Amid their bankruptcy processes, beleaguered cryptocurrency firms FTX and Celsius Network are actively divesting their digital asset portfolios.

Over the past week, these firms moved over $150 million of cryptocurrencies to several crypto trading platforms.

Celsius Network’s $45 Million Polygon Token Transfer

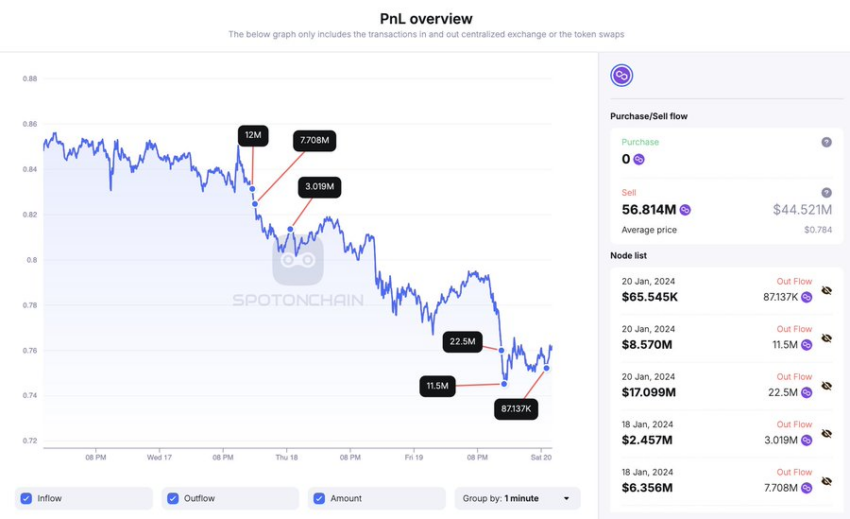

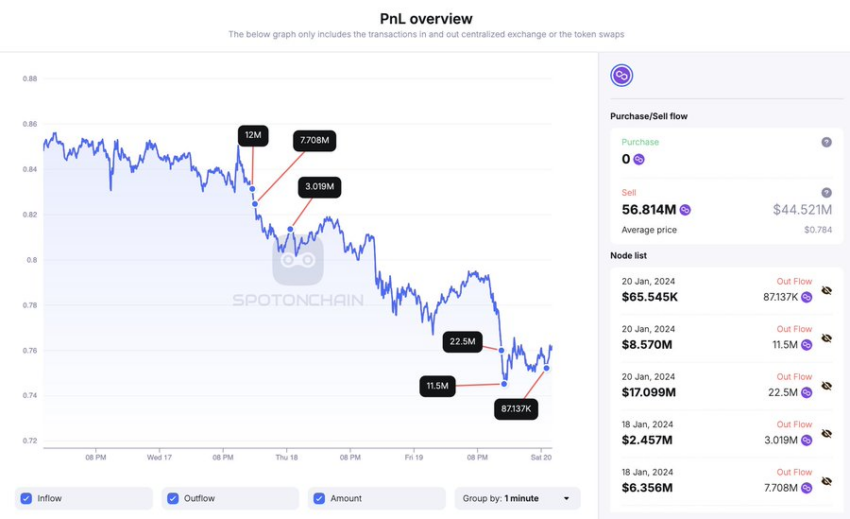

The sell-off trend by Celsius Network and FTX has persisted into this week. The distressed crypto lender Celsius Network moved 56.8 million of Polygon’s MATIC tokens, valued at $44.5 million, to crypto exchanges.

Prominent blockchain analytical firm Spot On Chain reported that the firm has already moved 34.09 million MATIC, equivalent to $25.7 million, to Binance. This recent transaction, combined with a prior transfer of 25.75 million MATIC, brings the total movement to 56.8 million MATIC. Therefore totaling $44.5 million in the last three days.

These transactions occur on the heels of a noteworthy development within Polygon’s ecosystem. Indeed, Polygon’s CDK — an open-source Layer 2 (L2) development kit — and Near’s Data Availability platform are poised to revolutionize user transaction costs. According to Polygon’s co-founder, Sandeep Nailwal, this integration will facilitate transactions at an exceptionally reduced cost — approximately 8,000 times lower than the Ethereum mainnet.

FTX and Alameda Liquidate Over $15 Million in Crypto

FTX and Alameda moved another $15 million in cryptocurrency to Binance and Wintemute. The transferred assets comprised popular digital currencies such as Wrapped Bitcoin and Ethereum.

This transaction follows a US Court of Appeal’s approval of an independent examiner to investigate the collapse of FTX. The court’s January 19 decision, prompted by the US Trustee overseeing the FTX bankruptcy process, came after the bankruptcy court initially denied the request for an additional investigation.

Read more: Who Is Sam Bankman-Fried (SBF), the Infamous FTX Co-Founder?

The court stated that the examiner must not have vested interests or prior involvement with the debtor. Besides that, the ruling also pointed out the historical association of FTX lawyers Sullivan & Cromwell, who previously served as pre-petition advisors to FTX.

“The collapse of FTX caused catastrophic losses for its worldwide investors but also raised implications for the evolving and volatile cryptocurrency industry. For example, an investigation into FTX Group’s use of its own cryptocurrency tokens, FTTs, to inflate the value of FTX and Alameda Research could bring this practice under further scrutiny, thereby alerting potential investors to undisclosed credit risks in other cryptocurrency companies,” Judge Luis Felipe Restrepo wrote.

Furthermore, the court emphasized that the Bankruptcy Code requires the appointment of an examiner when a debtor’s debts surpass $5 million. Consequently, it determined that an independent inquiry into FTX would address pressing issues while safeguarding the general public’s interest.

“In addition to providing much-needed elucidation, the investigation and examiner’s report [will] ensure that the Bankruptcy Court will have the opportunity to consider the greater public interest when approving the FTX Group’s reorganization plan,” Judge Restrepo added.

![]()

Coinbase

Explore →

![]()

KuCoin

Explore →

![]()

Metamask Portfolio

Explore →

![]()

Wirex App

Explore →

![]()

YouHodler

Explore →

![]()

Margex

Explore →

Explore more

The post This Company Is About to Sell 56.8 Million Polygon (MATIC) appeared first on BeInCrypto.