The recent approval of spot Bitcoin ETFs (exchange-traded funds) by the US Securities and Exchange Commission (SEC) has sparked intense debate.

This pivotal move, overshadowed by centralization and market volatility concerns, poses a significant question. Could this be the catalyst for a new winter in the cryptocurrency market?

ETFs Defy Bitcoin’s Principles

SEC Chair Gary Gensler viewed the approval of spot Bitcoin ETFs with irony. He believes that such financial products defy Bitcoin’s principles, making the digital asset centralized. Gensler warned that this move could lead to further speculation and volatility in an already unstable market.

He emphasized that Bitcoin remains a highly speculative asset, often associated with illicit activities such as money laundering and ransomware.

“Satoshi Nakamoto said this was going to be a decentralized system. Think about the irony of those who say this week is historic. This was about centralization and traditional means of finance. Investors could already express themselves in Bitcoin… But now you can buy it through this thing called an exchange-traded product as well, centralized,” Gensler said.

Likewise, prominent investor Kevin O’Leary expressed skepticism about spot Bitcoin ETFs. He questioned the value they add for long-term investors like himself who view Bitcoin as digital gold. O’Leary’s stance highlights these ETFs’ high fees and lack of direct ownership. These features might not appeal to purists who prefer direct Bitcoin holdings.

Read more: This Is How to Invest in Spot Bitcoin ETFs

Mr. Wonderful predicted that only a few of the newly approved ETFs will survive, with major players like BlackRock and Fidelity likely to dominate due to their extensive resources.

“If you’re a purist and you’re just holding Bitcoin for the long term as a digital gold as I am, I would never buy an ETF. Why would I pay these fees? It’s completely unnecessary, and they add no value to me,” O’Leary stated.

These statements set the stage for a critical examination of the potential impacts of these ETFs on the flagship cryptocurrency.

BTC as a Medium of Exchage

Bitcoin’s original intent as a medium for small online transactions has been overshadowed by its inefficiencies – high costs and cumbersome payment processes. Its adoption for larger transactions remains limited. Meanwhile, its use for secrecy and illicit activities raises questions about its practicality as a currency.

Even BlackRock CEO Larry Fink expressed skepticism about Bitcoin replacing traditional currencies.“I don’t believe it’s ever going to be a currency. I believe it’s an asset class,” he explained. Meanwhile, the International Monetary Fund’s Managing Director, Kristalina Georgieva, stated that cryptocurrencies such as Bitcoin should not be considered “money” in the conventional sense.

“Our view is that we have to differentiate between money and assets. When we talk about crypto, we are actually talking about an asset class. It could be backed up and in that sense, more secure and less risky, or it could be not backed up and therefore a riskier investment. But it is not exactly money. It’s more like a money management fund,” Georgieva said.

The introduction of Bitcoin ETFs further distances the cryptocurrency from its intended decentralized ethos, reconnecting it to traditional financial systems. Bitcoin exhibits a high correlation coefficient with highly speculative sectors rather than traditional stores of value like gold.

In times of financial crisis, like the bank runs of March 2023 and the pandemic panic of March 2020, Bitcoin has been anything but stable. It has showcased significant volatility and price drops, contradicting its proposed role as a digital safe haven.

History Points to a Market Top

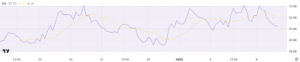

The launch of spot Bitcoin ETFs, as highlighted by a technical analyst under the pseudonym Crypto Con, might mark the beginning of a new bear market. This pattern reflects the analyst’s assertion, aligning major crypto events and critical market shifts.

“To say there is no correlation between Bitcoin and news events would be denial,” Crypto Con remarked.

He drew parallels to past events like the launch of CME’s Bitcoin futures contract in December 2017 and the Coinbase IPO in April 2021, both coinciding with market tops. Similarly, the FTX collapse in November 2022 and the Silicon Valley Bank collapse in March 2023 were followed by significant market lows.

The recent spot Bitcoin ETFs, akin to these events, could potentially signify a market turning point.

Historically, the cryptocurrency market has shown a heightened sensitivity to such significant developments. This sensitivity often results in abrupt market movements. Therefore, the introduction of spot Bitcoin ETFs could be a signal for cautious trading strategies.

![]()

Coinbase

Explore →

![]()

KuCoin

Explore →

![]()

Metamask Portfolio

Explore →

![]()

Wirex App

Explore →

![]()

YouHodler

Explore →

![]()

Margex

Explore →

Explore more

The post Spot Bitcoin ETFs: The Event That May Have Triggered a New Bear Market appeared first on BeInCrypto.