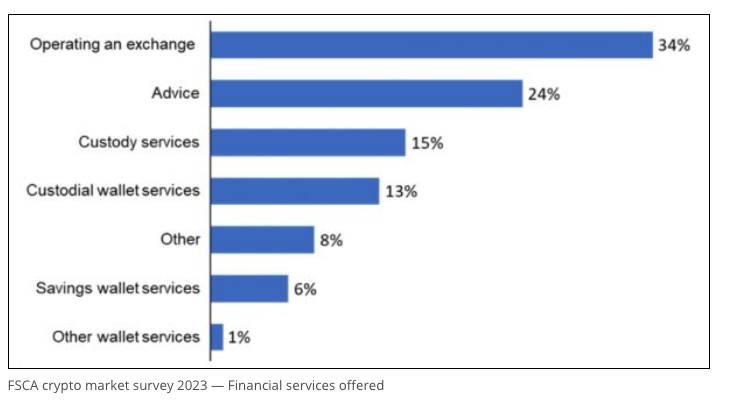

There are several applications whose success depends on the outcome of the February and March meetings of the Licensing Executive Committee. The watchdog called crypto asset providers to apply for a license between June 1 and November 30, 2023. By November 30, 2023, it had received applications from 128 crypto companies that were already operating.

In its evaluation of licenses, the FSCA considers the “criticality of market services” and whether crypto companies offer payment rails. The agency also evaluates policies regarding customer onboarding, data protection, cyber risks, handling of complaints, and counterparty risk.

Due diligence checks are also performed with the Payments Association of South Africa and the Reserve Bank Financial Services Department. In October 2022, the FSCA declared cryptocurrencies as financial products.

South Africa Crypto License Follows Bitcoin Surge

The new regime adds some much-needed protection as the percentage of the South African population holding crypto approaches 10%, or 6 million, according to recent data from the FSCA. Most use crypto for transactions and speculative investments.

“The crypto asset market has grown significantly overall and shows no sign of slowing down anytime soon. The potential for blockchain technology and crypto assets to transform numerous industries still exists despite the industry’s regulatory and other difficulties.”

Read more: Cryptocurrency Regulation in Africa: What We Know So Far

According to Paycorp, the number of withdrawals at crypto ATMs has increased recently. Crypto users in South Africa use Paycorp’s CryptoExpress app to cash out Bitcoin, Ethereum, USDC, and Tether. Paycorp fixes the exchange rate for the course of the transaction.

Read more: How To Accept Crypto Payments: A Brief Guide

A court in South Africa’s Western Cape province called the Mirror Trading International (MTI) operation a Ponzi scheme last April. The ruling came a day after the US Commodity Futures Trading Commission ordered the MTI founder Johann Steynberg to pay defrauded investors $1.7 billion and an additional civil penalty of $1.73 million.

![]()

GT Protocol

Explore →

![]()

DeGate

Explore →

![]()

KuCoin

Explore →

![]()

Metamask Portfolio

Explore →

![]()

Wirex App

Explore →

Explore more

The post Crypto Businesses in South Africa Anticipate First Wave of FSP Licenses appeared first on BeInCrypto.