In a striking market assessment, JPMorgan analyst Kenneth Worthington has set an $80 price target for Coinbase (COIN) stock, signaling potential headwinds for the prominent crypto exchange.

This target suggests a significant downside of over 35% from its current valuation, hinting at a potentially turbulent period ahead.

JPMorgan Analyst Casts Doubt on Coinbase’s ETF-Driven Surge

Coinbase experienced a surge in share value last year. This uptick was largely attributed to the optimistic forecasts surrounding the launch of spot Bitcoin exchange-traded funds (ETFs). However, the recent perspective offered by Worthington casts a shadow of doubt over these previous buoyant expectations.

Worthington’s analysis comes at a time when Bitcoin prices are demonstrating a noticeable decline, recently dipping below the $39,000 mark. This downward trend, according to the JPMorgan team, could lead to a diminishing enthusiasm for cryptocurrency ETFs. Such a shift would likely result in lower token prices, decreased trading volumes, and reduced ancillary revenue opportunities for firms like Coinbase.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

In his assessment, Worthington downgraded Coinbase’s stock from neutral to underweight. His evaluation underscores a skepticism about the immediate impact of the Bitcoin ETFs. Comparing the current inflows into Bitcoin ETFs with those witnessed during the launch of the Gold ETF in 2004, he noted a considerable discrepancy.

“While it has only been ~1 week since launch, the initial net inflows into Bitcoin ETFs seems to be far less than the cryptocurrency community was touting in the financial media, and less than what we witnessed in the first week of flows into the Gold ETF when it launched in 2004.

We think much of the crypto-industry set a high bar for the ETF launches, and, while meaningful, we think expectations are simply too high and unrealistic,” said Worthington

The response to Worthington’s downgrade has been notable. Out of 27 analysts tracked by FactSet, 11 now hold bearish views on Coinbase shares. With eight analysts maintaining bullish outlooks and eight others suggesting a hold position, the market sentiment appears divided. The average price target amongst these analysts is $126.67, closely aligned with Coinbase’s Monday closing price of $128.21.

However, in Tuesday’s pre-markets, Coinbase stock is down by over 5%, trading around $122.

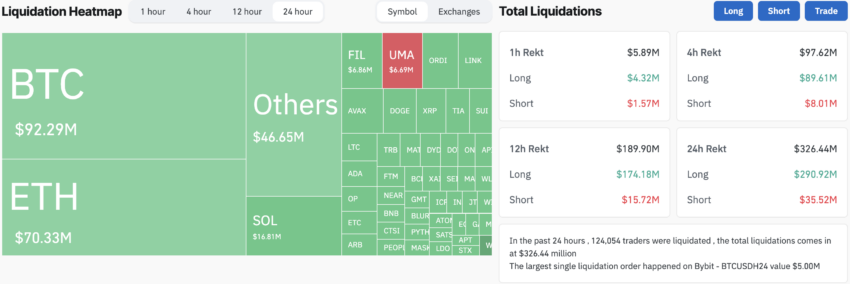

Over $300 Million Liquidated in the Past 24 Hours

This recalibration of expectations comes as the broader crypto market faces a correction. Bitcoin’s price has fallen below $39,000, marking a decline of over 5% in the past 24 hours. Similarly, Ethereum, another major crypto asset, has decreased 7.5%. These market shifts have led to significant liquidations, totaling over $326 million in the same timeframe.

The current market scenario presents a complex landscape for investors and market participants. While the advent of Bitcoin ETFs was initially seen as a harbinger of positive momentum for the crypto industry, the actual impact appears to be more nuanced.

Read more: What Is a Bitcoin ETF?

Worthington’s analysis, focusing on inflated expectations and the subsequent potential disappointment, offers a critical lens through which the future of crypto investments, particularly in relation to firms like Coinbase, can be gauged. As the market navigates through these uncertain times, the insights from JPMorgan’s analysis serve as a reminder of the volatile and unpredictable nature of crypto investments.

![]()

DeGate

Explore →

![]()

Coinbase

Explore →

![]()

KuCoin

Explore →

![]()

Metamask Portfolio

Explore →

![]()

Wirex App

Explore →

![]()

YouHodler

Explore →

Explore more

The post Coinbase Stock Faces Downgrade from JP Morgan: What’s Next for Investors? appeared first on BeInCrypto.