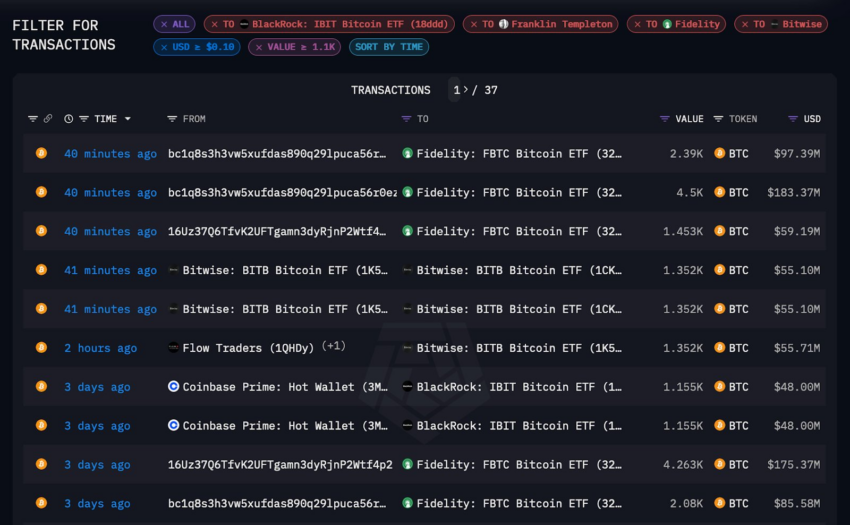

On-chain analytics firm Arkham Intelligence has identified four Bitcoin (BTC) exchange-traded products (ETPs) addresses. This latest discovery takes the number of exchange-traded fund (ETF) providers whose BTC addresses are known to five.

Arkham Intelligence has identified the addresses of products BlackRock, Bitwise, Fidelity, and Franklin Templeton offers.

BTC ETF Providers May Fear Public Exposure

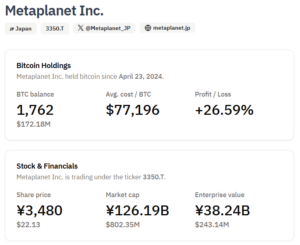

The data reveals that Fidelity holds $1.21 billion of BTC in the Fidelity Wise Origin Bitcoin Fund with the custodian Fidelity Digital Asset Services LLC. BlackRock, Bitwise, and Franklin Templeton hold $1.16 billion, $422.68 million, and $47.09 million worth of BTC on the Coinbase Prime Custody Platform.

Coinbase is the custodian for eight of the 11 Bitcoin ETFs, which some have called a concentration risk. A custodian holds the private keys that give address owners the ability to move their BTC. Gemini, the crypto exchange founded by Cameron and Tyler Winklevoss, is the custodian for the VanEck Bitcoin Trust.

Read more: What Is a Bitcoin ETF?

In February last year, the US Securities and Exchange Commission proposed new rules for crypto custodians. It plans to roll out these rules later this year.

The concentration of billions of dollars worth of crypto can create a single point of failure. A cybersecurity breach or legal risks can endanger customer funds. A Coinbase database hack can reveal transfers that institutions may not want to be made public.

CoinMetrics, an analytics company co-founded by crypto venture capitalist Nic Carter, has said it is important for new research methods to emerge as Bitcoin evolves. The company said in a recent blog post on on-chain analysis,

“As Bitcoin continues to evolve and mature, the imperative to critically research it grows correspondingly.”

Read more: How To Evaluate Cryptocurrencies with On-chain & Fundamental Analysis

Coinbase recently revealed that it had received over 12,000 law enforcement requests in 2023 related to criminal matters. The exchange is currently engaged in a prolonged court battle over the securities status of several crypto assets.

US Bitcoin ETF Impact Felt in Europe

The rollout of US Bitcoin ETFs earlier this month saw European and Canadian funds lose about 5,000 BTC. In the aftermath, exchange-traded product (ETP) providers in Europe, Invesco and WisdomTree, have slashed fees by as much as 60%. Fees on the WisdomTree Physical Bitcoin ETP have fallen from 0.95% to 0.35%, while Invesco dropped charges on its Physical Bitcoin ETP from 0.99% to 0.39% of the assets under management.

European and Canadian Bitcoin ETFs were among the only regulated Bitcoin products for institutions before their US counterparts went live. 21Shares, ARK Invest’s US Bitcoin ETF partner, is a prominent ETF provider in Europe.

![]()

DeGate

Explore →

![]()

Coinbase

Explore →

![]()

KuCoin

Explore →

![]()

Metamask Portfolio

Explore →

![]()

Wirex App

Explore →

![]()

YouHodler

Explore →

Explore more

The post Arkham Reveals On-Chain Addresses of BlackRock’s Bitcoin (BTC) ETF appeared first on BeInCrypto.